The tech sector is currently one of the top-performing groups in the exclusive Nasdaq 100 Index. The technology sector includes organizations that are concerned with the development, research, and sale of software and hardware. This sector contains well-known tech giants like Microsoft Corp. (MSFT) and Apple Inc. (AAPL) as well as various other companies within the technology industry.

As technology continues to grow and expand, it’s not surprising that a lot more traders are looking to get into exchange-traded funds (ETFs) tracking the index. Over the long term, investing in tech stocks could generate high returns. However, if you don’t want to buy and hold stocks, tying up the bulk of your capital, you could look into leveraged ETFs. In this article, we discuss how to trade the ProShares UltraPro QQQ (TQQQ) and the ProShares UltraShort QQQ (SQQQ), which are directly related to the Nasdaq 100 Index’s daily performance.

Before continuing, though, it’s important to emphasize that leveraged ETFs are highly risky, and these are best left for those who have a high risk tolerance. These securities have a negative connotation and are considered some of the riskiest to hold over the long run. Although these instruments are highly risky, there is a way to “properly” trade them. Leveraged ETFs are typically designed to amplify an underlying asset’s performance over short periods, like one day. Therefore, if you’re bullish or bearish on an index, like the Nasdaq 100, you could consider a leveraged ETF or leveraged inverse ETF, respectively.

If you don’t want to buy and hold stocks, tying up the bulk of your capital, you could look into leveraged ETFs.

How to Trade the Tech Sector with SQQQ and TQQQ

The SQQQ and TQQQ both track the Nasdaq 100 Index, and if you’re looking to trade these leveraged ETFs, you’ll need to follow the index or the PowerShares QQQ Trust (QQQ).

TQQQ’s primary objective is to provide amplified returns in relation to the Nasdaq 100. TQQQ is one of the most popularly traded leveraged ETFs in the United States and serves as a vehicle for those who are extremely bullish on QQQ or the tech sector. Here’s how TQQQ works: if the Nasdaq 100 Index rises 1%, TQQQ will generally rise 3%, and vice versa.

On the other hand, SQQQ is a leveraged inverse ETF and aims to provide three times the inverse of the Nasdaq 100 Index’s daily performance. In other words, if the underlying index falls by 1%, SQQQ should rise by 3%. The opposite is true if QQQ rises by 1%. With that in mind, you would consider SQQQ if you have bearish sentiment on the tech sector.

You can probably see how SQQQ and TQQQ could provide lucrative opportunities over the short term. But keep in mind your profit potential is proportionate to your assumed risk.

Potential Reasons to Trade SQQQ and TQQQ

You might consider SQQQ if major technology stocks have been weak or reported poor earnings.

One potential reason to trade SQQQ is sector rotation. If you notice there is some selling in multiple tech stocks, it could be a sector rotation and a reason to get long SQQQ. When there’s a sector rotation and the QQQ is near all-time highs, traders and investors might not want to buy at those levels. Consequently, there may not be enough buyers to keep prices propped up, potentially causing a sell-off in the Nasdaq 100 Index. This would benefit SQQQ.

Additionally, you might consider SQQQ if major technology stocks have been weak or reported poor earnings.

On the other hand, you might consider TQQQ if tech stocks have positive news or strong earnings. For example, the potential repatriation of overseas cash and lowered corporate taxes were catalysts that sent the Nasdaq 100 Index to all-time highs.

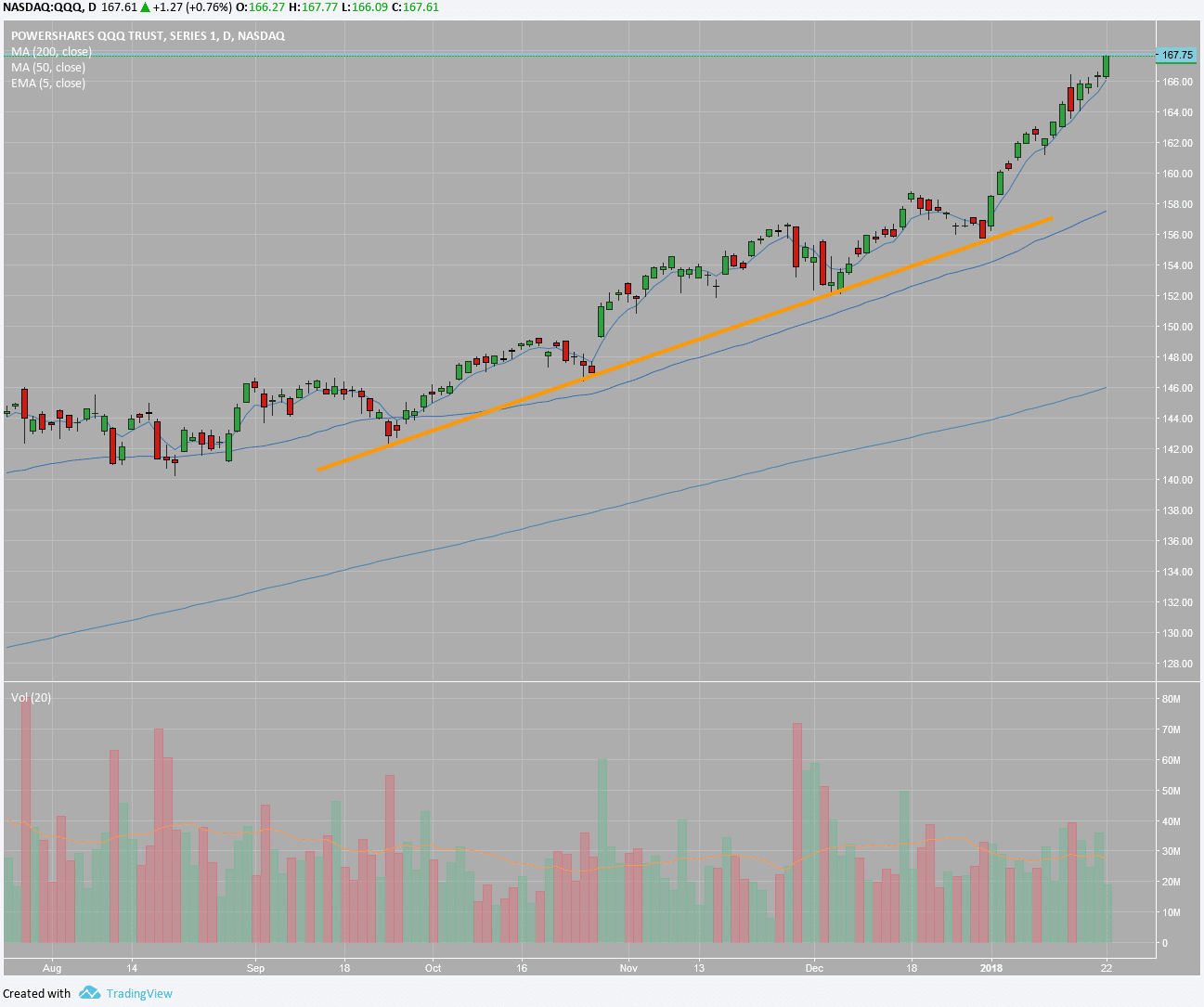

Another reason you may consider TQQQ and SQQQ is due to certain technical analysis indicators. For example, QQQ has been going straight up, and we’ve been waiting for a bearish signal to potentially give us the proper risk-reward. Here’s what we noticed in QQQ:

Now, before you consider buying SQQQ, we would want to see a bearish candle or setup. If and when there is a bearish candle, we’re looking for QQQ to test the support trend line. For those who don’t have access to an options account, SQQQ could serve as an alternative to placing a bearish bet on the market over the short term.

QQQ vs. SQQQ and TQQQ

As we mentioned earlier, TQQQ amplifies the Nasdaq 100 Index’s returns, while SQQQ goes up when the index falls. Think of SQQQ as a short QQQ.

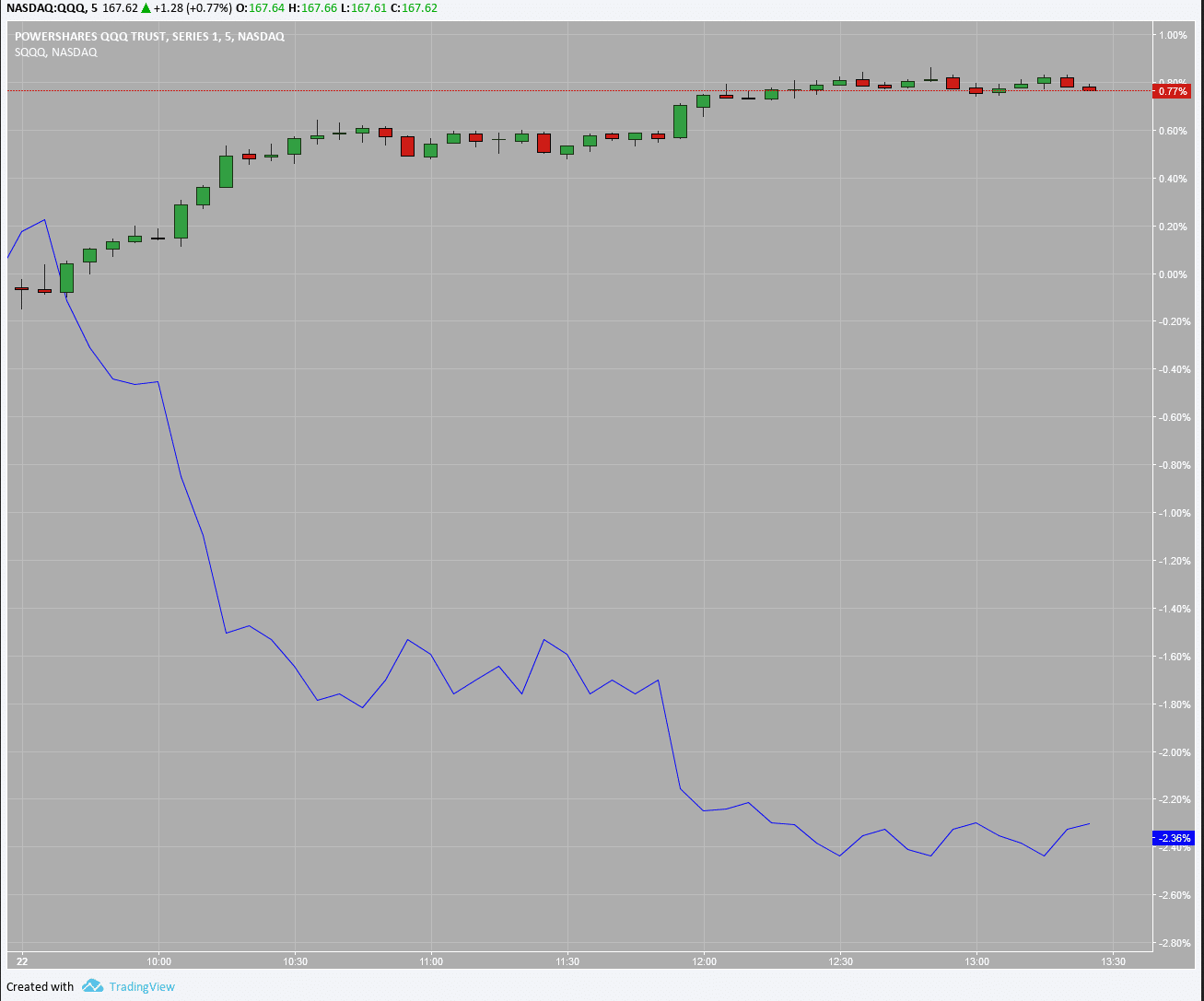

Here’s a look at QQQ with SQQQ overlaid on the 5-minute chart:

You’ll notice that SQQQ (the blue line) amplifies the inverse of QQQ’s daily returns. Since QQQ was up 0.77%, SQQQ should be down approximately 2.31%. Keep in mind that the figure will not always be exact. For example, in the chart above, when QQQ was up 0.77%, SQQQ was down 2.36%.

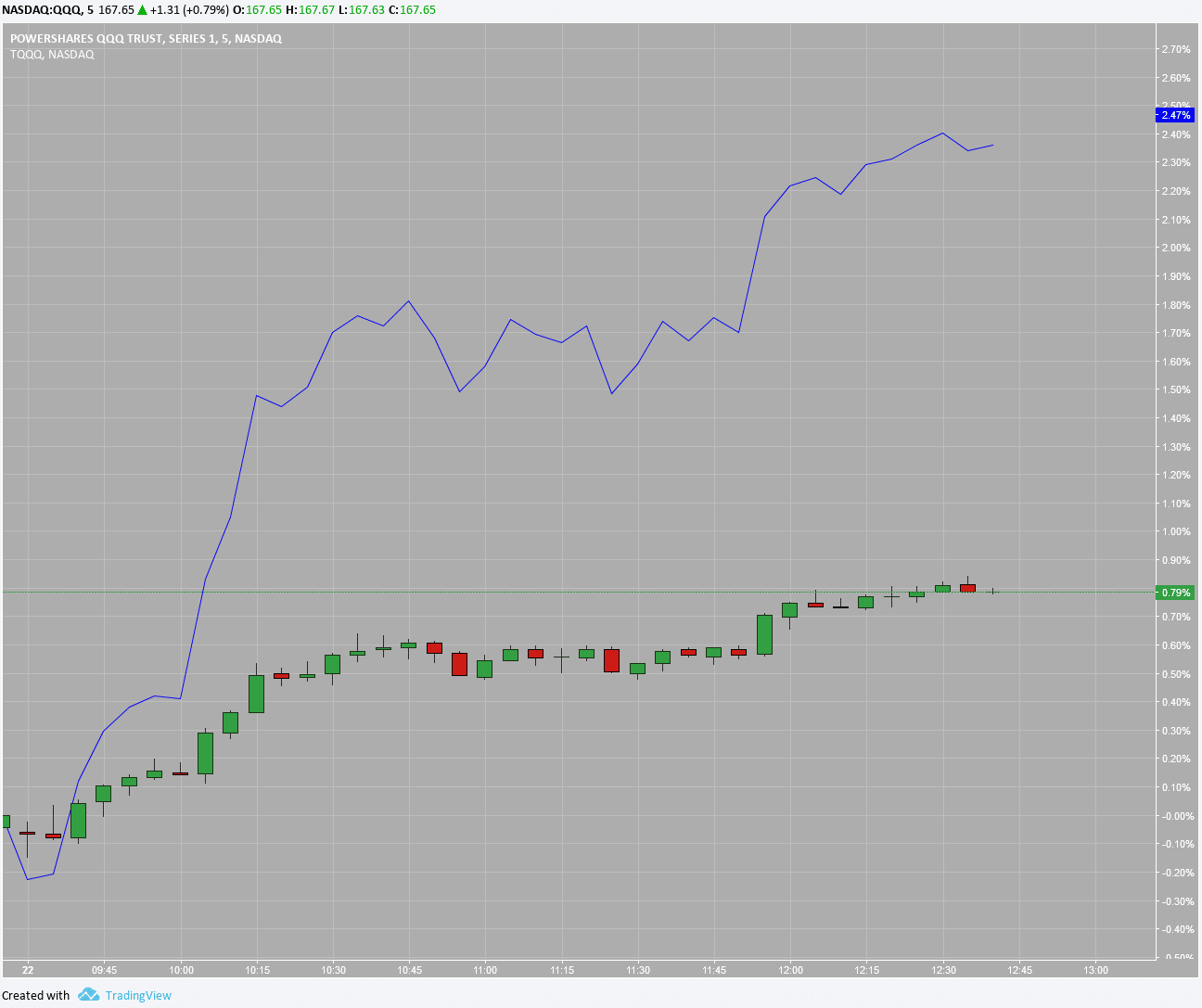

Now, let’s take a look at TQQQ in relation to QQQ:

Notice TQQQ amplifies QQQ’s gains by approximately 300%. When QQQ was up 0.79%, TQQQ was up 2.47%. Now, this isn’t exactly three times the QQQ’s percentage change, which is primarily due to market participants bidding up the price of TQQQ, potentially placing a speculative bet that QQQ continues higher.

Final Words

TQQQ and SQQQ could provide short-term opportunities in the tech sector. However, TQQQ and SQQQ aren’t pure plays for tech stocks. The underlying index is comprised of approximately 60% of technology stocks, which is subject to change.

The Nasdaq 100 Index is market-cap weighted. In other words, companies with large market caps will have a higher portfolio weight. For example, Apple (AAPL), the largest company by market capitalization, has a portfolio weight of more than 10%. That said, if the top 10 holdings start to fall, it could cause a ripple effect and push the entire index lower, which would benefit SQQQ. Conversely, when the 10 largest holdings start to rise, TQQQ would benefit.

Again, you should only consider TQQQ and SQQQ for short periods since the compounding of daily returns could eat away your returns. Moreover, these leveraged ETFs are highly risky and should only be considered by those who have an appetite for risk.