How the Option Greeks Can Help You Select the Right Option Strategy Right Now

If buying and selling stocks is like trying to win at a game of checkers, then trying to trade options is like a game of chess by comparison. The activity is more complicated, and you’d better be able to select the most strategic move as the game develops.

In some ways, learning to select the right strategy is a lot easier for option traders than for chess players. That’s because there are three numbers, available to practically any option trader, that carry key information needed to identify the right strategy. The three numbers are derived by the option greeks: Delta, Gamma, and Theta. To understand them you’ll need a quick explanation of what they mean and how to read the numbers they generate.

Delta:

This variable generates a number between 0 and 1.00. It designates how sensitive an option is to a one dollar change in the price of the underlying stock. Delta scores can be understood by comparing a $1.00 move in the price of a stock with whatever the Delta number is. That number will tell you how much the option will change in price if the stock price changes by one dollar.

For example, if stock XYZ is trading at $100 per share, and I decide that I want to buy a call option at the $100 strike price (an at-the-money option). Suppose I pay $2.50 for that option which expires in two weeks’ time. Now I might be curious to know how much the price of the option will change if XYZ goes up to $101 per share in a single day. The Delta value can tell me what to expect.

Suppose the Delta value for the call option that I bought is .52. This tells me that when XYZ reaches $101 in price, my option should be pretty close to $3.02 cents per share (2.50 + .52). The price of my option doesn’t go up penny for penny compared to the stock price, because some of that move is already priced into the option to begin with. In this case, I paid $2.50 at the outset, so the option seller made a bet that the stock won’t move more than $2.50 in my favor over the next two weeks. If the stock goes up by one dollar, the seller of that option isn’t terribly worried. There is still another $1.98 to be made on this trade from the seller’s perspective (2.50 – .52).

The less time an option buyer has on the contract they have purchased, the higher the Delta score tends to be. Options that are at the money tend to be scored around .50, options further in the money are above .50, and options that are out of the money are below .50. Delta scores on call or put options of .5 or greater are good for traders who want to make a swing trading play and want to leverage a short-term move most effectively.

Gamma:

This variable designates how sensitive the delta score is to a one dollar move in the stock price. It is used to determine how rapidly an option will increase its sensitivity to the move of the stock. A low gamma value (something less than .10) will mean that the delta value will change slowly as the stock prices moves in the same direction as the option (up for calls, down for puts). A high gamma score means that the option will rapidly become more valuable if the stock moves favorably.

For example, suppose XYZ’s 100 call option, (we’ll name this one option A), has a gamma score of .06. That means that when XYZ moves from 100 to 101, the 100 call option will change its delta value from .52 to .58. Gamma scores tend to increase if the price of the stock is lower, or If the time to expiration is less. But suppose XYZ were not priced at $100, but instead it was priced at $10, and instead of two weeks to expiration, it might have only 1 day left before expiration.

If those conditions were true, XYZ’s $10 call option (we’ll name this one option B) might have a delta of .50, but it might also have a gamma of .48. That means that if XYZ moved from $10 to $11 in the next hour or so, the delta score could jump to .98. That means that from that price point or higher, that $10 call option would gain value just as quick as the share price of XYZ. So you can see why call option B would gain value much more rapidly compared to call option A.

Options with a high gamma score are excellent for short-to-intermediate-term strategies. This means that when you are looking to risk a small amount of money on a low-probability bet that has the potential for high-stakes opportunities, you’ll want to find an option with as high a gamma score as you can get.

Theta:

This variable designates how much the passage of time affects the price of an option. More specifically it designates how much value an option loses with the passage of one day’s time. Unlike Gamma and Delta, which connect the price of the option to the price of the stock, Theta is related to the price of the option alone.

Theta scores are negative numbers, so the highest score is 0. The closer an option is to expiration, the more negative the theta scores become. The closer an option is to being at the money, the more negative the theta scores become as well.

For example, if XYZ stock is $100 per share, and the 100 call option has 14 days left before expiration, the theta score might be something like -.07. This means that after one full day, the value of the option will decrease by seven cents, assuming the price of the stock holds constant. That same 100 call option that has two days before expiration, might have a theta score of something like -.45, meaning it will decrease by 45 cents in one day all other things equal.

Options with higher theta scores (anything above .10) are good candidates for short-to-intermediate time strategies that seek to collect value from the passage of time. These strategies are more likely to begin with the selling of options, rather than the buying of options. Strategies such as vertical credit spreads or iron condors are a good match because they have comparatively larger theta scores.

There are several other Greeks such as Rho, and Vega, and many others. Each can help an option trader better identify what an option can best be used for. But the most important are Delta, Gamma and Theta, because those three have a more potent impact on option prices than the others.

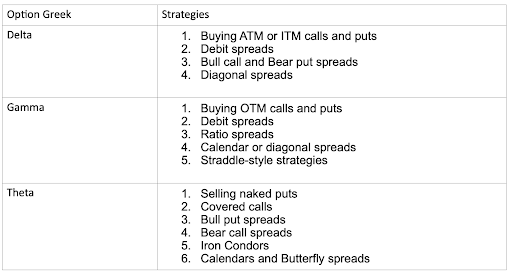

That’s why Options Academy uses these three option greeks as labels for the three different trading styles an option trade can start from. Each of the trading styles seeks to maximize the use of that option Greek by using strategies that go with the proper option Greek. Below is a summary list of strategies aligned with the three most influential option greeks. It matches the list of strategies associated with each of the three trading styles: Delta, Gamma and Theta.