I’m So High Right Now

-Seth Rogan and $SYTA -probably

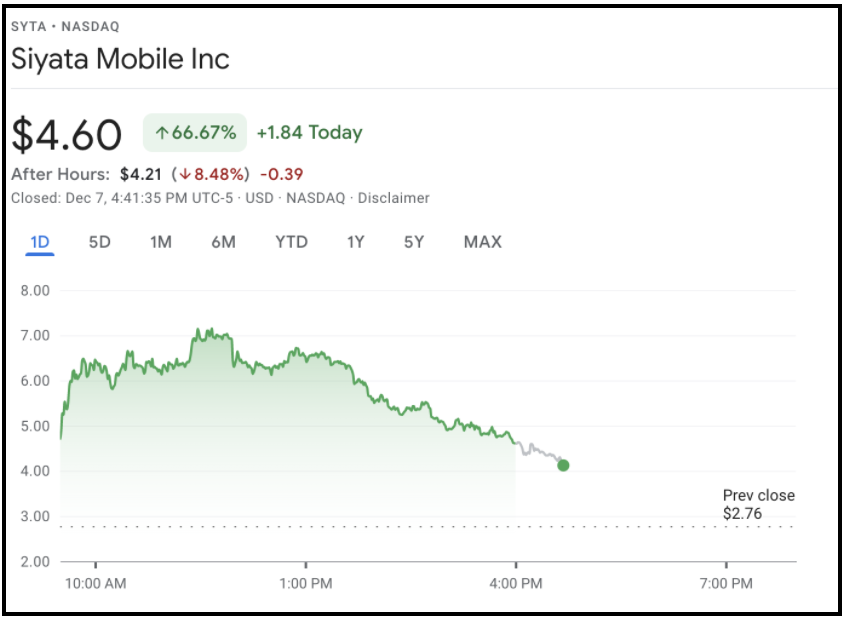

Shares of Siyata Mobile had a better Tuesday than you did. The company’s stock rocketed higher on news that it received a $1.3M purchase order for first responder customers and police in Europe, the Middle East, and Africa. The purchase order was for Siyata’s recently released SD7 ruggedized devices, VK7 vehicle units, and other accessories. While not an overly large order monetarily compared to the numbers being thrown about on Wall Street, investors clearly liked the early adoption of the company’s products. The stock finished yesterday’s trading session up an incredible +66.7%.

- Siyata is a global vendor of Push-to-Talk over Cellular (PoC) devices and cellular signal booster systems.

- The company’s products allow first responders and enterprise workers to instantly communicate over a nationwide cellular network of choice, to improve communication, increase situational awareness, and save lives.

- The SD7 and VK7 are seen as upgrades to the current Land Mobile Radios that often suffer from network incompatibility, limited coverage areas, and restricted functionality.

Siyata’s stock price was down 82% from its February high of $15.75 as of Monday’s closing price of $2.76. The stock’s most recent swing high of $9.68 put in on October 27th is my next upside target for $SYTA. I’m keeping $SYTA on my watchlist for evidence of continued momentum to the upside.

I Like to Moovit Moovit

Puns are underutilized in corporate America!

It’s a bittersweet moment when the baby birds grow up and fly away, as Intel (INTC) is about to find out. The chipmaker is spinning off the autonomous driving technology unit Mobileye via IPO, but won’t be total empty nesters since it’s still retaining a significant stake. Much like my parents still paying my cell phone bill after college.

- Intel acquired the Israeli company back in 2017 for $15B.

- Mobileye specializes in chip-based driver assist and autonomous driving technology products under the EyeQ name, as well as operates the mobile trip planning app Moovit. Hopefully, all future product offerings will also be pun-based.

- The Mobileye unit recently shipped the 100 millionth EyeQ system as well as deployed a robotic taxi into service in Tel Aviv and Munich. Driverless taxis may still seem a bit unnerving, but the experience probably beats an overly chatty Uber driver.

- Through Q3 2021, Mobileye has produced $361M in operating income on $1B of sales which are already up over full-year 2020 results of $241M in operating income from $967M in sales.

The market reacted favorably to the news, with INTC up 3.1% on Tuesday. Intel will remain the majority owner of Mobileye and will continue to consolidate results into reporting… So basically instead of moving completely out of the house, Mobileye is just fixing up the parents’ basement into a cool bachelor den.

Brace for Impact – Evergrande

Misses $82.5M Interest Payment

Pictured: Evergrande Heading to Davy Jones Locker.

The saga of Evergrande continues its descent as the Chinese developer announced yesterday that it was forming a risk management committee of state officials in an effort to, well, mitigate future risks. The group is pretty much bending the knee after missing the grace period on a $82.5M interest payment, originally issued for Nov 6 by Scenery Journey Ltd, and will either go through a massive debt restructuring or become China’s largest company default.

- There was no doubt that the sinking of Evergrande would create a big splash but it appears the trend is rippling throughout the Chinese real estate market. Fellow developer Kaisa Group Holdings announced on Friday it “might” fail to pay off a $400M bond due this week, and its shares were suspended for trading yesterday.

- The Death spiral of these real estate developers is likely due in part to a concentrated effort by the Chinese government to change its attitude regarding corporate default. Victims of this shift towards a no-bailout philosophy include chipmaker Tsinghua Unigroup which experienced default in December 2020. Evergrande is big though, a lot bigger…

You already knew this but for starters: it seems that Chinese real estate development is quite the toxic investment and you should stay away… just like my ex. What this saga does inform us is the prevailing attitude of China’s government in the face of the private sector. Clearly Xi and friends don’t want to admit any kind of business is “too big to fail” and wants to punish developers like Evergrande and Kaisa for leaning into debt-fueled growth. If this stance persists, today’s actions may indicate which businesses will draw the ire of the world’s second-largest economy.