This Stock is the Ship!

-sorry, Dad joke

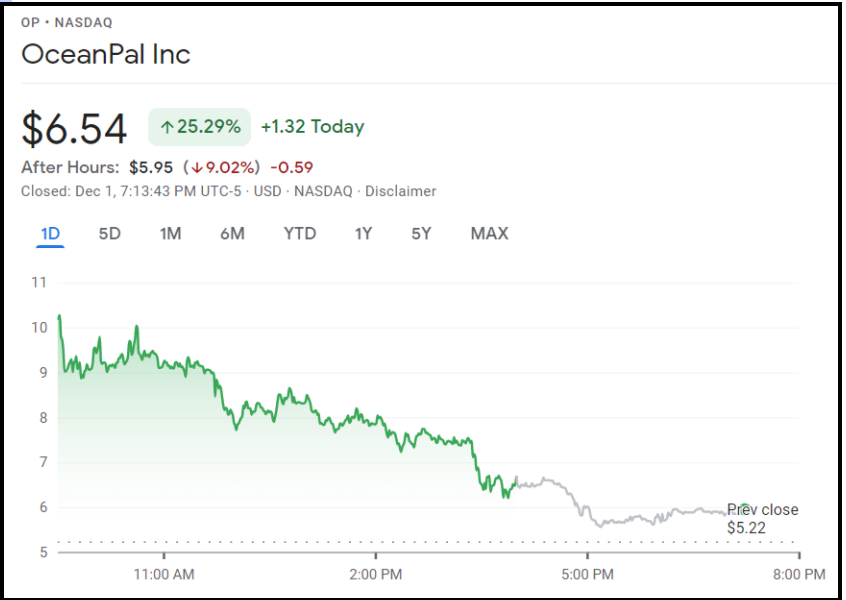

Shares of OceanPal Inc. (OP), a “global provider of shipping transportation services through its ownership of vessels,” screamed higher to start Wednesday’s trading session. The stock climbed as high as $10.75 before sellers came in to rain on $OP’s parade, reversing what was a +86% gain down to a reasonable +25.29% to close the day. I’m starting to see a trend the past couple days… OceanPal was spun off from dry-bulk vessel owner Diana Shipping (DSX) on November 29th and made its NASDAQ debut the following day.

- Shareholders of Diana Shipping received 1 share of $OP for every 10 shares of $DSX held on the record date of November 3rd.

- OceanPal’s focal point will be on dry-bulk shipping, like Diana Shipping, but will specialize “on older vessels with shorter duration charters.”

- Shares of Diana Shipping have dropped -6.9% (not nice) over the last two days but are still up an impressive 103% YTD.

Shares of $OP can remain volatile anywhere from a few days to a few weeks like most newly traded stocks. If you want to play the dry-bulk sector, and you have virtually zero historical data to go on as is the case with $OP, there are a few places you can look to for guidance. Textainer Group Holdings (TGH), the Transportation ETF (XTN), and the Breakwave Dry Bulk Index (BDRY) are good starting points. One note of caution for traders that have never dipped their toes in these stocks, they can be quite volatile and sometimes lack liquidity⦠granted I should’ve guessed the latter since dry is in the name.

A Quantum Leap for Honeywell

Something about the space-time continuum and whatnot. Honeywell (HON) has spun out its quantum computing business unit into a standalone firm, which is now the largest company of its kind in existence. The new company, Quantinuum (which is a kick*ss band name tbh), brings together hardware, software, and applications into a full stack, allowing it to offer clients solutions regardless of how the technology develops.

- The new company has about $270M in balance sheet capital to begin, and while management has not announced impending plans to go public, this is a definite watchlist item for me.

- The applications for quantum computing are endless, but some early candidates for development include logistics optimization, pharma molecule mapping, and cyber security.

I can’t pretend to understand quantum computing, but this move is interesting as it comes on the heels of other conglomerate breakups like GE and JNJ, so we might just have ourselves a macro trend. Other than that, all I know is that Ant-Man did something with the quantum realm, and Dr. Sam Beckett never made the final leap home.

On the grid, off the charts

Voltus whenever they see an open socket.

Voltus Inc announced on Monday that it’s going public via a SPAC merger with Broadscale Acquisition Corp, setting Voltus’s evaluation at $1.3B. The electricity-market startup uses software to manage distributed energy resources, aka DERs (read: anything that eats, stores, or sh*ts electricity) for huge companies like Coca-Cola and Home Depot. More specifically, it optimizes each DER’s electricity use and enables its owner to make a profit by selling the excess electricity back to the grid. Nice hustle.

- Voltus has serious backing. Broadscale itself holds $345M, but Voltus has also raised $100M from private investment in public equity from investors like Equinor ASA, which mayhelp fuel its growth right out the gate.

- There’s a reason for all the interest. Some analysts believe that widespread adoption of DERs will be critical to decarbonizing the economy and kicking Big Oil to the curb. If Voltus can make that transition profitable, it’s in a really good place.

Voltus’s CEO Gregg Dixon described the company as the AirBnB of electricity systems- a means for all electricity producers to make a profit off their resources by connecting to the grid. Curiously he left off any mention of cleaning fees. If he’s right, this company has the potential to scale very rapidly by expanding the grid through decentralization. What’s more, they’re already partnered with grid operators in the U.S. and Canada, so they’re better situated to take advantage of a burgeoning market than potential competitors. I’ll be on the look out for this one once they go public.