Small trading accounts get destroyed by the PDT rule, FOMO, and drinking the Kool-Aid. Address those headon and you might have a chance.

WHY drinking the Kool-Aid is a problem for small account growth …

… and how my $2,000 Small Account Journey addresses it.

As we discussed in part 2, penny stocks often go supernova.

But they are dangerous for the trader desperate to grow a small account.

Because monster breakouts lead to fear of missing out (FOMO).

Which leads to chasing.

Which leads to catching the top.

Which leads to drinking the “Kool-Aid”.

“Drinking the Kool-Aid” refers to a trader who thinks a doomed stock has high rewards.

Which leads to bag holding.

A bag holder is a trader who holds onto poorly-performing stocks, hoping they will rebound.

Remedying losses, versus focusing on realizing gains, is the root issue here.

Bag holders tend to lose money by being the last owners of a failing trade.

Now I love penny stocks. It’s one of my biggest services.

I believe they are great for the retail day and swing trader i.e. big fish in a small pond.

Trading preys on emotions and these are some of the biggest culprits.

- Pattern day trade rule

- Fear of missing out

- Drinking the Kool-Aid

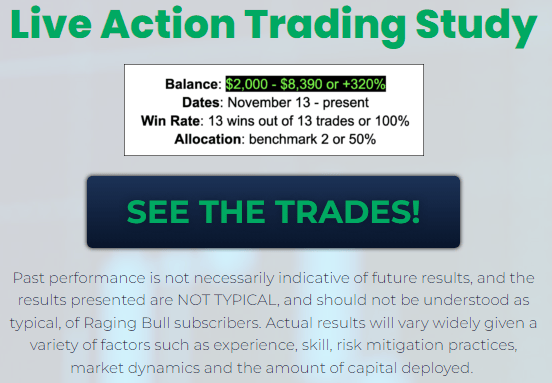

What if there was a small account strategy that:

- Mitigated the dreaded pattern day trade rule?

- Fear of missing out isn’t triggered?

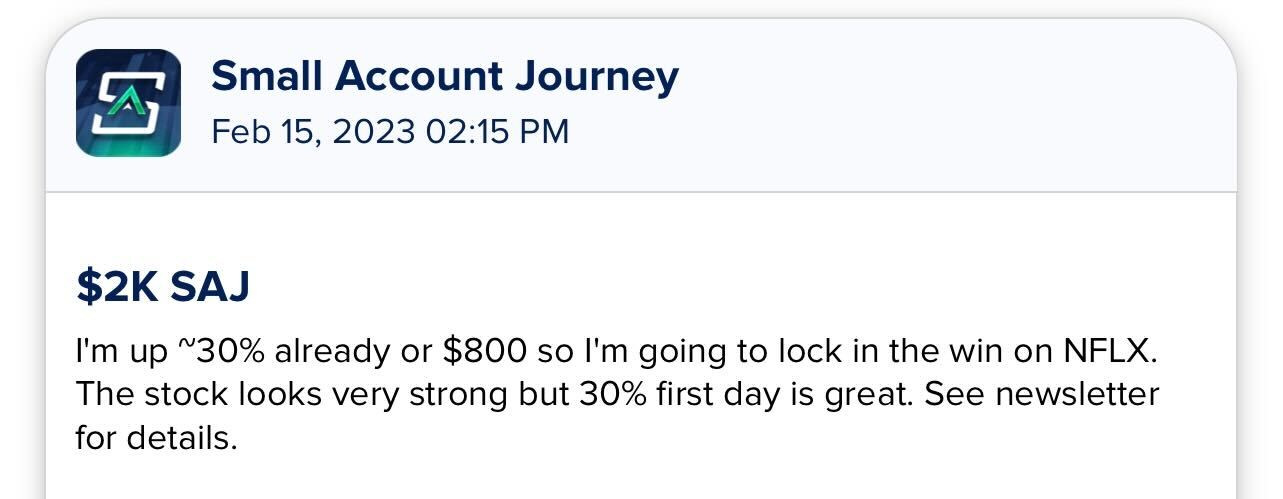

- A win or loss outcome will happen in a few days to weeks i.e. cannot bag hold and therefore, no Kool-Aid

What if this strategy had limited risk, high probability trades that were cashed up quickly?

Sounds too good to be true.

It’s not.

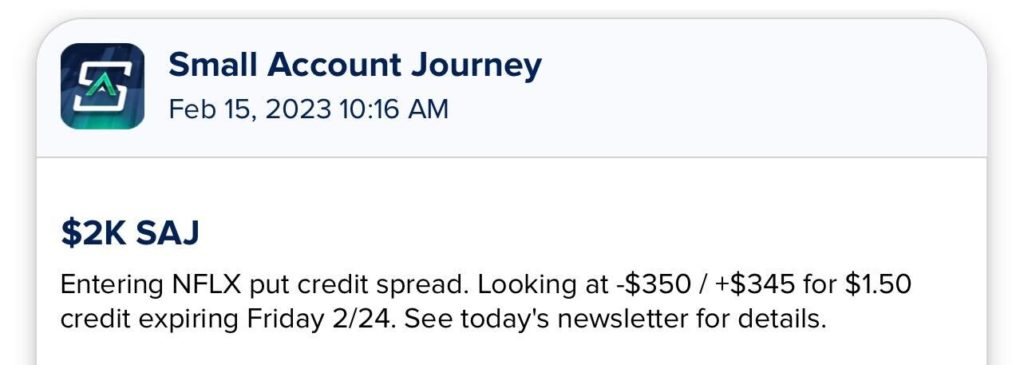

I’m teaching the strategy and alerting the trades before I enter and exit.

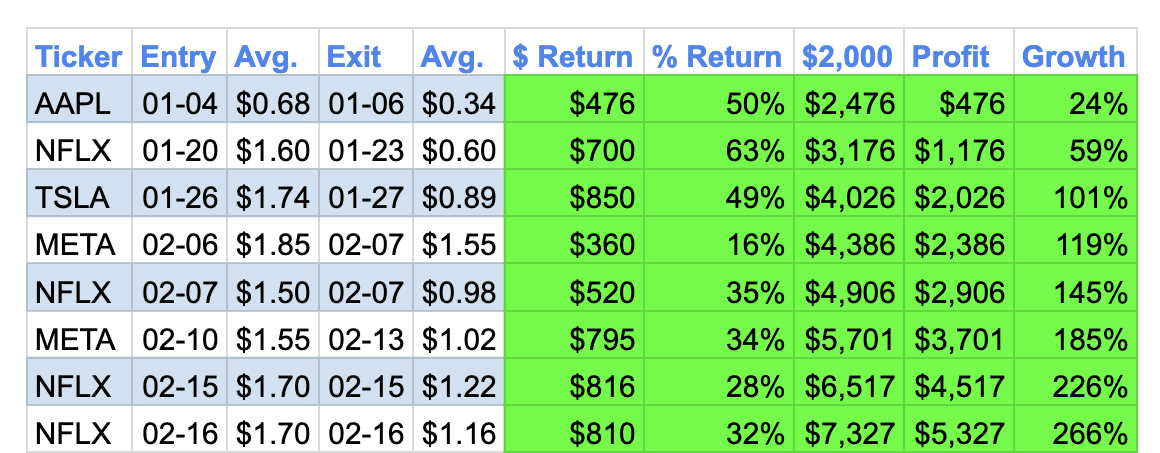

It’s called the $2,000 Small Account Journey or $2K SAJ.

No strategy is perfect. I will have losses here. But this is the best one I know.

No strategy is perfect. I will have losses here. But this is the best one I know.