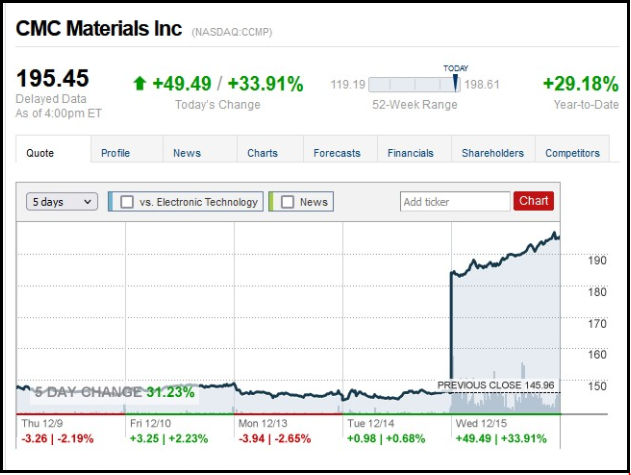

Silicon Surge – CMC Materials

Shoots up due to Acquisition

Shares in semiconductor materials supplier CMC Materials (CCMP) gained 33.91% yesterday thanks to the announcement that CCMP will be acquired by rival Entegris in a cash-and-stock transaction. Gold is so last century, silicon wafers are the new hotness.

- Entegris will be paying CCMP shareholders $133 in cash and 0.4506 shares of Entegris for each CCMP share that they hold. This is a windfall for those investors as this exchange will be a 35% premium compared to where the stock closed on Tuesday.

- The transaction is paid via fully committed debt financing from Morgan Stanley Senior Funding but is not subject to financing conditions. When all is said and done, CMC shareholders will own 9% of the company, with Entegris shareholders controlling 91%.

Despite the number of shortages and shipping delays that have affected semiconductor manufacturers for the past 2 years of the pandemic (stares at the calendar and cries), it’s a pretty safe bet that their services aren’t going anywhere (just like their products due to shipping delays). Entegris CEO Bertrand Loy has a similar amount of confidence on the matter, positing that the company expects to realize $75M in run-rate cost synergies and $40M in CapEx synergies within the 12-18 month period after the deal closes in 2022. If they end up staying true to predictions, it could be positioned to make a serious splash on the semiconductor scene and investors will be hoping to strike some serious silicon.

Jay fixes inflation

Jay goes back to sleep after the inflation problem is solved

Well it finally happened, the eggheads at the Fed got together and agreed that maybe, just maybe, inflation is getting to be a problem, and that they should do something about it. On Wednesday Fed Chairman Jerome Powell announced that the Fed will be raising interest rates in 2022 faster than initially anticipated. Talks on the matter began to swirl around mid-November, with a number of officials doing their best to wake ‘ol Jay up, and the market began to adjust accordingly. A faster taper rate than expected reflects the chair’s confidence in the economy going forward. That or he’s as tired of hearing the word “transitory” as are the rest of us.

- In November, the Fed started taking baby-steps towards combating inflation by curbing its $120B-per-month bond purchasing program by $15B starting November and December, a pace which would cut the program by mid-June 2022. Today’s announcement doubles that rate to $30B a month, now concluding the program by end of Q1.

- With the bond-buying program’s conclusion on the horizon, the likelihood of rate hikes is pretty much assured. Powell went on to say they don’t anticipate the need to raise rates before the taper ends, but reserve the right to do so before the country hits full employment. In fact, Jay and his buddies are so confident that policymakers see five more increases as appropriate across 2023 and 2024 to really let the air out of inflationary tires.

This is certainly great news for the market, which has been looking for any kind of concrete policy from the Fed instead of: “let’s throw taxpayer money at it and see what happens”. Rate hikes happening sooner than anticipated is due to inspire a lot more confidence in the market amongst the public, bringing us from the brink of bearishness. The markets adjusted accordingly, with the S&P 500, Dow, and Nasdaq rising 1.3%, 0.9%, and 1.7% respectively.

Holiday cheer worthless

Santa dropping an absolute dump of a CPI into your stocking this year

While November spending outpaced YoY price gains, the lead was measly– just a seasonally adjusted 0.3%— in comparison to October’s phat 1.8% gain. Some analysts attribute this weak holiday performance to the record-high transitory inflation that’s even got J-Pow freaking out (cough cough gas prices are up 52% from December 2020 cough). Or maybe Santa just isn’t coming this year.

- But it’s not as bad as it looks. For one thing, consumer demand is way better than it was this time last year– 18.2% better, in fact. For context, the YoY gain from 2019-2020 was just 6.8%.

- And it turns out that people did do their Christmas shopping– in October. Apparently people started shelling out their cash before stores started assaulting customers with Michael Bublé.

- Inflation does have something to do with the slump, though. While most customers will pay inflated prices for longer than you’d expect, that lack of resistance drives prices even higher, creating a cycle where eventually a significant portion of customers get fed up and leave.

The Fed signaled a more hawkish stance towards inflation, and in this context that’s a good thing. The prospect of lower inflation will improve consumer sentiment and likely drive up spending. Higher spending will (hopefully, after a while) combine with realized lower inflation and produce better seasonally-adjusted retail sales numbers for the coming months. In general this news is a sign for optimism in markets across the board.