When beginners are first learning about the stock market, it makes sense for them to learn to trade penny stocks. However, if you’re a beginner and want to get into the world of trading, you should only focus on trading penny stocks listed on the New York Stock Exchange ( NYSE) and Nasdaq. companies have to comply to stringent requirements to be listed on these exchanges, unlike OTC Markets. That said, a lot of beginners often ask, “What is the minimum needed to trade penny stocks?” Well, the answer is it depends. Now, let’s take a look at the “minimum” needed to trade penny stocks.

Minimum Needed to Trade Penny Stocks

Depending on your brokerage firm, there is a minimum requirement to open an account. Now, there is no defined minimum you need to trade penny stocks. The U.S. Securities and Exchange Commission defines a penny stock as a stock whose value is trading under $5.

Now, depending on your goals and the amount of capital set aside, the minimum needed to trade penny stocks varies. One thing to keep in mind is the fact that penny stocks are cheap. That in mind, you don’t need a whole lot of money to get started when compared to other trading styles.

For example, if you want to purchase 100 shares of a blue-chip stock, say Apple (AAPL), you would need tens of thousands of dollars to do so. However, with a penny stock, you would need under $500 to purchase 100 shares. That in mind, trading penny stocks could be more efficient at generating high returns on capital when compared to trading other asset classes.

Minimum Needed to Trade Penny Stocks – The Broker

Fees, trading costs and account minimums vary between brokerage firms. For example, to open a brokerage account with TD Ameritrade, there is no account minimum. On the other hand, E-Trade has an account minimum of $500. Either way, if you want to trade penny stocks, you need to deposit some capital into your brokerage account. However, with these two, you could can learn how to use the platform and learn to trade penny stocks without putting any money on the line until you’re comfortable.

You also need to understand trading costs and fees when trading penny stocks. For example, if you’re looking to make $50 per trade, you might want to look for a brokerage firm with lower costs. On the other hand, when you want to trade penny stocks with large size and try to make $500 to $1,000 per trade, you might not care too much about fees and trading costs.

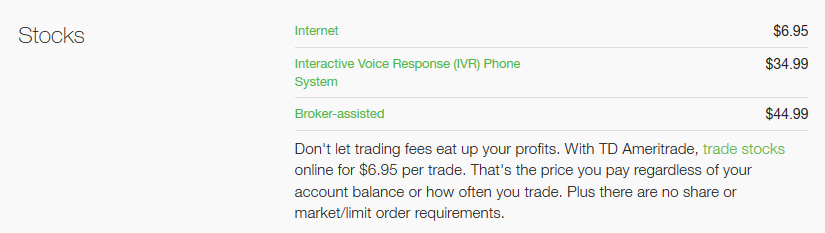

For example, if you select TD Ameritrade as your broker, it’ll cost $6.95 per trade if you’re trading through their platform.

Source: TD Ameritrade

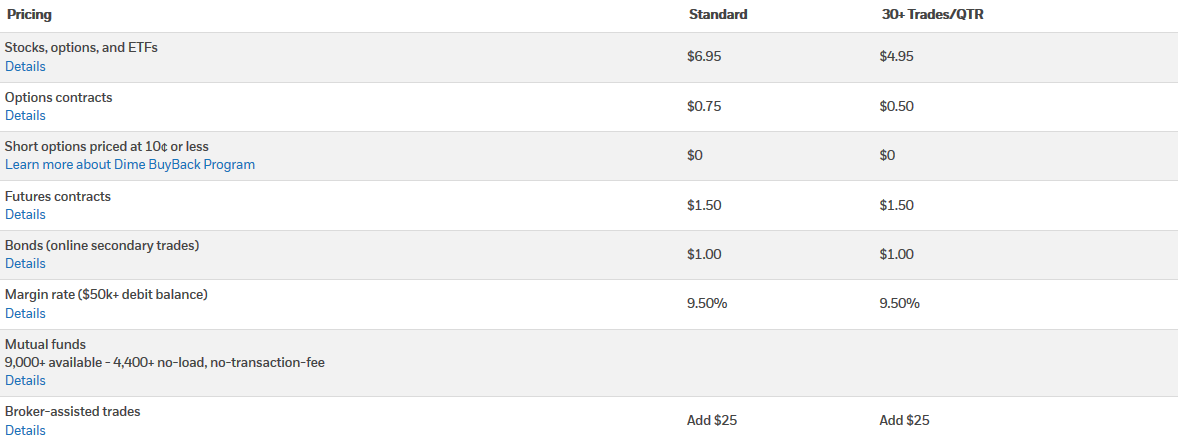

Here’s a look at E-Trade’s fee scheduling.;

Source: E-Trade

Now, I personally use E-Trade, but there are plenty of other brokerages out there and you should pick the one that best suits your needs.

Minimum Needed to Trade Penny Stocks – Tips

Basically, you want enough capital that’ll keep you in the game long enough. For example, if you only have $1,000 to trade, it’ll be very difficult for you to trade penny stocks. If you don’t know how to risk manage properly, you could lose a large portion of your account if a trade goes sour.

Ideally, you want at least $5,000 to trade penny stocks, but the more capital you have, the better. That way, you could actually afford to trade because if you choose something like TD Ameritrade or E-Trade, you’re paying around $14 per round trip (buying and selling, or shorting and covering). If you only have $1,000 and trade 10 times and break even on those, you would lose over 10% of your capital.

Now, if you want to day trade penny stocks everyday of the trading week, well you’ll need at least $25K due to FINRA rules and regulations.

Again, there is no set minimum to trade penny stocks. However, there is a minimum needed to open an account with some brokerages. Just keep in mind you could trade penny stocks even if you only have $5K, but it’ll be difficult and you might want to learn from a trading community rather than going at it alone.

3 Comments

Great information. Recommended reading?

Not too much overlap or overload.

Worked at Brockerage firm in Ops while in school- never traded. Curious . Thx Ed

I am new to this. I really do not want to invest much at this time, I would just want to get my “feet wet” and get a better understanding of buying stock. not really trading on a daily.

Just need a simple start to understanding everything involved. thank you.

Your statement shows a smart and causious approach to investing . I’m looking into it in with the same goal . Good luck .