It’s OK Rivian, You’ll Get Better

With Practice

Nobody is great their first time, but Rivian (RIVN) absolutely flopped in its virgin reporting quarter as a public company. The EV maker reported a quarterly loss of $1.2B and announced that it would fall short of its annual production goal of 1,200 units. Seriously Rivian, you can’t even get 100 trucks a month out the door?

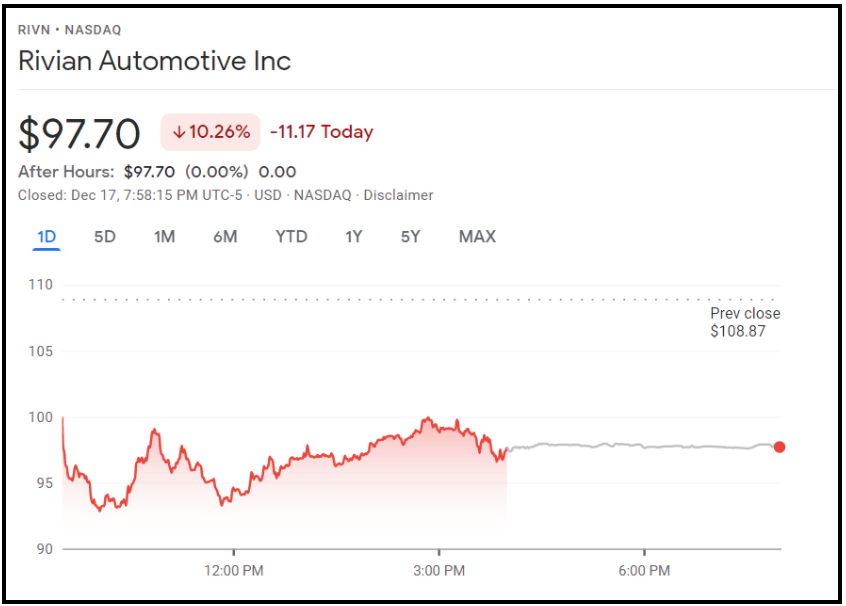

- Shares of RIVN were down more than 10% on Friday to close at $97.70.

- The company is struggling to produce vehicles due to component shortages and difficulties getting an Illinois production plant up to speed. Reservations remain strong, currently about 71,000.

- Rivian announced plans to build a second production facility in Georgia, but as with all EV companies not named Tesla, we’ll believe it when we see it.

Rivian came out of the gate fast, rising 130% from its IPO price of $78, but like many of us as awkward high schoolers, it just didn’t have much stamina. With deep-pocketed partners such as Amazon and Ford, however, RIVN may just need a bit of seasoning. If the company can manage to build and deliver vehicles (a big ask, I know) it may be the firm that can challenge Tesla. After all, its pickup actually looks like a pickup, unlike the Cybertruck, which looks like something a three-year-old would build out of Duplo blocks.

That’s Quite a Package

What’s in the box?

FedEx (FDX) smacked Wall Street expectations like Covid smacked NFL rosters this week, after the company announced strong earnings and a $5B buyback on Friday. The company reported $4.83 in EPS on $23.5B in sales vs. expectations of $4.27 in EPS and $22.4B in revenue. FDX also raised full year guidance to $21 per share from $20.38 per share.

- FedEx has been a bit bipolar this year, cutting guidance in September only to raise it again in December. Tis the season for hanging out with crazy friends and relatives I suppose.

- In previous quarters the company had warned about labor inflation, but the most recent results may be a bellwether that proves some rising input costs can be managed. Shares of FDX rose 4.9% on Friday.

A strong holiday season could continue to build momentum for FedEx, as it is finally starting to pick up speed after trailing the market by about 12 points this year. Regardless of the stock performance, be sure to thank your FedEx and UPS drivers, those people literally keep our economy moving. They deserve a pat on the back and maybe a nice bottle of bourbon. Especially if you’re like me and regularly order 40 pound bags of dog food from Chewy.

Market Madness: Major Indexes

Drop after Volatile Week

It keeps going and going and going!

American stock indexes tripped, then stumbled, then tripped again before landing flat on their face the previous week after some serious volatility. On Friday, the Dow fell 532.2 points to close at 35,284, the S&P dropped 48.03 points to close at 4,620.64, with the Nasdaq dropping 10.75 points to finish at 15,169.98 points. As is usually the case, the related causes were of myriad origin, from the scheming of the Fed, to our good ol buddy Omicron, compounded by just plain bad timing.

- Last week was marked by the Fed’s recent hawkish turn regarding the tapering of bond-buying, which naturally has turned the market temporarily bullish as caution abounds. The potential for interest rate hikes in the coming year certainly do not help the sentiment.

- Some of the volatility is being attributed to “quadruple witching”, the concurrent expiration of single-stock options, single-stock futures, stock-index options, stock-futures, and end of quarter fund rebalancing. This was always going to happen on Friday, but when paired with Omicron and the Fed, it lends itself to further volatility.

After a year of record-setting weeks on the major indexes, a week like this could seem really gloomy for the future by comparison. But when you step back and gain a little perspective on the situation it isn’t cause to hit the ejector seat just yet. By and large, these market drivers were the cause of investors taking a moment to process the Fed’s new policy and the spread of omicron in the US. Quadruple witching just happened to occur at the same time. Perhaps take this as an opportunity to pursue some stocks you’ve been monitoring for the dip (if applicable) and see how the situation develops.