Look at what someone sent me!

Wall Street is rigged!

It’s time to fight back with WALL ST BOOKIE.

Read this, print it, and put it on your desk as a harsh reminder that the game is rigged against you → UNLESS you take action.

Let’s begin.

As you probably already know, options approval has 4 levels.

Beginning retail traders are often started at Level 1 & 2.

What isn’t disclosed to beginners is those are very low probability trades.

And that high probability trades in Level 3 & 4 are ‘too complex’ for beginners.

I repeat:

- Most retail investors ONLY have access to the most basic call and put options

- They don’t have access to options spreads

- Yet options spreads have been used by Wall Street professionals for decades

“A staggering majority of these small-time traders are buying the most basic call and put options, which have a much lower probability of profit compared with advanced strategies that may not be easy for investors to grasp, such as options spreads.

For example, 11% of Robinhood’s monthly active users made an options trade in the first three quarters of 2021. Meanwhile, fewer than 1% executed a multi-leg options trade, which involves two or more transactions at the same time.” ~ CNBC

Even worse, brokers make more for options order flow than stocks, which incentivizes them to push beginners into options, where they stand little to no chance of success.

MIT’s Sloan School of Management which just published this article in August.

Retail investors lose big in options markets, research shows

Think your broker has your back?

Robinhood was fined $70 million over “systemic supervisory failures” and accused of letting users make risker trades than they were ready for.

It’s disgusting if you think about it:

- Brokers make more on money flow from options than stocks

- Therefore brokers are incentivized to push beginners into options

- However, they start beginners at the lowest probability levels, 1 & 2

- Meanwhile, Wall Street pros use the high probability levels, 3 & 4

I used to buy call and put options a lot and know first hand the high highs a monster win delivers, but the low lows always took out those wins and left me at a net loss.

Can you relate?

This is why I relaunched WALL ST BOOKIE recently, which ONLY uses Level 3 options spreads, and they are NOT as complicated as Wall Street pros might tell you.

Here are the BOOKIE’s rules:

- Staying mechanical is key to my success.

- Right now I like to put about $5,000 into a trade and look for 50% of the premium so $2,500 is a good win.

- When selling at-the-money (most extrinsic value) vertical put spreads into dips I look for an entry at 40% of the width. For in-the-money vertical put spreads I look for an entry at 30% of the width.

- These are swing trades so 5-7 days to expiration. Remember, the rate of decay on the extrinsic value of an option is fastest 5-7 days to expiration.

- I pick the width based on technical analysis as well as where I can get 40% credit e.g. $10 wide would be a $4 entry with a $2 exit goal.

- Opening bull puts into dips is my favorite setup.

- MSFT, TSLA, AMZN, GOOG, PYPL, WMT, AAPL and NFLX are my favorite stocks to trade right now. All are earnings winners and therefore should find buyers into dips.

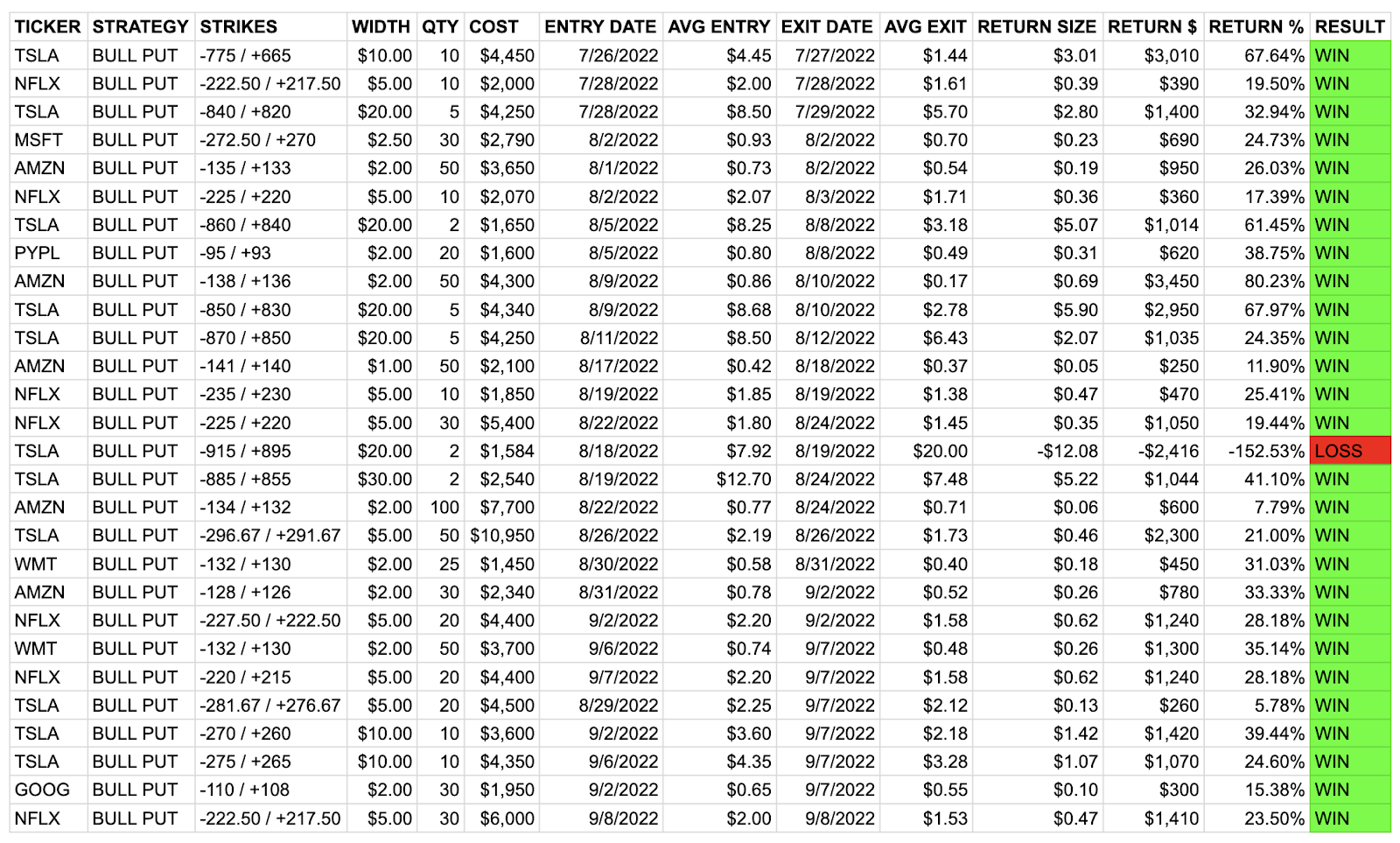

Here’s every trade I’ve alerted in WALL ST BOOKIE since it relaunched. Remember, options spreads, level 3, are some of the highest probability trades in the market.

Note I broke my rules once, by doing an option spread with just 1-day to expiration, versus rule 4 above, which calls for 5-7 days to expiration. And in breaking my rules, I took a loss.

27 wins and 1 loss since service launched 6-weeks ago on July 27. All trades from watchlist and were alerted before I entered and exited positions. Nothing promised or guaranteed in the future except my transparency and passion for teaching you to learn from both the wins and losses.

WALL ST BOOKIE teaches a high probability options strategy, one that Wall Street professionals have been using for decades. One that I’m convinced they do NOT want you using.

Now with everything I’ve just taught you, do you really believe it’s just coincidence that Wall Street starts beginners off at the lowest probability of success options levels, 1 & 2?

It’s corrupt if you ask me.

But like I said at the beginning. You have a choice because you can take action.

CLICK HERE to learn more about my options spread service, WALL ST BOOKIE.

As traders it’s our job to find an edge in the market:

- I will teach you how to do a spread

- I will provide you with a watchlist premarket each morning

- And I will alert you before I enter / exit these trades

This is my favorite strategy and I’m very confident I can teach it to you.