Let’s keep things civil

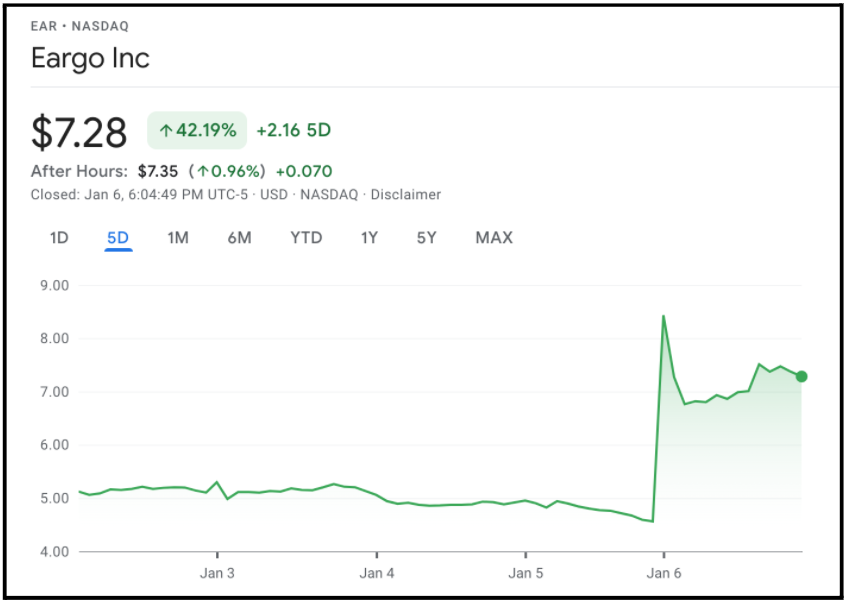

Hearing aid producer Eargo Inc turned up the volume yesterday thanks to an announcement that the DOJ’s criminal investigation has been closed and referred to its civil division. $EAR (of course it is) rose 85% in premarket trading before leveling off to a 59.65% gain on the day. Eargo’s stock tanked 68% in a single day back in September when the criminal investigation was initially announced, so this jump is just playing catch-up.

- They’re still hurting… bad. Even with this rebound, Eargo’s stock hovers around a pitiful 10% from its February 2021 glory days of $76.52/share. And after news broke that the DOJ was getting their Sherlock Holmes on, the company laid off 25-30% of its workforce due to the resulting dropoff in demand for its products.

- The exact details of the probe are unclear, but they concern roughly $44M of insurance money Eargo received from the federal government on behalf of its customers covered by the Federal Employee Health Benefits program. It seems that some of this money might have disappeared.

It ain’t over till it’s over. A probe in the DOJ’s Civil division is still a probe, albeit a less ominous one, which injects some inherent noise from a market standpoint. Granted, they can just turn their hearing aids down if they don’t want to hear it. Listening device jokes aside, Eargo’s fundamentals are still strong and before all this probe business, their growth prospects were too. If Eargo ever gets fully out of the woods in the legal department, then to my eyes and ears their potential is there.

Tech takes a tumble

It’s been a rough week for tech stocks. The past few days have seen the most intense market selloff since the 2008 financial crisis, with the Nasdaq incurring its worst daily and two-day drops in nearly a year. Though losses were widespread, the vast majority hit tech as hedge funds continued their December practice of shedding high-growth, high-value assets (i.e software, chip stocks).

- The driving force behind this overdue correction is likely the Fed’s announcement that they’ll move up the rate hike timeline, potentially beginning as early as March.

- But among this sea of red, there’s still some good news. Treasury yields rose for the fourth consecutive day Wednesday, causing the 10-year Treasury yield to briefly hit 1.751%, its highest point in two years.

Some sources believe that like all selloffs, this one creates an excellent buying opportunity. In this case, those sources would be playing the long game, because stocks are likely to fall when the rate hikes hit and would only recover after quelled inflation fears improve market sentiment. If I decide to go that route, the lowest-risk options are probably my mainstays with excellent recent growth records, like Apple and Microsoft.

Gonna go to Home Depot, maybe Bed Bath

& Beyond if there’s time

Bed Bath & Beyond (BBBY) had itself a nice little Thursday. The company missed revenue and earnings estimates, reported that supply chain disruptions cost them $100M and they struggled to keep items on shelves and that the challenging environment would continue into 2022. So naturally, the stock was…checks notes, up 8% on the day. It appears that those crazy Reddit kids are up to their shenanigans again.

- BBBY lost $2.78 per share vs. analysts’ expectations of a breakeven quarter, and sales of $1.88B fell well short of the estimated $1.95B.

- The WallStBets crowd expressed enthusiasm for the company online and might have been working their magic in their Robinhood accounts as the stock was up 23% at one point during the day.

- I would make a boxing analogy to describe the fight between fundamentals and meme-ability, but the current state of the sport is Youtubers fighting D-List celebrities and former athletes, which may in fact be an appropriate comparison after all.

The Reddit army may be closing in on its next short squeeze target, but BBBY has a lot of short-term and long-term headwinds and a shrinking cash position, so traders may have a ball with the big price swings. On the bright side though, yours truly used an expired 20% off coupon the other day on a wooden pizza paddle to go with my sweet new Ooni pizza oven.