Taking it in the (Padded) Shorts

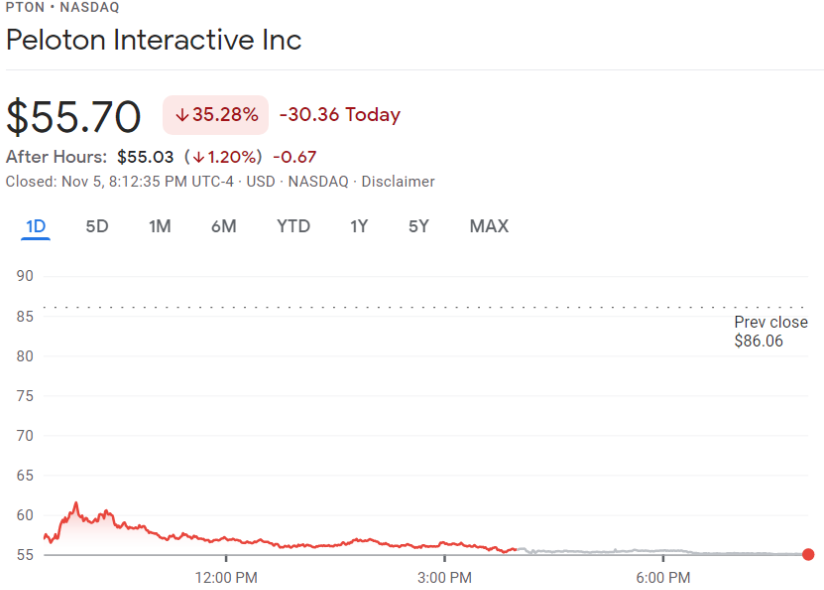

‘How to lose $9B in one day’ is not a new Kate Hudson rom-com, but instead is the absolute disintegration of Peloton’s (PTON) market cap on Friday. Shares were down an astounding 35% following a massive miss on earnings and cutting forward guidance. Right now, thousands of dads across the country are feeling quite smug thanks to their DIY solutions of duct-taping an iPad to an old Schwinn exercise bike.

- The company appears to be making some operational changes, announcing a hiring freeze and a slowdown in showroom openings.

- Friday exacerbated a tough 2021 for Peloton, which is down about 63% YTD.

- 2020 was a monster for the company, up 434%, but it appears that much of 2021’s growth was pulled forward into those results.

- And on an embarrassing note, CEO John Foley’s net worth dropped from billionaire status to a paltry $850M. Cue Gary Gulman.

Belief in the reopening trade will most likely be the main driver of PTON for the near future. If people flock back to the gym then names like Planet Fitness (PLNT) could come back from the dead and outperform Peloton. That especially rains true if the traditional pattern holds of gyms being crowded in January but emptying out by March while members continue to have their dues auto-debited.

Pfize on the prize

Shares of Pfizer were up almost 11% on Friday after a study showed that their COVID-19 treatment pill reduced hospitalizations and deaths in high-risk patients by 89%. I’m not a doctor but that sounds good. That result really rains on Merck’s parade, since their pill, molnupiravir, only reduces deaths and hospitalizations by 50%. MRK shares slid nearly 10% on Friday.

- Meanwhile the only thing Moderna knows how to reduce is their own share value. After posting flimsy Q3 earnings, MRNA stock tumbled over 16% on Friday, leaving Pfizer no competition for the COVID-treatment crown.

- Merck’s head start means they’re technically still in the game. Their pill’s already on the market, while Pfizer’s still needs emergency authorization from the FDA, who’s currently reviewing PFE’s product.

- This pill is just the Pficing on the cake. Last week, Pfizer’s Q3 earnings had already beat estimates, with revenue outpacing predictions by over $2B thanks to their vaccine. They already had the upper hand going into Q4, but their pill has turned a battle into a smackdown.

The combination of Pfize’s baller study and the strong performance of their injectable vaccine means that the FDA is probably going to push emergency authorization as fast as possible. Between booster shots and the potential FDA approval of this pill, Pfizer is likely to have a strong couple of quarters coming up.

Bridging the gap

After hours and hours of pushing and straining (and intraparty negotiating) on Friday, Congress passed a $1T infrastructure bill that will hopefully fix that one pothole you always hit on your way to work. $555B of the legislation will go to fixing necessities like gas mains, roads, and trains, as well as funding renewable energy initiatives and mitigating climate disasters. *Joe Manchin’s withered coal-powered heart beats its last*

- Because six progressive Dems voted against the package, it would have died on the House floor without the support of thirteen Republicans, making its passage technically a bipartisan effort. We forgot what that word meant.

- The lefties who voted against were holding out for Biden’s much larger and more controversial $1.75T (previously $3.5T) social spending bill, Build Back Better. They wanted to vote on the larger bill before this one so that they could force moderate Dems to vote for BBB by holding the smaller infrastructure bill hostage.

Now that the infrastructure bill has passed, Democrats are inoculated from the charge that they’ve been ineffective in power. Huge spending on social welfare, health care, and renewables aren’t guaranteed. What you can bet on are solid performances from the construction sector and from raw materials such as concrete, cement, and gravel, since the $1T bill locks in spending on highway maintenance and transit projects.