I don’t always go back to the well, or rather the gold mine, but when I do, I make sure that I do my best to make it count.

On this occasion, in this gold mining stock, I did.

As I always do, I let my members know ahead of time that I was looking to get long the stock and then posted my exact entry in the chatroom once I got long.

So how exactly did I go 2-for-2 in this stock?

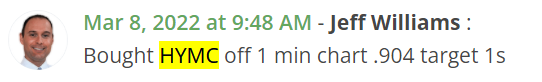

I traded HYMC twice on the long side, between March 8th and March 10th.

If you’re wondering what’s with all the gold puns, it’s because HYMC is a mining corporation.

According to Yahoo, HYMC operates as a gold and silver producer in the United States.

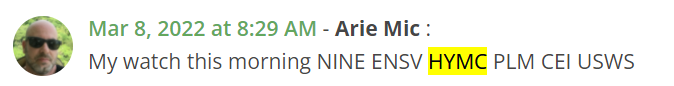

HYMC was on my radar on the 8th of March (highlighted in yellow above) as it was gapping higher and had broken the downtrend on the daily chart.

A moderator in the chatroom also posted his watch list for all members to see, which included HYMC.

All that remained for me now was a clear setup to enter the position.

I was specifically looking for a pullback and a sign that HYMC might head higher.

Trade 1

Of course, I let my members know exactly what I was doing:

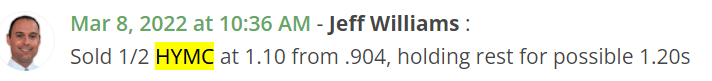

Then, two days later, the stock returned to the high from day one and right into my target area, so I sold the remainder of my position from $0.90.

With that sale, I closed out my long position in HYMC for a return of about 25%.

But I wasn’t done yet.

My members watch me run live scans daily to narrow the markets down to my absolute best and most favorite chart patterns.

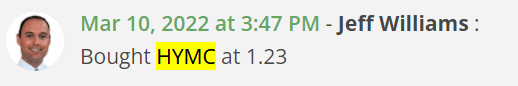

During that process, lone and behold, HYMC topped my radar again.

I posted in the chatroom that I had HYMC on my end-of-day watch list, looking for an entry and a possible move towards $1.70s.

The stock was holding above resistance and trading with clean upside momentum on the day.

I also noticed the consecutive higher highs and higher lows on the intraday chart and therefore targeted a pullback for an entry into the close.

I one-upped myself with that trade, as my sale at $1.56 resulted in a $26% return on the trade.

As I said, I don’t always go back to the well or to stocks that I have recently traded.

However, the benefit of keeping a stock that I recently traded on my radar is that it might set up again and provide further opportunities.

The chatroom was on fire that day as I was trading live, sharing my thoughts and game plans, and posting my entries and exits in the chat.

As I always do!

If you also want to see me trade live and receive my advanced notice alerts, watch lists, and much more, click here to become a member and be a part of The Trading Floor community.