DocuSign’s terrible, horrible, no

good, very bad Friday

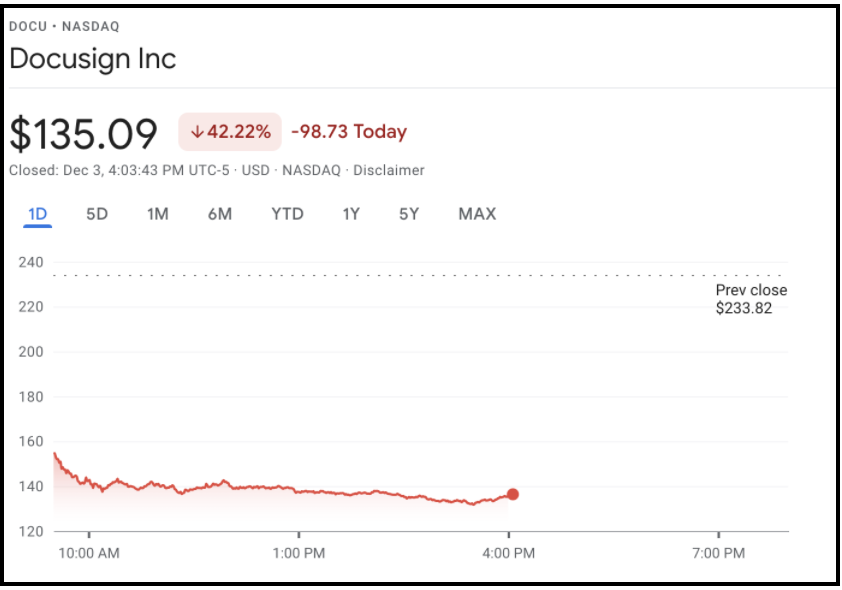

Shares of DocuSign (DOCU) decided to end the week lower than how you felt when you realized your parents love your sister more than you. And not in a weird step-sister kind of way. The e-signature software company announced their Q3 earnings after the bell on Thursday, and while they beat analysts’ estimates according to FactSet, their Q4 guidance was what caused their stock price to tank. In the words of Citi analyst Tyler Radke, DocuSign’s earnings report was, “one of the biggest [software as a service] whiffs in recent memory.” The stock closed Friday’s trading session down 42.2% to levels not seen since June 2020.

- The company reported Q3 EPS of $.58/share on $545.5M of revenue vs. analysts’ estimates of $.46/share on $531M of revenue. And that’s where the good news ends.

- DocuSign expects Q4 billings to be between $647M-$659M while analysts had forecasted Q4 billings of $705.4M.

- Analysts from Piper Sandler to JP Morgan all cut $DOCU’s price target from the mid-to-high $300’s to the mid-to-low $200’s.

- CEO Dan Spranger said, “While we had expected an eventual step down from the peak levels of growth achieved during the height of the pandemic, the environment shifted more quickly than we anticipated.” Ya don’t say?

Personally, I’m a big fan of DocuSign, but that’s because it allows me to not have to interact with other human beings in person… the size of Friday’s down move however gives me pause. $DOCU was below $100 when the pandemic hit, before reaching an all time high of $314.76 this past August. Friday’s close is roughly 60% lower from that ATH, so I’m keeping $DOCU on my watchlist, but will be waiting to see the stock put in a rounded bottom or two before deciding to jump in and buy.

Welcome to the Show

Surprised that index fund rebalancing isn’t a reality show.

The S&P Dow Jones announced Friday afternoon that Tesla, Microsoft, Amazon, and the other 490+ members of the S&P 500 index are getting new brothers and sisters this Christmas. Unlike the College Football Playoff selection show, however, Dow Jones went the boring route and just issued a press release rather than putting on a four-hour show to drag out what was a foregone conclusion.

- Congratulations to SolarEdge (SEDG), Signature Bank (SBNY), and FactSet Research Systems (FDS), which got the call up to the big leagues.

- The new entrants replace HanesBrands (HBI), Leggett & Platt (LEG), and Western Union (WU) which will be relegated from the S&P 500 to the S&P 400 Midcap Index and have to go sit in the corner and think about what they’ve done.

- The rebalancing aims to align market capitalizations in the index to be most representative of the companies included. The folks at Dow Jones definitely would’ve put Notre Dame in over Cincinnati.

The effective date of the changes is December 20, and Index Funds and ETFs will need to update their holdings to reflect new makeups. Definitely, something to keep in mind if trading these names over the coming days. This must be what it’s like in those European soccer leagues where teams get promoted up and relegated down at the end of each season.

Well, that was disappointing

We already had a pretty good idea of how the November jobs report was going to go, considering how it left Jay Powell shaking in his boots a week ago, but the numbers are finally here and wow do they suck. November had the worst growth this year and we’re here to pick up the pieces and see what that could mean for the future.

- Of the two surveys done by the Department of Labor (the establishment survey of businesses, and households) there was a significant discrepancy in payroll increases. The businesses survey disclosed a 210K increase, which is well below the forecasted 573k additions.

- The household survey however rose by 1.1 million, suggesting a shift towards self-employment. This might account for the drop in unemployment to 4.2%.

- The biggest growth in jobs was experienced in the professional and business services sector with an increase in 90K positions being filled. This was followed by Transportation and warehousing with a gain of 49.7K jobs.

- The biggest letdown (besides you to your parents) was in hospitality and leisure, which experienced only an increase of 23K jobs – a stark contrast to the 170K and 108K increases in October and September. As we’ve heard before, the tight labor market for these services has led to further wage growth for these workers (something chief economist at Jefferies, Aneta Markowska, warns could lead to a wage-price spiral).

While job creation did not hit its targets, the payroll increase in households and lower unemployment rate are some positives. It is important to note that historically the household survey has been more volatile, but given the uncertainty of the covid-economy, it may be more truthful than the past (we’re looking for silver-linings here, people). At least we have some security in knowing that the Fed is unlikely to flip-flop on tapering their bond purchases after these dismal results.