Being able to make quick decisions and be reactive is something I place massive importance on as a trader.

Whether or not I decisively react to breaking news in a stock or a breakout in price can often be the difference between a successful or unsuccessful trade.

The market rewards me for having a plan and acting on it without hesitation when I see the opportunity present itself.

I’m prepared, I have a plan, and if the market confirms it, I place the trade.

After all, all I can do is

Plan the trade and trade the plan.

Over the last few days, I focused on a penny stock beverage company after having fresh news, and a good pattern developed.

With fresh news and a possible breakout, I was armed with a plan and looked to react to the market, confirming that my thesis was correct.

So what beverage company loaded with potential has caught my eye?

Kona Gold Beverage (KGKG) was the focus and will continue to be one of my focuses going forward.

KGKG, according to Yahoo, is a holding company focused on product development in the better-for-you and hemp and CBD functional beverage sector.

Three days ago, the company announced that its Ooh La Lemin Lemonades would be sold in Walmart (WMT) brick and mortar stores.

(source: stockcharts.com)

As a result of the news release, the stock saw a significant increase in shares traded and almost doubled in price on the first day.

The market favored the news based on the stock’s reaction on day one.

As a headline, it read well, in my opinion.

However, perhaps comparing this company to the future Coca-Cola of the hemp and CBD beverage industry is premature and far-fetched.

I’ll leave the predictions and assumptions to the analysts.

After all, my job is to react to price action and make sound risk: reward decisions.

And that’s what I did here, gang.

With the breaking news and the stock holding up throughout the day, on day 1, I developed a thesis and trade plan.

With the stock up significantly on the day and holding above support, It became clear to me that this stock had the potential to continue its momentum to the upside.

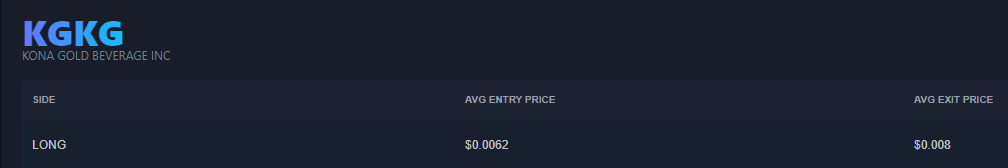

I bought the stock into support on day 1, targeting a higher high.

I alerted my members to the setup, in the chatroom, and once again when I bought the stock.

In the above chart, highlighted yellow is where I entered the stock long.

The following morning, the stock traded higher and into the previous day’s high.

With the strong pusher higher right off the open, I sold ⅔ of my position.

I then held the remainder of my position targeting $0.009, or a new high.

Yesterday, the stock traded back to the $0.008s and again had some trouble getting above.

It became clear that this area has now firmly developed into resistance.

I sold my last third of the position yesterday afternoon at $0.0081, from $0.0062.

Here is a screenshot from my trading journal, which recaps the trade:

But WAIT, there’s MORE.

Sure, I am pretty pleased with that trade, gang.

However, as I said, my job is to react to price action once the market confirms I am right in my thinking.

Well, I might not be done with KGKG just yet.

As I mentioned above, the $0.008s has now developed as resistance, and therefore IF the stock breaks above the newfound resistance, I will be looking to get back into the stock.