When it comes to energy production, industry-wide decisions regarding infrastructure spending do not happen overnight.

These decisions are largely based on supply and demand laws that often move at a glacial pace.

When deflation is present, as was the case for a little more than a decade leading into the Covid crisis of early 2020, energy supplies are abundant due to decreased demand.

Conversely, when inflation is present, increased demand causes energy supplies to become scarce.

Therefore, when commodities are cheap due to abundance, it dis-incentivizes companies from spending money to bring new supplies online.

Because of this, massive underinvestment across the energy sector since the financial crisis of 2008 likely needs to be reversed as inflationary forces bring a resurgence of demand.

For traders trying to find long-term ideas, this means that the energy sector should be full of opportunities.

Oil’s 2021 weakness is presenting numerous buying opportunities

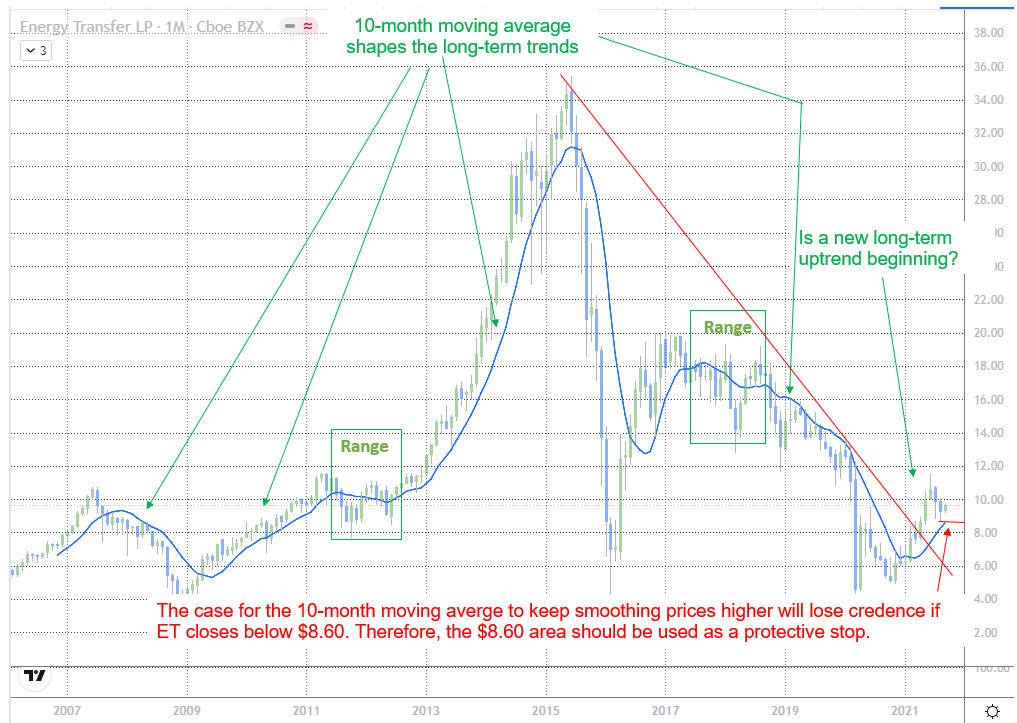

When longer-term trends are in their infancy, one incredibly effective way of finding stocks that may be poised to rise for an extended period is to identify stocks bouncing off of their rising 10-month moving average.

With that in mind, this year’s summer pullback in shares of energy companies should be viewed as an opportunity to look for bargains.

I’m focusing on 2 stocks in particular that may be ready to resume their post-Covid crisis rallies well into the future.

Energy Transfer LP (ET)

Energy Transfer owns a large platform of crude oil, natural gas, and natural gas liquid assets primarily in Texas and the U.S. midcontinent region. Its pipeline network transports about 22 trillion British thermal unit per day of natural gas and 4.3 million barrels per day of crude oil. It also has gathering and processing facilities, one of the largest fractionation facilities in the U.S., and fuel distribution. Energy Transfer also owns the Lake Charles gas liquefaction facility. It combined its publicly traded limited and general partnerships in October 2018.

From a technical perspective, ET rallied above a 5-year downtrend earlier this year, and has spent the 3 – 4 months correcting its 2021 gains.

As Figure 1 shows, ET recently bounced off of its rising 10-month moving average, which, as we also learn from the chart, has a strong track record of smoothing long-term price trends.

Based on this visual backtest, bullish positions can be established above the $8.60 level, which is where the most recent pivot low, established on August 19th, has combined with the 10-month moving average to form a powerful support confluence that must hold in order for this bullish thesis to remain valid.

Figure 1

Western Midstream Partners LP (WES)

Next up is Western Midstream Partners LP is a US-based company which own, operate, acquire and develop midstream energy assets. The company through its subsidiary is engaged in the business of gathering, processing, compressing, treating and transporting natural gas, condensate, NGLs and crude oil. It owns or has investments in assets located in the Rocky Mountains (Colorado, Utah, and Wyoming), the Mid-Continent (Kansas and Oklahoma), North-central Pennsylvania and Texas.

From a technical perspective, WES also spent the last 3 – 4 months correcting its 2021 gains, after rallying above a 5-year downtrend earlier this year.

As Figure 2 shows, WES is also finding support at its rising 10-month moving average.

Based on this visual backtest, bullish positions can be established above the $18.50 to $18.00 area, which is where the most recent pivot low, established on August 19th, has combined with the 10-month moving average to form a powerful support confluence that must hold in order for this bullish thesis to remain valid.

Figure 2

1 Comments

THANX A BUNCH!7