2021 was a wild year!

And that means it’s time for some celebrations – Happy New Year!

The entire Raging Bull family, and I personally, are wishing you a wonderful 2022!

May it be full of joyful moments, positive emotions, time with loved ones, and, of course, great trades!

I hope you enjoy the first weekend of the new year and come into 2022 well-rested and well-prepared!

In the meantime, let me recap some of the most memorable call-outs of 2021, brought to you by your Raging Bull gurus.

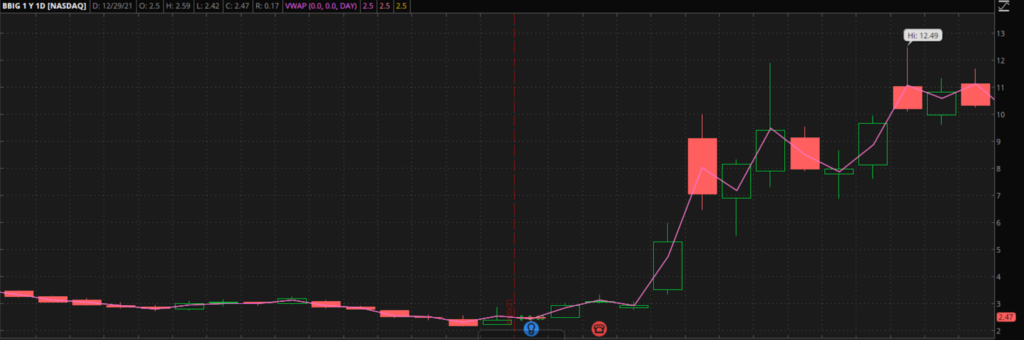

BBIG Options Call Out

Out of nowhere, the little-known stock BBIG became one of this year’s hottest momentum traders, following the acquisition of a TikTok competitor.

I mean look at that:

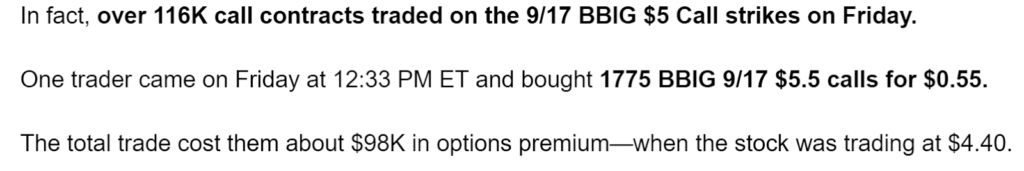

In what turned out to be one of my coolest call-outs of 2021 I noted the very aggressive and highly unusual options activity in the name early into the pump.

Here’s what I wrote back then:

“When the stock was trading at $4.40” – and you already see on the chart what happened next!

Shares nearly tripled and the calls have truly exploded $4.80!

Those like myself who watched the aggressive options buying had yet another indicator to support getting into the trade.

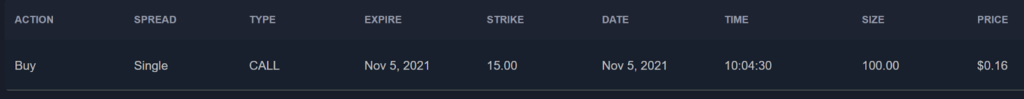

Lotto Trade In UVXY

I once explained to you why we call some trades “lotto’s” and what they are.

In a nutshell, these are the high reward, but very high-risk trades that we’d sometimes enter with negligible size – truly, like the lottery tickets.

In early November, Jason picked up some lotto’s on UVXY, betting on a pullback in SPY, that’s truly overextended:

It was a Friday, the day of expiration, meaning all out-of-money contracts normally go for very cheap, so Jason got his contract for $0.16 each.

Well, the SPY did pull back that day. And his UVXY Calls did work:

How is that chart looking?

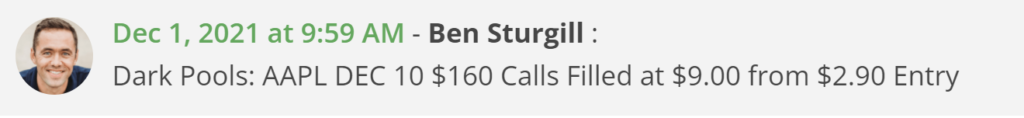

Ben’s Following AAPL’s Trend

Ben Sturgill didn’t sit back either.

You may often hear from skeptics that classic technical setups don’t work.

There’s some merit to that argument, but Ben’s here to prove them wrong.

Ben was looking at AAPL’s breakout to all-time highs – a classic setup we often talk about.

Following a breakout to new highs, the stock dipped back into the $157 area, which is exactly where Ben loaded up on call options.

He put on a continuation trade against prior all-time-high – classic “follow-the-uptrend” trade.

You already know from the chart above that the stock ripped higher.

Here’s how Ben’s actual trade went:

Here’s another stunning chart of the price of his options contract:

Comments are closed.

1 Comments

Thanks