Time is Money for Hour Loop’s IPO

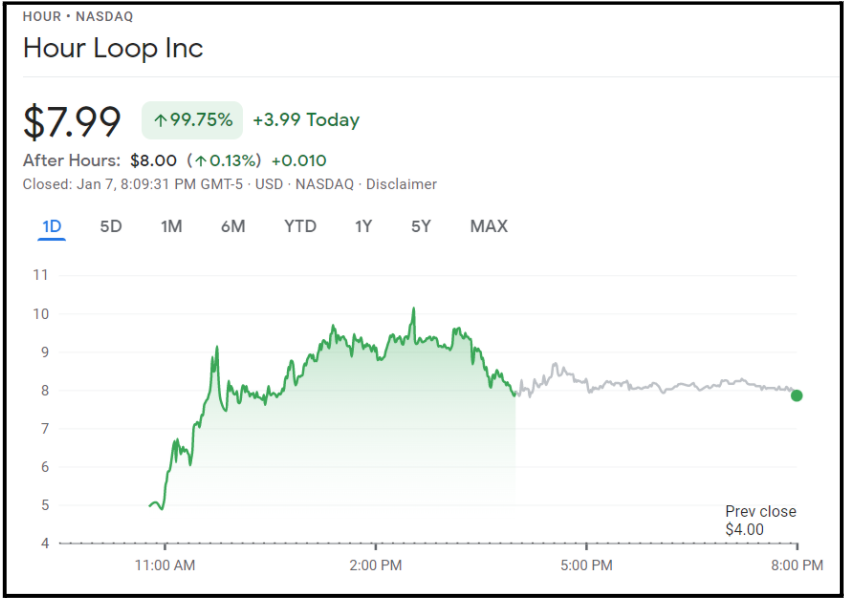

There was a lot of hype on Wall Street Friday after online retailer Hour Loop (HOUR) conducted its first day of trading on the Nasdaq. No one could be more hyped than CEO and VP (who are lovers, aka husband and wife) as the stock closed at $7.99, well above their initial offering of $4.50 a share. HOUR essentially acts as a middleman for Amazon and Walmart.com, buying in bulk directly from manufacturers, paying the big digital storefront fees, and then foisting them off onto American consumers. Basically, they’re a domestic Wish.com that mostly peddles its wares through Bezos’ Silk Road.

- The IPO transaction included an underwriter’s over-allotment option for an additional 225K shares and hit an intraday high of $10.33.

- HOUR reports that they experienced a profit of $2.3M and $31.4M in revenue through September 30th. This compares to their 2020 profit of $3.8M for $38.7M in revenue. Good thing Americans have such a penchant for cheap plastic crap.

The single-day growth of HOURs stock is definitely eye-catching but one has to wonder if this short-term hype will actually persist for the retailer as they stay on the market. HOUR currently sells products on Walmart.com and their own website, but sales on a little-known bookstore called Amazon make the bulk of their profits. That is all well and good, as Amazon isn’t going anywhere, but it does appear that HOURs margins are dropping. With that in mind, my thinking is that the stock might not be the best long-term commitment, especially when considering there isn’t much that HOUR does to stand out from the crowd.

Mixed Bag Madness: The December Jobs Report

To really put the lid on the awesome… year that was 2021, the Department of Labor has released its jobs report for the month of December. In a now well-established tradition, it turns out that analysts had been too optimistic about payroll growth for the month as they rose only 199k (contrast that to the Dow Jones estimate of 422k). While that number may have disappointed, the overall unemployment rate fell to 3.9%, a rapid decline from 5.6% back in June. Looks like J Pow has even less excuses to not raise interest rates.

- Revisions from the previous two jobs reports showed that an additional 141K jobs had been added to the economy over previous estimates. Maybe some of those analysts weren’t too optimistic…

- The share of people ages 25 to 54 (AKA almost everyone in the US) working in December was up to 79%. For context: in the before-times of February 2020, that number was 80.5%.

- Job creation was highest in hospitality with 53K jobs added to payroll, followed by professional and business services, and manufacturing with 43K and 26K added respectively.

With the big miss on jobs things don’t look great at face value, but the massive dip in unemployment rate combined with the employment rate for 25-54 year olds indicate that there’s light at the end of the tunnel. At the very least these numbers are the evidence the Fed needed to maintain its course for tapering in the new year, which should be good news for everyone. That being said, the data in this report was recorded largely before Omicron made its impact on the US so we’re not out of the woods just yet.

Gamblers Anonymous NYC Taking Reservations Now

Shares of licensed online sports betting operators, save for Fanduel which finished down 1%, were up between .5%-5.5% during Friday’s trading session. Why? Oh just some news that the New York State Gaming Commission will allow online sports betting in the Empire State starting on Sunday. Draftkings (DKNG), Caesars (CZR), Fanduel (SRAD), and Rush Street Interactive (RSI) could commence operations in the state no earlier than January 9th at 9am, while Bally’s (BALY), Bet MGM (MGM), and others will be approved on a rolling basis.

- Up until this point, New Yorkers could only place sports bets in person at casinos, or feel like even bigger degenerates by crossing state lines into New Jersey just to place a bet on their phone.

- Speaking of Jersey, it’s estimated that 90% of their wagers are placed online, thus allowing Jersey Shore types to gamble from the comfort of their own tanning beds.

- Sports betting in New York will be taxed at 51%, and they’ve estimated that $482M in annual tax revenue will eventually come from mobile sports wagers.

This isn’t the poker craze of the early 2000s, which eventually dwindled in popularity due to fraud and other regulatory actions… and resulted in a great song by O.A.R. As more and more states accept mobile sports betting and iGaming, shares of DKNG, PENN, and others should continue to see their revenue increase. I will be keeping gaming stocks on my watchlist as news of additional state approvals could lead to volatility and, thus, trading opportunities.