If you’re starting out with a few thousand dollars there aren’t many trading strategies that…

Learn from my 69 trade win streak Trading with high probabilities

When you’re trading stock options, it’s important to understand what’s at stake. You should know…

What’s the difference between a stock warrant and a stock option? For starters, a warrant…

Options volume and price movements in the stock market are reflections of decisions to purchase…

Investors know that selecting a good stock is never easy. The high volume of stocks…

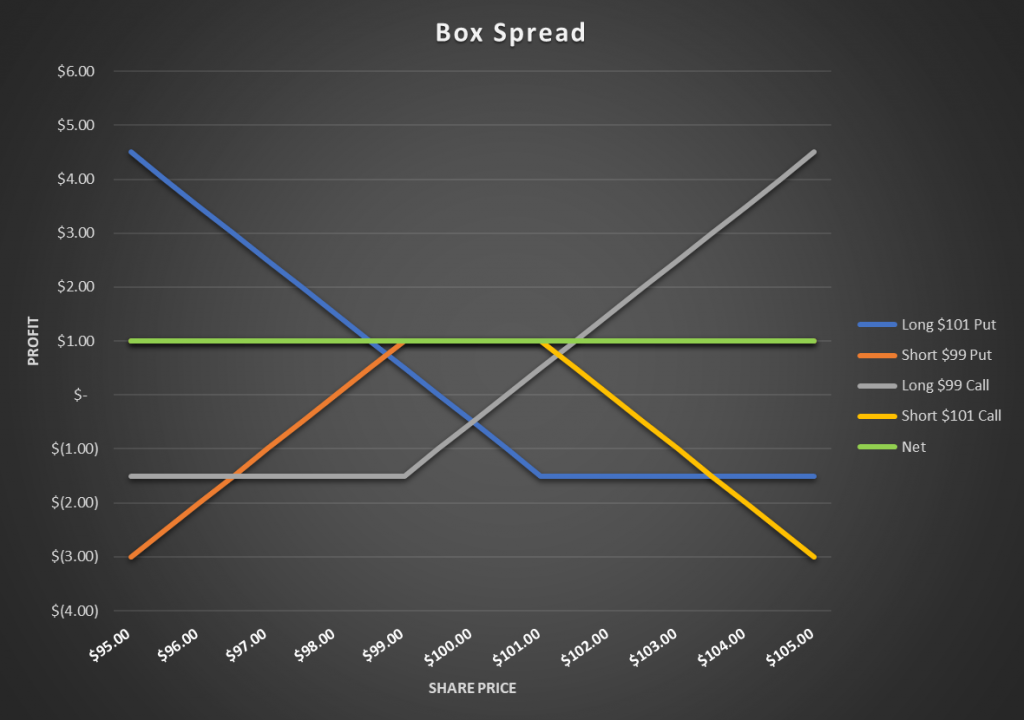

What Is a Box Spread Option? A box spread option means buying a bull call…

What Is Volatility Trading? Volatility trading is trading on the volatility rather than on the…