Where is Spock When You Need

Him?

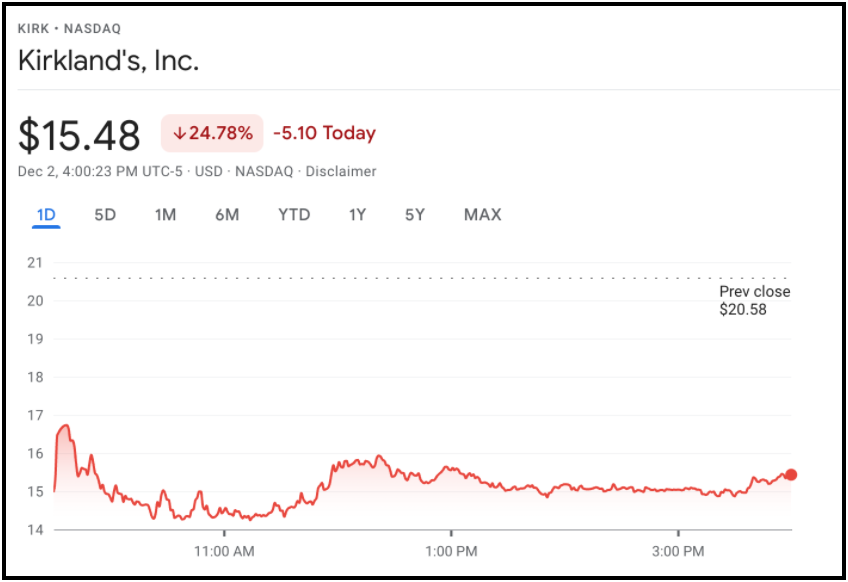

Shares of Kirkland’s Inc. (KIRK) *readers nodding now that they understand this article’s title* got smacked in the mouth during Thursday’s trading session. The stock, which released disappointing Q3 earnings and forward guidance, fell nearly 25% on the day. Before we move on, let’s clear one thing up. Kirkland’s Inc is a U.S. home decor and furniture retail chain, while Kirkland Signature is Costco’s private label brand of which I’m a big fan of their ankle socks. The more you know, amirite?

- Captain Kirkland’s earnings came in at $0.51/share on $143.6M in net sales vs. the expected $0.81/share on $146.1M in net sales.

- Kirkland’s saw a Q3 net income of $7.2M vs. the $12.4M the company saw in Q3 2020, which is less than ideal.

- The company also stated that Q4 earnings would be lower than the same period the previous year.

You’re not going to believe this but Chief Executive Steve Woodward said the disappointing earnings numbers were due to, “inconsistent traffic patterns and broader supply chain constraints.” Next you’re going to tell me there is a new and concerning virus variant…oh wait. Today’s announcement moved $KIRK down to levels not seen since December 2020. I’ll be watching to see if there is some consolidation at these levels over the next few weeks before considering a potential long position.

Cleared for Takeoff (Almost)

Permission to buzz the tower? Boeing (BA) is a step closer to getting the 737 MAX back into the skies, at least the ones above China. The country’s aviation regulator laid out a series of steps that BA needs to take to get the MAX flying again. If you don’t recall, the aircraft was grounded worldwide back in 2019 after two crashes occurred over the course of five months, and has slowly been coming back into service in other regions.

- The steps outlined include updating the flight manuals and control software, hopefully to include instructions about staying airborne until it’s time to land.

- Like Lions coach Dan Campbell, Boeing is badly in need of a win after a series of faceplants, and BA shares were up 7.5% on Thursday (if you were expecting a takeoff or liftoff pun, sorry to disappoint, but we strive for excellence here at TDS).

- BA management expects to receive final clearance by the end of the year and expects deliveries to China to resume in Q1 2022.

Besides Boeing (obviously), beneficiaries could be fuselage maker Spirit AeroSystems (SPR) and components manufacturer Hexcel (HXL). Note: Spirit AeroSystems should not be confused with Spirit Airlines, the flying insane asylum where passengers engage in cage fights at 30,000 feet for $20 seats.

Special Snowflakes

SCHOOL’S CLOSED! Grab your gloves and coat because the cloud-based data warehousing company Snowflake inc. (SNOW) had its best day since March. Shares were up 15.85% on Thursday thanks to its favorable Q3 earnings report, which revealed that SNOW’s revenue had doubled since last year.

- While the company did report a loss per share of $0.51, it did post $334M in revenue, higher than the $305M expected by analysts.

- SNOW’s large growth in revenue is attributed to higher than anticipated consumption by its largest customers. This shift in information technology towards cloud-based models and data science creates the perfect conditions for companies like SNOW and its competitors.

- $SNOW raised its Q4 guidance to roughly $350M, higher than the expected $315.9M, and also raised its 2022 revenue to the range of $1.126B to $1.13B. The revised expectations would both represent YoY growth north of 90%.

Snowflake doesn’t really show any signs of melting soon, and seems to be well positioned for its future and the development of the tech industry. That being said, it is likely important to consider the perspective of analysts like Kirk Materne at Evercore ISI: “[Snowflake] is not going to be immune to market gyrations”, and if the landscape stays volatile, change is always in the air. However, analysts like Materne and Oppenheimer’s Ittai Kidron are still encouraged by the company’s ability to weather such a storm.