Good morning, 360  |

| As always, we keep an eye on the biggest movers and the top headlines in the Market. Be the best prepared Trader on the Street! Have a great day, 360! |

|

|

|

|

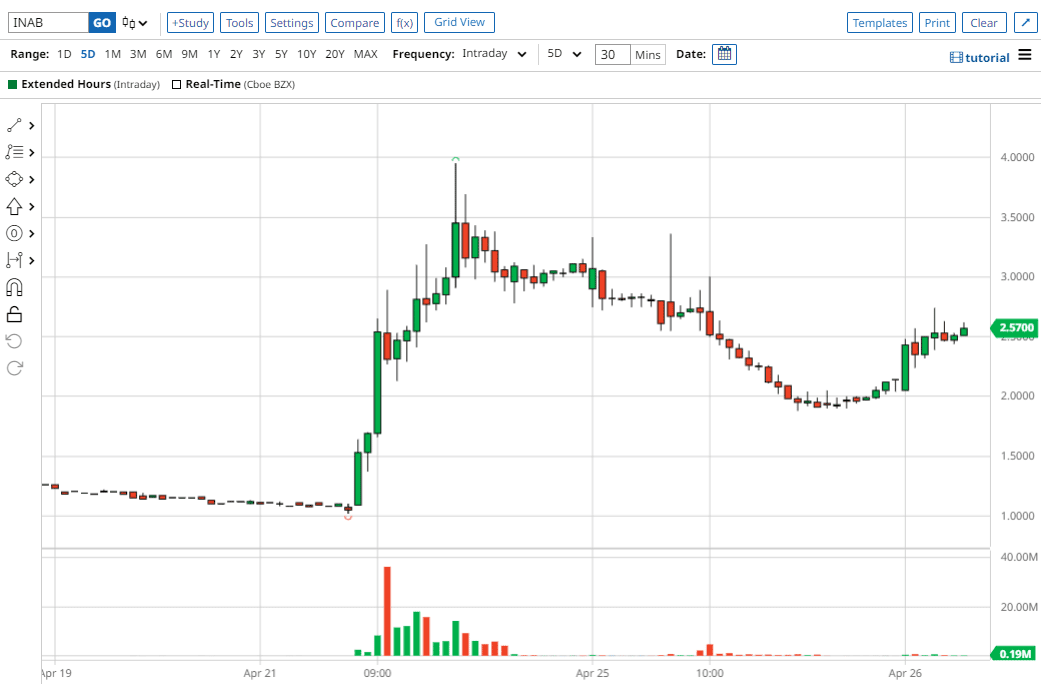

| INAB – Up over 37% in pre-market after H.C. Wainwright reiterates BUY rating, $14 price target |

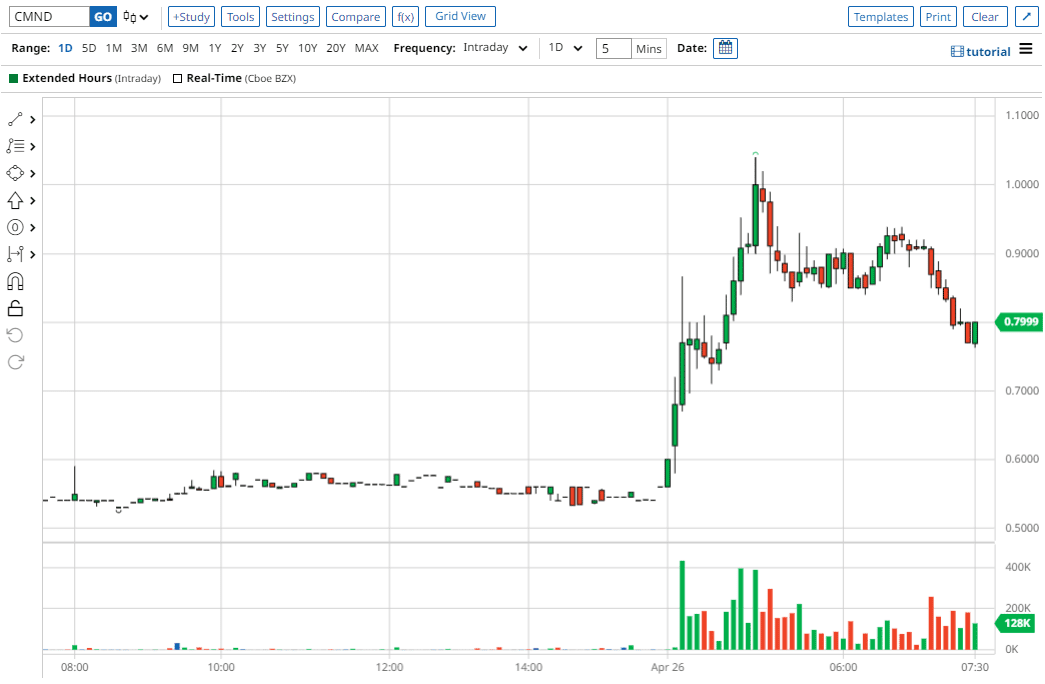

| CMND – Up over 39% in the pre-market this after announcing a collaboration and patent application for treatment of depression with SPRC on Friday |

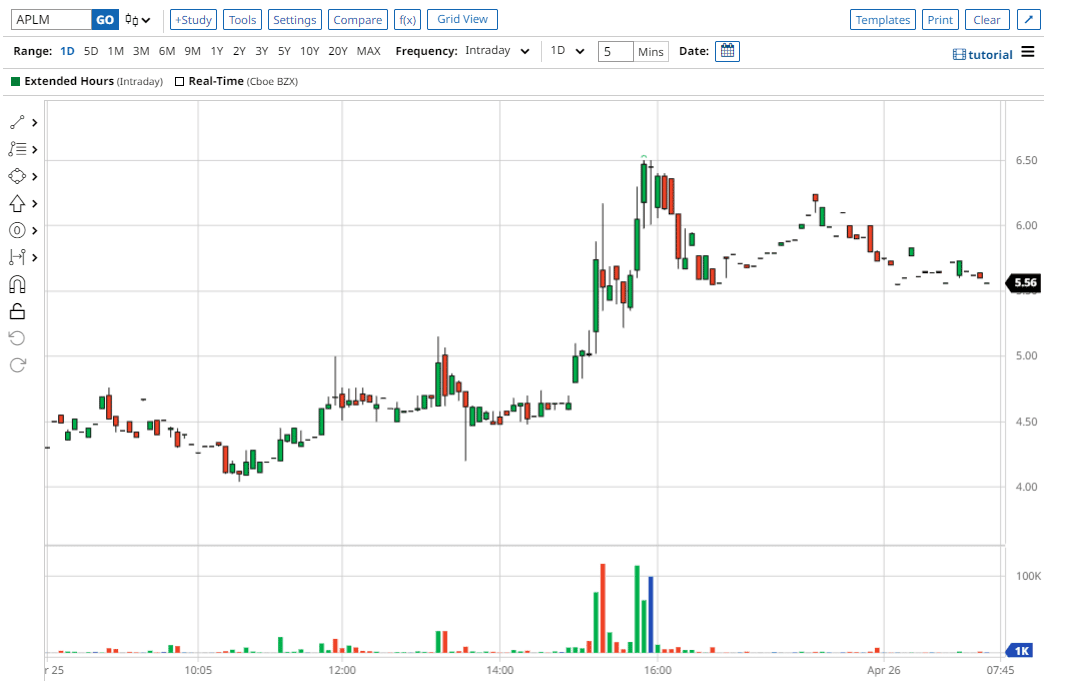

| APLM – 2nd day play, closed up over 59% after E.F. Hutton initiated coverage with a BUY rating and $25 target yesterday |

|

|

|

|

You too, like Aaron, can get Jeff’s next 13 Bullseye Trades of the Week              … … |

| For a measly $47!!! |

|

|

| Altered (but we’re totally sure he’s thinking this) |

| Don’t worry, Aaron — we got you! |

Come see why Jeff Bishop is rated 4.8/5  on TrustPilot, and check out why people love BOTH Bullseye Trades & Wall Street Bookie (where Jeff has won his last 18 options selling trades* – scintillating on TrustPilot, and check out why people love BOTH Bullseye Trades & Wall Street Bookie (where Jeff has won his last 18 options selling trades* – scintillating  ). ). |

| *at the time of writing this ad April 25th |

|

|

|

|

| INAB – Up over 37% in pre-market after H.C. Wainwright reiterates BUY rating, $14 price target |

| IN8bio (INAB) is up 37% in pre-market after H.C. Wainwright reiterated its BUY rating and $14 price target. On Monday, the company presented new data for its drug INB-100 showing long-term complete remissions and elevated Gamma-Delta T Cells in 100% of evaluable treated leukemia patients (n=7) including high-risk acute myeloid leukemia (AML) patients and a patient with acute lymphoblastic leukemia (ALL) who had failed 4 prior lines of therapy, including CAR-T, with all evaluable patients remaining alive at last assessment and one patient out beyond 3 years. |

| The stock closed up over 200% on Monday, before falling 37% yesterday. It has since recovered yesterday’s losses so far in the pre-market on the reiteration. Any large shorts that did not cover yesterday could be in trouble today. |

|

|

| The $2.50 area was support on Monday and again in the pre-market this morning and will be an important level to watch. |

| Above it, targets to the upside are $2.88, $3, $3.25, $3.40, $3.70 and then Monday’s high of $3.95. Beyond that, $4.50 and $5 come into play. |

| Below $2.50, there is potential support at $2.05, $2 and $1.90. Below that targets to the downside are $1.60, $1.40 and a gap to fill at $1.05. |

|

|

| CMND – Up over 39% in the pre-market this after announcing a collaboration and patent application for treatment of depression with SPRC on Friday |

| Clearmind Medicine (CMND) announced a patent application for the treatment of depression with SPRC on Friday. CMND is focused on the development of novel psychedelic-derived therapeutics to solve major under-treated mental health problems |

| While SPRC has been up over 20% since Friday and over 50% over the last few weeks, CMND has been trading sideways. It’s doing some catching up this morning. |

| MNMD, another psychedelics play is also up over 20% the last few days. This sector may just be starting to heat up. |

| CMND and SPRC filed a patent relating to the protection of the unique combination of MEAI and SciSparc’s (SPRC) palmitoylethanolamide for the treatment of depression, alcohol and drug addiction. |

|

|

| The $0.74 area was support in the pre-market and will be a pivot point to watch. |

| Above it, targets to the upside are $0.80, $0.85, $0.90, $0.94, $1 and then the pre-market high of $1.04. Beyond that, $1.20, $1.40 and $1.50 come into play. |

| Below $0.74, there is potential support at $0.70, $0.64 with a gap to fill at $0.5520. |

|

|

| APLM – 2nd day play, closed up over 59% after E.F. Hutton initiated coverage with a BUY rating and $25 target yesterday |

| Apollomics (APLM) received a BUY rating and $25 target from E.F Hutton yesterday and closed 59% on the news. The $25 target still represents over 300% upside from yesterday’s close. |

| APLM is a recent SPAC merger aimed at supporting candidates targeting difficult to treat cancers. |

| The stock is a prior runner, that traded above $40 on Mar 30, 2023, the day of the merger. |

|

|

| The $5.55-$5.40 zone was a support area during trading hours yesterday, in the after-hours and in pre-market this morning so is an important level to watch. |

| Above it, targets to the upside are at $6, $6.20, $6.50. Beyond that, $8 and then $12 come into play. |

| Below $5.40, the is potential support at $5.20, $5, $4.80, and then $4.50. |

|

|

|

|

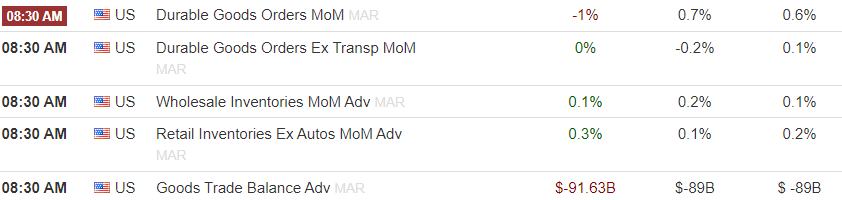

| Economic Calendar |

|

|

|

|

| To Your Success! |

…

… on TrustPilot, and check out why people love BOTH Bullseye Trades & Wall Street Bookie (where Jeff has won his last 18 options selling trades* – scintillating

on TrustPilot, and check out why people love BOTH Bullseye Trades & Wall Street Bookie (where Jeff has won his last 18 options selling trades* – scintillating  ).

).