If the title of this piece wasn’t a big enough hint for you, I’m talking about drone stocks.

Yesterday was an eventful day in the markets, gang.

A flurry of news came out, which positively affected the market.

Chinese stocks traded higher after China signaled support for the shares.

Then, the FED approved the first interest rate high in more than three years.

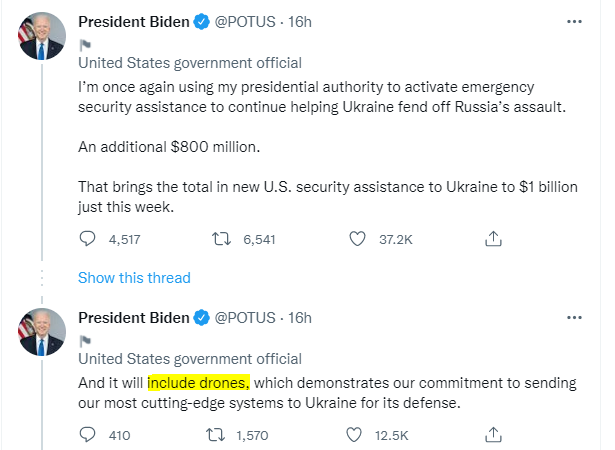

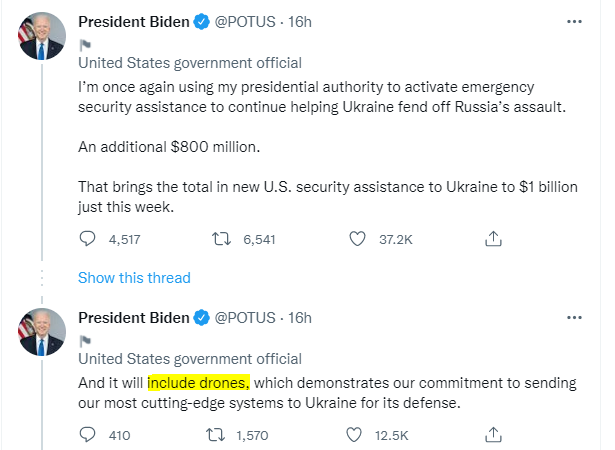

To top it all off, President Biden announced an additional $800m in security assistance for Ukraine.

(source: Twitter)

As you can imagine, the vast amount of news and its importance had an impact on the stock market.

What I particularly LOVED was the action in the IWM.

That is, of course, because I like to focus on small-cap stocks.

What does this news and combo of events mean for us?

The IWM, which is made up of 2000 small-cap stocks, closed the day up 3.15%, according to Finviz.

Not only did the IWM close up over 3%, but it also broke above the declining 20d MA and is ever so close to bucking the downtrend.

The move yesterday in the IWM gets me excited, gang.

Why?

A reversal in the IWM could signal a reversal in small-caps and might signal an increase in small-cap opportunities and volatility.

With the potential for an uptick in small-cap opportunities, I want to go back to the announcement made by the President yesterday.

As his tweet mentioned, it will include drones.

Now it just so happens that I like a couple of small-cap drone stocks.

Together with short-term bullish IWM, and a tweet from the President, I am now paying close attention to these two stocks:

AgEagle Aerial Systems (UAVS)

UAVS, according to Yahoo, operates in the aerospace and defense industry and designs, develops, produces, and supports unmanned aerial vehicles.

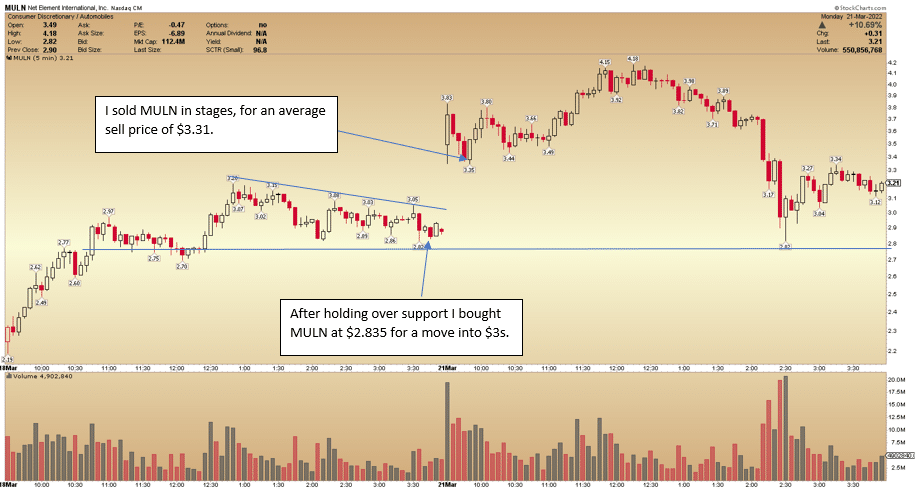

Yesterday, with the drone news coming out of Washington, the stock saw volume increase and price break above the downtrend’s resistance, as you can see in the above chart.

I like the action and the setup in this stock.

I want to see the stock base over the 50d MA, which it came into yesterday.

I also want to see the volume continue to trade above the average volume, which would signal that the buyers are still taking charge.

Draganfly (DPRO)

DPRO, per Yahoo, operates in the aerospace and defense industry and manufactures and sells commercial unmanned aerial vehicles worldwide.

Similar to UAVS, DPRO recently experienced a significant downtrend that started late last year.

Recently the stock spent two months consolidating at the lows.

Yesterday, however, the stock might have confirmed a possible reversal after it broke above the previous two days’ high and saw volume increase over the previous day.

I will be looking for the stock to continue to hold over the 50d MA and make a higher low.

If the interest and volume are sustained in DPRO, and the stock can make a higher low, I might look for an entry on the long side.

The Bottom Line

As I have said before, gang, as a trader, all I can do is process the information that the market is giving me and react as I see fit.

Plan the trade and trade the plan

So with the catalyst and a strong short-term IWM, I am keeping these stocks and this sector on watch for a potential follow through to the upside opportunity.