Small trading accounts get destroyed by the PDT rule, FOMO, and drinking the Kool-Aid. Address those headon and you might have a chance.

WHY the pattern day trade rule (PDT) is a problem for small account growth …

… and how my $2,000 Small Account Journey strategy addresses it.

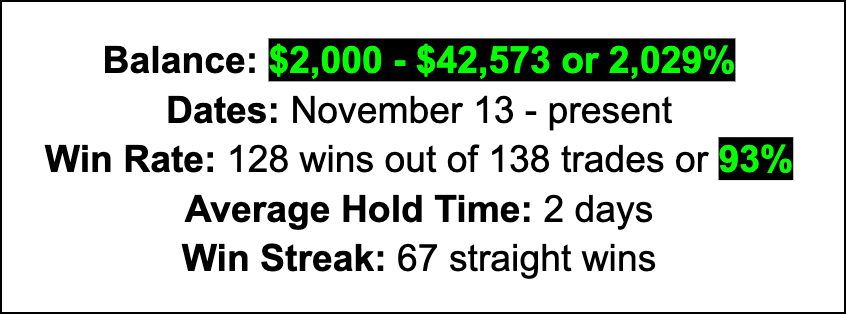

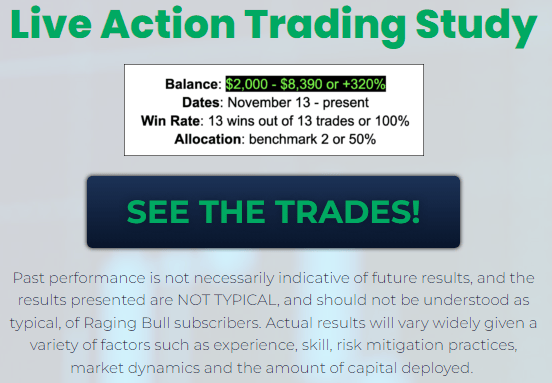

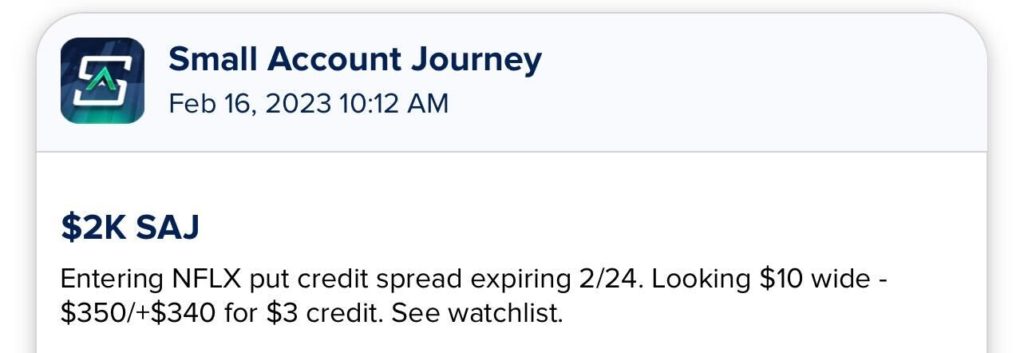

January 1st I started teaching and trading the $2,000 Small Account Journey strategy.

I teach from a daily watchlist and send trade alerts straight to your smartphone before I enter and exit.

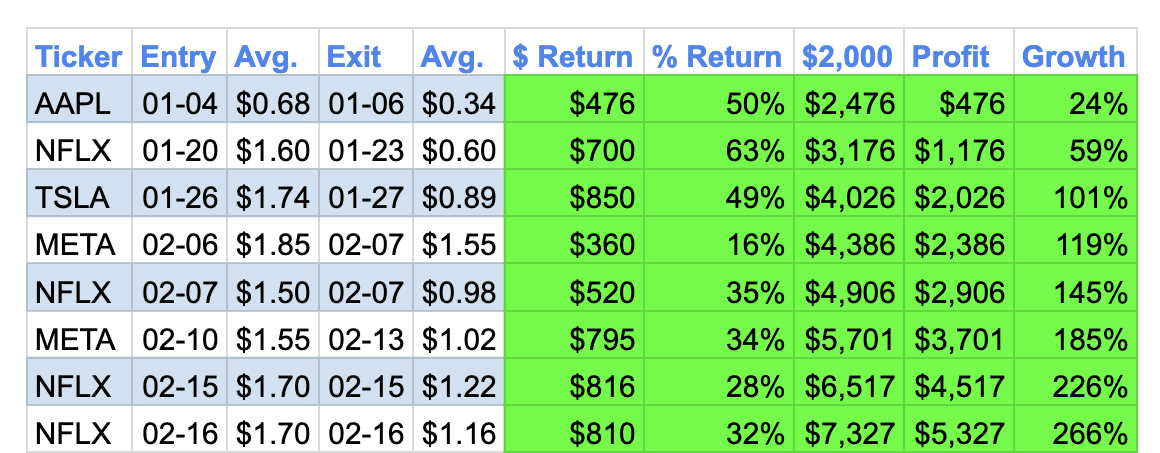

There were 8 trades in the first 6 weeks.

The $2,000 grew to $7,327 or 266%.

The strategy works one trade at a time on the best tech stocks in the world.

Each trade has limited risk and high probability.

And while the strategy rewards swing trading, if I can cash a few up fast, who am I to look a gift horse in the mouth?!

Its rising popularity stems from addressing core issues when growing a small account.

One of which is the dreaded pattern day trade rule.

If you’ve ever traded with less than $25,000 you know what I mean.

The problem!

It’s Friday and you’re riding a big win on a penny stock up 50% and want to sell before happy hour.

What a wonderful way to end a week that saw you crush 3 day trades in your small account.

Enter the dreaded pattern day trade rule.

If you sell that 50% winner, your account, suspended, from opening any news trades for 90 days.

That’s one quarter of the year!

So you hold until the following week.

At which point the gains have not only evaporated, but the loss wipes out the prior week’s gains.

As for the strategy taught in the $2,000 Small Account Journey?

There were 8 trades in the first 6 weeks.

The pattern day trade rule allowed for 18 day trades during that period.

Of which there were only 3.

Results not typical. Nothing is guaranteed.

Results not typical. Nothing is guaranteed.

That’s because the simple strategy I’m teaching often rewards swing trades.