Leveraged index ETFs could offer a wealth of opportunities since you’re able to capture higher returns if you’re right on the money. If you could figure out which way the index is headed, you could catch the trends and potentially make over 10% in a short period. In this post, we will go over how to trade two leveraged ETFs that relate to the Russell 2000 Index, the Direxion Daily Small Cap Bull 3X Shares (TNA) and the Direxion Daily Small Cap Bear 3X Shares (TZA).

Although leveraged ETFs offer higher potential returns, keep in mind that leveraged ETFs are highly risky. If you don’t have an appetite for high risk, you should stick with regular ETFs. In general, many consider this asset class to be among some of the riskiest over the long term. That said, you should only consider trading these in the short term because that’s the way they’re designed.

What is the Russell 2000 Index?

The Russell 2000 Index tracks the performance of approximately 2,000 small-cap stocks found in the Russell 3000 Index.

How to Trade the Russell 2000 Index (TZA and TNA)

TZA and TNA track the Russell 2000 Index, both of which are leveraged ETFs’ underlying index. TZA aims to provide investment results corresponding to -300% of the Russell 2000 Index. On the other hand TNA seeks to amplify the daily performance of the Russell 2000. This means if the Russell 2000 rises by 1%, TZA will typically show a daily percentage change or -3%. Conversely, if the index closes up 1%, TNA should be up approximately 3%. The opposite is true when the Russell 2000 falls by 1%. In other words, if the index closes down 1%, TZA would close up around 3%, while TNA would close down 3%.

Think of it this way: if you’re bullish on the Russell 2000 index ETF, you would buy TNA. However, if you’re bearish on the index, you would buy TZA.

As you can see, both the TNA ETF and the TZA ETF have 3:1 leverage. This could significantly enhance your profits. Don’t forget that the profit potential is proportional to the risk.

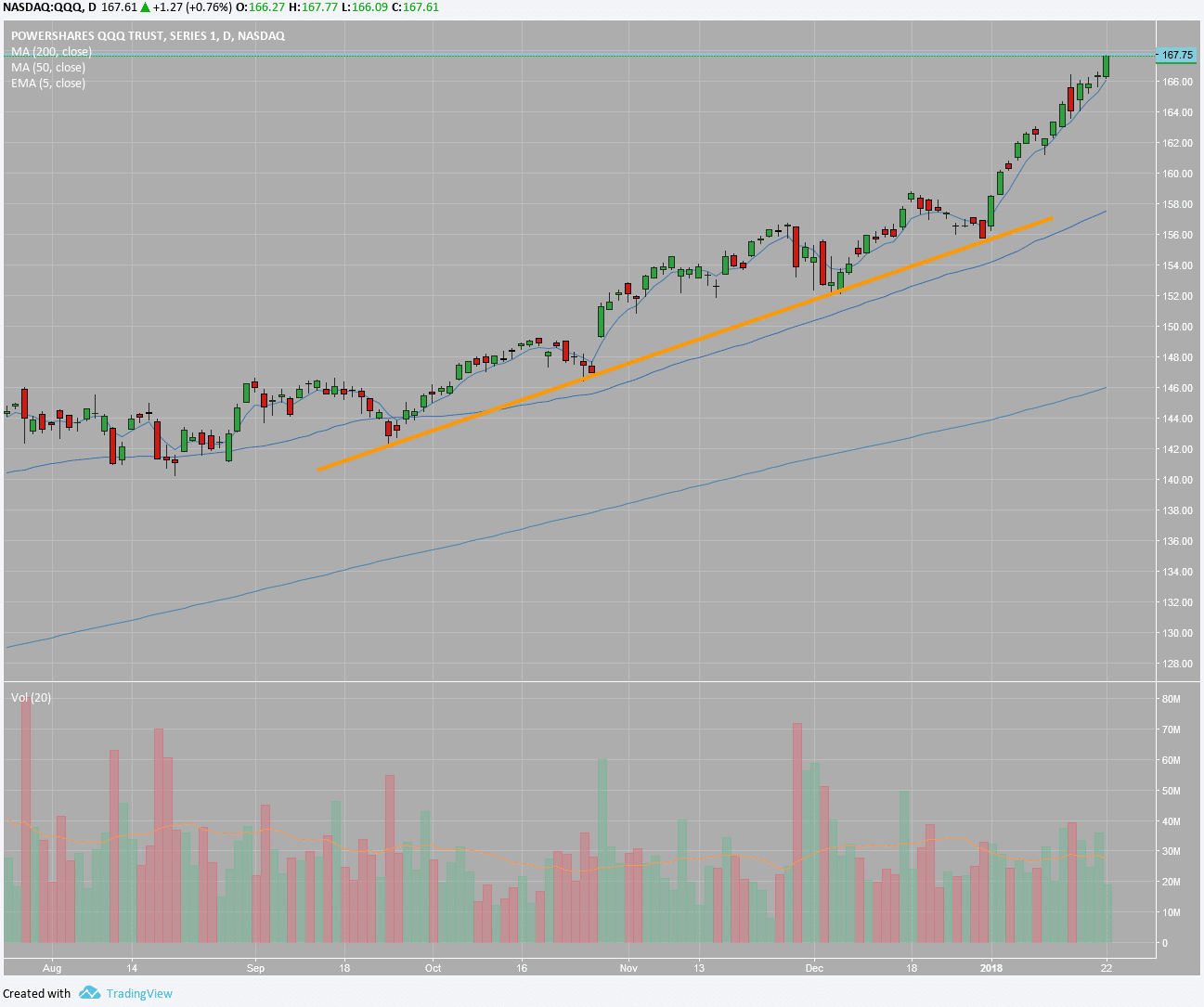

Tracking the Russell 2000 Index Chart

If you have a high-risk tolerance and want to trade TNA and TZA, it’s extremely important you follow the underlying index. Ultimately, the Russell 2000 Index is the key driver behind the movements in these leveraged ETFs. The Russell 2000 Index performance is important to track when you are trading in this area. Now, you’ll have to understand the market well and have indicators, and a thesis behind why you are bullish or bearish on small-cap stocks.

It could be tricky to figure out a direction in the market, so you’ll need to create and trade a plan. For example, you might be bullish on small-cap stocks over the long term, but once you consider trading leveraged ETFs, you could consider both sides in the short term.

For example, let’s assume you noticed this technical pattern:

The 13 simple moving average (SMA) crossing above the 30 (SMA) on the hourly chart, in early March. I would consider this a bullish pattern.

That said, I would consider buying TNA over the short term since I’m bullish on small caps.

Now, here’s TNA on the hourly chart:

Notice how both the Russell 2000 and TNA charts are nearly identical.

Here’s the hourly chart on TZA:

The chart is the inverse of TNA and the Russell 2000 Index.

Final Thoughts

Leveraged ETFs could be lucrative, but you’ll need to be able to handle the risk. Now, you’ll need to figure out a direction and a catalyst, whether it be technical or fundamental. Again, if you’re bullish on small-cap stocks, you could consider TNA. On the other hand, if you’re bearish on the Russell 2000 Index, you might consider a position in TZA. Keep in mind that you should only hold these for a short period of time because you could lose a lot more than anticipated over the long term.

#-#-#

Jeff Bishop is lead trader at WeeklyMoneyMultiplier.com and widely recognized as the Mensa Trader. He runs short-term trading strategies, using stocks, options and leveraged ETFs.

1 Comments

Hi Jeff,

I liked this article and had a question?

Is the TNA/TZA a “split” strategy or an “all in” and a “Sell/Buy” as one move?

I’ve done it both ways and I’ve had about the same success and losses.

Your Thoughts?