When you’re swing trading, it’s sometimes hard to figure out how to find stocks that are profitable. What is swing trading? Read this tutorial to find out what swing trading is, and learn how to swing trade stocks.

Learning how to swing trade can be a difficult task. Oftentimes, you’re using various analysis tools to try to catch profit over multiple day holds. The benefit of buying and holding over multiple days is that you’re saving capital by “trading” less when compared to day trading. However, there is some risk associated with holding stocks for multiple days, such as news events that may be released overnight. That being said, if you’re looking to swing trade and understand the risks, you need to know how to find stocks to swing trade.

Depending on your trading style, you might want to use a catalyst event, technical analysis, or fundamental analysis when conducting due diligence. For the most part, combining technical analysis and catalyst events works well in the trading community. Before we learn how to find stocks to swing trade, we first need to understand what swing trading really is.

What Is Swing Trading?

Swing trading is a type of trading that is basically aimed at making the most of short-term opportunities for profits in the market. Swing traders fit in between day traders and buy-and-hold investors.

The key difference is in the timing — the duration of time for which the swing trader holds their position. The swing trader will at least hold overnight, while the day trader has tighter limits and will close before the market closes.

The swing trader masters the art of holding onto a security for just long enough to capture price spikes, and then they quickly sell it off before the trend changes.

Remember, as a swing trader, technical analysis is your friend. Swing traders will examine charts and formulate a unique strategy. There is no one size fits all, though — a strategy may or may not work.

Pros and Cons of Swing Trading

Now that you understand what swing trading is, let’s look at its pros and cons. It’s worthwhile to learn how to swing trade because it presents unique opportunities. However, it also has its fair share of challenges. Let’s examine some major advantages and disadvantages of swing trading.

Pros:

- Maximize your short-term gains: Swing trading helps use short-term price movements to make maximal short-term profits. As the name suggests, swing traders use the market swings to their advantage. The market is continuously changing, and it is not always on the support and resistance zones. The swing trader will keep trading in and out, and hopefully, make profits all along the way.

- It can be easier: In swing trading, it can be relatively easy to find stocks that are worth investing in. There are a few key things to keep in mind. The strategy often includes stocks that have greater volume and volatility, which can help present more profit opportunities.

- Versatility and flexibility: Swing traders can use a number of different investment vehicles to maximize their profits and put their strategies to the test. It is possible to apply strategies to groups of stocks that are bundled in funds, cryptocurrencies such as Bitcoin, and single stocks, of course. This makes swing trading very versatile.

- Availability of tools: Swing traders usually rely on technical analysis, and have a number of tools at their disposal. There are many swing trading platforms and resources, such as video training, mobile apps, and online groups of swing traders, which can help dramatically raise the odds of making more profits.

Cons:

- Needs time: Swing trading involves staying up to date on the market conditions by the hour. If you are really serious about it, you will need to extract significant time from your daily life for market monitoring and analysis if you hope to make this activity profitable.

- Involves risks: Swing trading can be a very risky endeavor indeed — especially for those who are not accustomed to the level of risk-taking and stress it involves.

- Missed long-term opportunities: Without a doubt, owing to the very nature of this activity, swing traders may miss out on any long-term opportunities since they focus only on the short-term.

- Experience in technical analysis: Learning how to swing trade can be challenging because it requires you to master the art of interpreting charts and graphs and using technical analysis tools. Swing traders will need to be exceptionally good at it to be able to make the right decisions. If there is one individual who needs a thorough understanding of technical analysis more than any other trader, it has to be the swing trader.

If you want to learn how to use these tools to create a strategy that can promise higher rewards, check out this resource on technical analysis tools.

How to Find Stocks to Swing Trade

The first thing you want to do is see if there are any upcoming events, such as earnings. You can do this by going on the company website, or EarningsWhispers. Next, you want to see if there are any news events. Generally, a catalyst will help stocks move.

A few quick tips:

- You’ll want to start your trading day early and check on company news. Many trading platforms have news built-in, so make sure yours does as well before proceeding.

- If you don’t have access to this, then you can check CNBC, Bloomberg, and Finviz. Moreover, swing traders will also look at SEC filings, too.

- You need to be mindful of overall market news, such as political and economic events.

- Swing traders typically use The Basics of Technical Analysis in Day Trading technical analysis to spot potential trades, and if there’s a positive catalyst to support a bullish pattern, it could increase the probability of the trade being successful.

Aside from that, you can judge stocks on certain criteria, such as:

- Liquidity: Stocks with high liquidity typically have lower bid-ask spreads, resulting in a lower risk of loss. Your daily minimum volume is relatively arbitrary, but 500,000 shares per day is considered pretty reasonable.

- Correlations and volatility: Check sector-leading stocks or the major market indexes to determine which stocks have high correlations with them. Additionally, highly volatile stocks are more likely to break away from the trading range, allowing you to make more of a profit.

- Reliability: Swing traders tend to gravitate toward stocks that trade in patterns because they are seemingly more reliable. Similarly, the stocks of companies that regularly make the news during trading hours have a higher likelihood of bouncing out of the trading range, creating a good entry point for a trade.

- Number of market makers: Market makers increase liquidity and facilitate transactions by holding onto stocks. They often create trends by directing fund flows that impact a stock’s movement. Swing traders often gravitate toward stocks with at least a few market makers so that they can interpret the clues they leave behind.

Technical Analysis

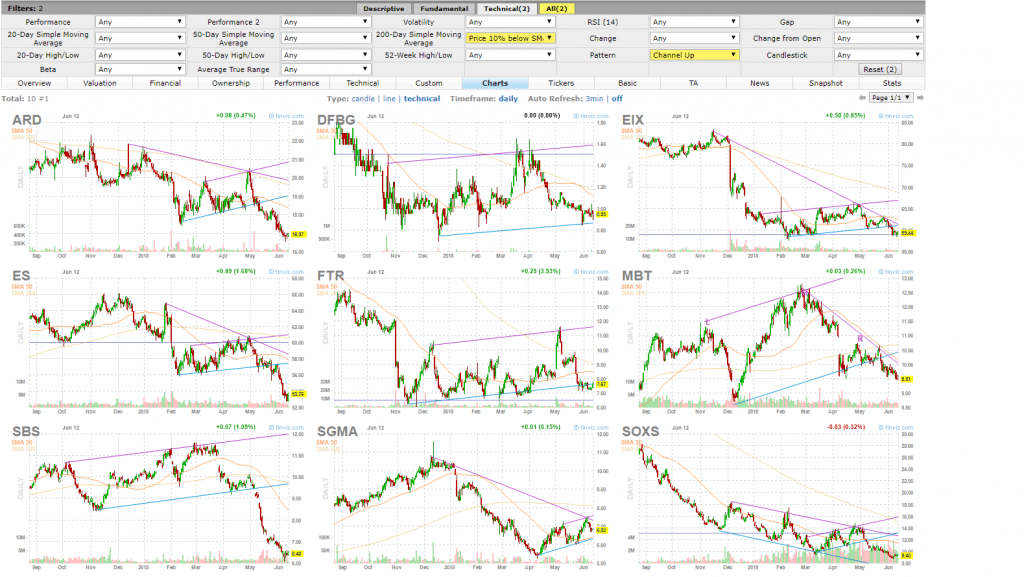

If you don’t have access to a screener through your trading platform, you could use Finviz instead. For example, let’s say you find buying stocks above the 200-day simple moving average, and trading in an up channel, works well for swing trading. You could easily do that using Finviz’s free tool.

For the most part, we swing trade penny stocks, as well as low-dollar stocks. Now, keep in mind, not all penny stocks are created equal. Many traders prefer to find the ones that trade on Nasdaq or NYSE. It’s not too hard to learn how to trade penny stocks if you know what to look for.

Examples of Finding Stocks to Swing Trade

Now, the key is to find what works best for you, and learn how to find stocks to swing trade over time. If you’re a technical trader, it helps to look at technical patterns every night, and see which ones are poised to rebound or break out.

I like to look for stocks that have been up big, and pulled back, giving another potential entry. A lot of the time, I’ll screen for this on my trading platform and look at the chart to see if it fits my setup. For example, here’s a look at some of my trading plans:

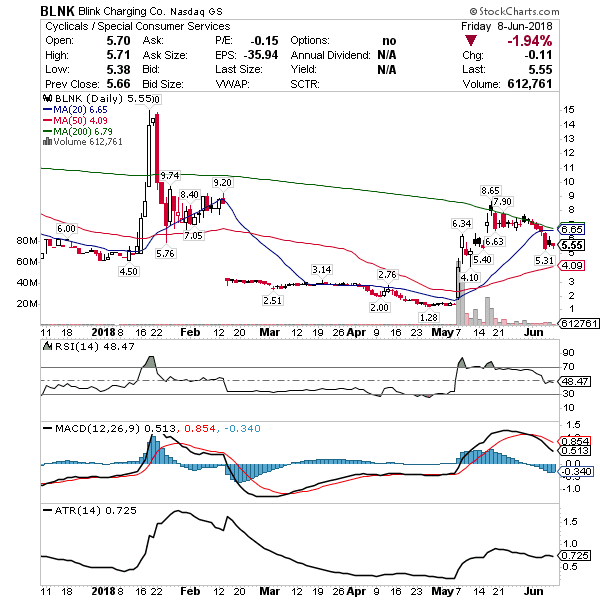

- BLNK – I’ve been waiting for a pullback to swing this one. Using Wednesday’s low of $5.31, I’m watching for an entry and swing back to the middle $6’s or maybe $7 if it heats up.

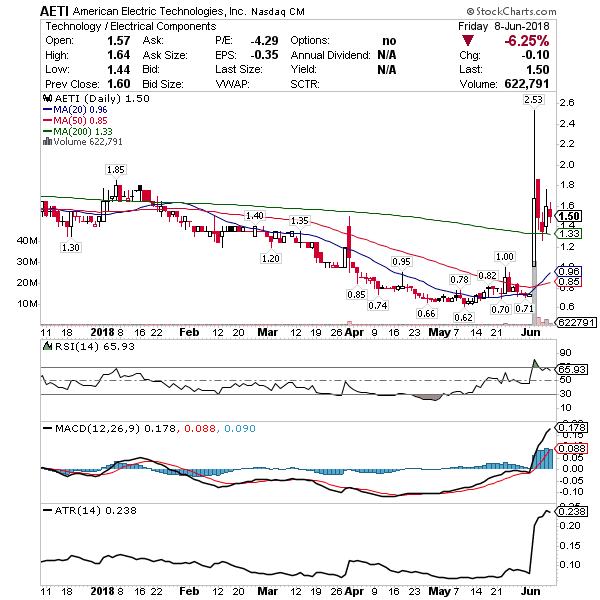

- AETI – Picked this one up on Thursday, and it ran about 30% for me. I took 2/3 off for about $3,000 and hold 1/3 in play above the MA(200). I will consider adding 10,000 shares above $1.33 for a move to $2ish.

Final Thoughts

Once you know how to find stocks to swing trade, you need to come up with a plan. That means having a specified entry price, stop-loss price, and target profit. If you don’t have a plan, you’re setting yourself up for failure. Especially when you’re swing trading, you need to devise a plan and properly manage risks.

Thereafter, if you execute a trade on the stock, you need to stay up to date on any news, and figure out if there are any upcoming events. Finally, once you’ve exited the trade, you should journal and write out whether the trade worked. If it didn’t, write out why you think it didn’t work and how you could trade it differently if you see the same pattern next time. You should make a note for your winning trades, too.

When you review your trading journal, you’ll be able to see which swing trades worked best. Ultimately, you want to learn how to find stocks that fit your swing trading style by doing this.

Remember, swing trading is not without risks, but you can certainly be in a much better position to manage them if you know your way around technical analysis tools. You can have a look at the resources designed by our trading experts, which is a great way to master the art and science of technical analysis. This way, you can be sure that you have the right strategies in place, and be ready to face the market and the opportunities that it brings, every single day.