Options offer traders some unique advantages and are undoubtedly a great way to enhance your portfolio. They can also help mitigate losses in the stock market. When traded correctly, options can help a trader have defined risk, but it’s important to remember that options are not risk-free trading tools.

Understanding the risks associated with options is key to your trading — as well as getting clearance from your broker to trade more advanced options strategies.

Let’s take a closer look.

Risks When Trading Options

There are some major risks associated with trading options, and in order to be a successful trader, you should familiarize yourself with these and monitor these potential hurdles very closely.

Some risks to options traders include:

- Time

- Volatility

- Substantial risk of losses on short options

Time Decay

The most important thing to understand is that every option will expire. As such, there’s a time value factored into each option’s premium.

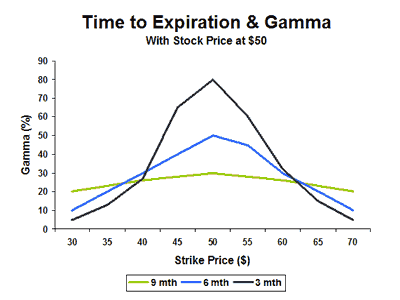

Unlike stock investing, time is not your friend as an options buyer… and the closer you get to expiration, the faster the premium in the options will erode due to time decay.

In other words, if you don’t get a strong move by the stock in the right direction by the time the option expires, you’re liable to lose money on the trade… even if you’re kind of right on direction.

Some things you can do to help combat time decay are:

- Buy options that are at the money or in the money to minimize the impact of time decay.

- Trade options with expiration dates that are more than one month out. Three months is generally considered a “sweet spot” for short-term traders, since it allows more time for the trade to play out. However, it’s important to note that premium may be higher the further out you go.

- Don’t hold your option through expiration, since that is when the fastest rate of time decay will occur.

Volatility

Volatility occurs when stocks go up or down, and is another factor in determining an option’s price.

It is integral that option buyers are aware of implied volatility (IV), which measures the market’s expectation of price movement in the next year.

Implied volatility will increase or decrease depending on supply and demand, and a higher IV means higher option prices, while a lower IV translates into lower option prices.

When you buy options, you want IV to be as low as possible, so you can profit on any increases in IV. If implied volatility is elevated, it means you’ll be paying more premium to initiate your position — which limits the benefit of leverage.

Traders should be aware that IV tends to rise into expected events like earnings or FDA announcements, since these catalysts tend to spark bigger share price moves.

The risks outlined above are for option buyers. Options sellers, on the other hand, are in a position to take advantage of time decay and elevated IV levels. We’ll take a deeper dive into options selling in a later section, but it’s important to underscore this potential risk to call and put writers.

One Major Risk to Option Sellers

The most notable risk to options sellers is the potential to suffer significant losses — which is why naked call and put selling is only a strategy allowed to options traders who have margin accounts and have reached the top level of clearance from their brokers.

Being “naked” when you are short options means that you are selling a call or a put without a proper hedge against it.

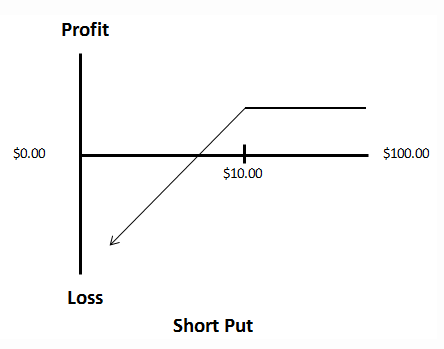

While options buyers’ risk is limited to the premium paid, sold calls carry the potential for theoretically unlimited losses and sold puts could lead to substantial losses.

Why?

Because when you sell an option, you are obligated to deliver the stock at the strike price if the option is assigned. This creates substantial risk to sellers, since, for call writers, there’s theoretically no cap on how high a stock can climb, and for put writers, their losses will accumulate on a move all the way down to zero.

Wrapping Up

Options are flexible tools and hold the promise of massive returns to traders, while also minimizing losses when used properly. However, options are not risk-free, and it’s important to do your research on the risks associated with trading these derivatives.

For options buyers, factors that impact a contract’s price like time decay and implied volatility could potentially eat into profits, while option sellers must understand that they open themselves up to substantial losses if their contracts are naked, or uncovered.

It’s also important to know what your personal risk profile is before pulling the trigger on a trade. If you’re a beginner, start small and get a feel for how option’s pricing works and what risks are out there.