Now and then, a significant sector theme presents itself.

For example, a short squeeze or a particular catalyst might ignite an entire sector of small caps.

Remember the COVID19 vaccine small-caps in 2020?

How about the pot stocks back in 2017 / 2018? Or the shippers back in 2016?

Currently, oil is a significant theme in the market.

The soaring price of crude oil has resulted in several small-cap, low float penny stocks surging higher over the past week.

Check out the above chart of the United States Oil Fund ETF, USO, from Finviz.

On the year, the ETF is up 89.36% and up 22.07% on the week.

I have been all over this sector and the several small-cap energy names moving lately.

My members, as a result, have been kept in the know and were made aware of the small-cap energy-related penny stocks that started moving with the overall sector last week.

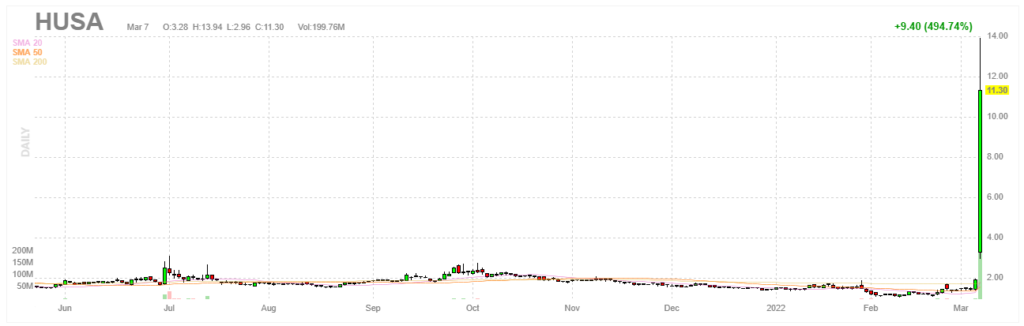

According to the Top Gainers list from Finviz, yesterday’s TOP gainer was HUSA, which was up 494%.

I alerted my members to HUSA last week when I wrote about it in my Mid Day Watchlist stock.

At the time, the stock was trading around $1.50. Yesterday, it closed at $11.30.

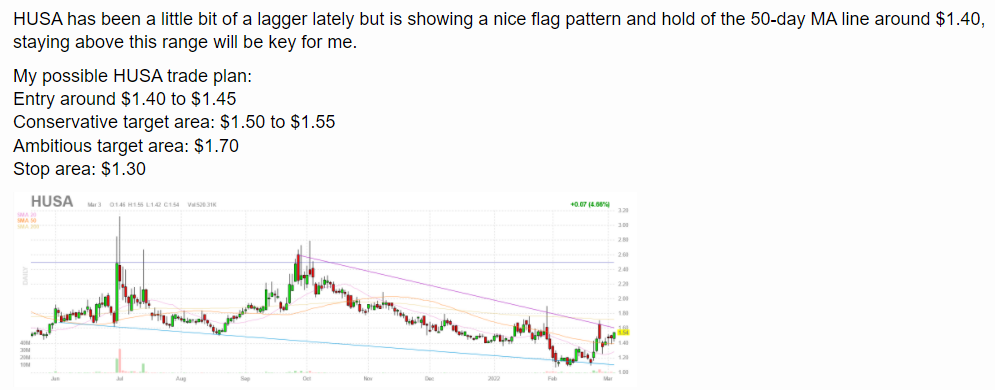

These were my exact words to my members on March 3, 2022:

HUSA, at the time, was lagging several other small-cap names which had already made more impressive moves to the upside.

Therefore, I told my members that I would be keeping an eye on this stock because it might play catch up to the rest.

As you can see in the chart above, HUSA at the time was trading in a consolidation and had yet to break out.

Let’s now take a look at the most recent chart of HUSA.

As I said to my members, staying above the $1.40 – $1.45 range was vital. The stock did that and broke above the range on Friday.

Yesterday, the stock gapped higher, along with several other small-cap energy stocks, and closed the day up 494%, according to Finviz.

By identifying the sector theme early on and understanding the theme and type of stocks that might move off of it, I was able to identify a significant mover early on.

The best part? I wrote about this stock and theme a week ago to my members!

Is the opportunity over?

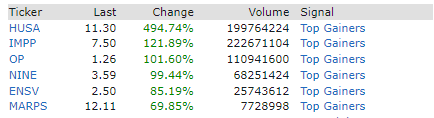

Gang, the small-cap action, was dominated by the energy theme yesterday.

Yesterday, the top 6 stocks on the Finviz Top Gainers list were all energy-related stocks.

This tells me, along with the action in several other names yesterday, that this sector might be experiencing a major rush of attention, and a new wave of participants are getting involved.

Now, I might not be buying stocks that have been up significantly for multiple days in a row and are trading near the highs.

Instead, I would be looking to identify stocks that are beginning to perk up, break out of a consolidation, and put in higher highs and higher lows. Those setups present the risk: reward that I am looking for.

For example, in the above chart of HUSA, from stockcharts.com, take notice of the clean consolidation leading to a breakout pattern.

The stock spent close to three hours consolidating between $5.50 and $4.50. Around 1 pm, the stock broke out of the range (highlighted in yellow), confirming the consolidation breakout pattern.

These are the types of setups, on an intraday basis, that I am identifying and alerting my members too because they offer significant risk: reward.

Lastly, while I was speaking about the sector early last week and some individual names to my members, like HUSA, It’s important to remember that stocks don’t just go straight up forever.

If oil continues to rise, then this sector and several small-cap participants might present a pullback opportunity to get involved.

Now it’s back to the screens for me as I look to identify the next HUSA for my members!