The market is down today… Again!

And this last part has me worried…

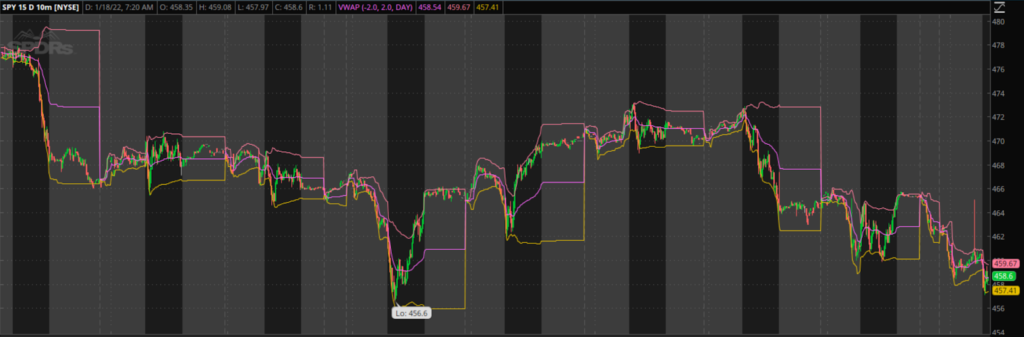

There’s no argument that the past 2 weeks or so have been volatile:

The SPY has had multiple days with nearly $10 of range, and that’s a big deal for a product that represents the entire market!

Indices rallied into the close on Friday, surely betting on a bounce today – a bounce that never came.

If you have any meaningful long-side exposure – this is not a comfortable spot to be in.

Let’s see what may happen next and how to brace yourself.

Inflation & Job Market Taking its Toll

This market has been simply amazing, and the past year and a half might very well have been the best time in history to be a bull (or, a Raging Bull, in our case).

But you can’t ignore some of the macro warning signs we’ve been seeing lately, not anymore.

For one, the job numbers continue to consistently disappoint, undermining the economic recovery.

Secondly, and more importantly, there’s inflation… and inflation is a HUGE deal!

You see, FED’s number one course of action in times of high inflation has historically been to raise interest rates.

The theory behind this is simple: higher rates will incentivize people to save more money, spend less and lower the demand for goods and services – thus, slowing down the inflation rate.

For the equities markets, this has an obvious side effect – if the rates are higher, investors will pull more money out of the riskier assets (like equities) and into lower risk, fixed income products.

Hence, the capital outflow and lower levels of buying activity will bring the stock market lower.

This mix of economic uncertainty and the expectation of a rate hike may explain away a good chunk of the pullback we’re seeing in the market.

So, what’s next?

Expect Volatility in Short-Term

Whether you think the next big move will be up or down, one thing is pretty clear – the opinions are heated on both sides.

Bulls are aggressively buying the dip and calling for more upside, while bears are finally thinking they can call the top, citing the reasons from above.

Such an environment usually only means one thing – high short-term volatility.

Those long-biased will jump on every breakout, while bears will short every breakdown.

Volumes will be elevated, but the market likely won’t pick a direction until one side exhausts.

The advice here is quite simple – be ready for a choppy environment. Don’t bet too have on one side, plan ahead and keep your risk very tight.

In the words of our own Ben Sturgill: “The name of the game right now is be nimble with short term trade and take the money and run.”

But What and How to Trade?

In the case of Ben Sturgill, he mostly talks about very short-term, good intraday setups on names in play at the moment – the stuff he normally covers in The Workshop.

Another approach one may take is that of Jason Bond.

He trades what he preaches in The Octagon, hence, here’s his plan for the near term:

“I’m not bearish because history shows markets generally perform well in a rising rate environment. Therefore, I’m an aggressive seller of Puts, through vertical spreads to manage risk, on good companies like SHOP, NFLX, RH, PYPL, and PAYC. I like to go 1-2 weeks out and collect the premium when sideways and/or bounces occur.”

Jason does put a special emphasis on “manage risk” – after all, nimble is the name of the game, remember?

In any case, stay safe and make this volatility an opportunity to remember, not an experience to forget.

Related Articles: