Call Buying

Stock traders have a number of different strategy options to maximize their portfolios and increase their chances of success. Many speculators enjoy participating in options trading, which is a way to earn income while hedging risk.

Gaining a better understanding of options trading can help you decide whether you want to pursue it, as well as which strategy you plan to use when participating in this type of trading.

Call options can also be appealing for investors as it can provide them exposure to stock for a significantly lower price than it would be to buy the shares outright. When they pan out well, you can end up with a significant gain if the stock rises.

But even if it doesn’t, there are several options strategies that allow for a limited exposure to risk.

At the second level of options clearance, traders are allowed to play bought, or long, calls, which are the most traditional way to use options to bet bullishly on a stock.

As they graduate to higher levels, traders can also initiate a bull call spread to lower risk (though they’re also sacrificing some potential reward with this two-legged strategy) or take the neutral-to-bullish route with short puts or a short put spread, each of which we’ll discuss in later sections.

For now, let’s take a closer look at the long call.

Long Call

The bought call is a basic strategy for beginners and allows an investor to bet that a specific stock price will rise above the strike price by the expiration date.

When stock market volatility is fairly low and a stock is trending strongly higher, long, or bought, calls are a great way to play the directional move. That’s because options are cheaper to buy than the underlying stock — and you can rake in leveraged profits when the shares rally as you expected.

Here’s an example of how you could profit off a bought, or long, call option.

Let’s assume stock RBLL is trading at $50. While you’re upbeat the shares will rise in the near term, putting up $5,000 to buy 100 shares seems a little intimidating. However, you can buy to open a 50-strike call at an ask price of $1, dropping the price to initiate your bullish play to $100 (1 option contract x $1 premium paid x 100 shares per contract).

In order to break even by expiration, you need to make at least $1 on the option. Here’s how you get to your breakeven price.

Call Option Breakeven = Strike Price + Cost of an option (premium) = $50 + $1 = $51

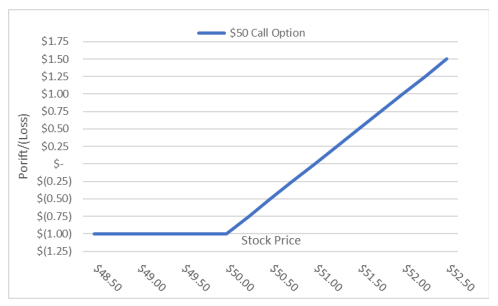

Traders often use payout diagrams to help their decisions. Here is a payout diagram for this call option.

With the call option, you add the cost of the premium to the strike price. Why? You must exceed the strike price by the amount you paid just to break even. Notice on the chart above that a call buyer’s profit potential beyond their breakeven point is theoretically unlimited.

Now, let’s say RBLL stock rises to $55 at options expiration. The call is now worth $5 (5 points of intrinsic value; zero time value). Accounting for 100 shares, you could now sell to close the call for $500, netting a $400, or 400%, profit. If you had just bought the shares outright, your net profit would still be $500, but your return on investment would be a much slimmer 10%.

Even if the expected pop higher doesn’t pan out, you still have clearly defined risk on the trade. Specifically, the call buyer will forfeit the premium paid as their maximum loss, should the stock price be lower than the strike price at expiration.

Wrapping Up

These are a number of ways to place bullish options bets. The long, or bought, call is the most traditional way to bet on upside for a stock with options and is opened up to speculators who have been approved for the second level of options trading. The basic options strategy offers a more affordable way to target an upside move in a stock, compared to buying the shares outright, and limits risk to 100% of the premium paid.