Nuclear power gets a bad rap.

Justified or not, its track record as a reliable source of clear energy generation must be taken into serious consideration when thinking of ways to reverse the effects that fossil fuels have had on climate change.

In fact, as the world has been taking climate change more seriously in recent years, more nuclear projects have been coming online globally.

There’s a small number of stocks involved in the mining and production of the key mineral at the center of this industry, uranium, and today we’re going to take a look at how recent price action may be close to generating a short-squeeze in three stocks that I’m watching right now.

Nuclear power is the world’s unsung energy hero

The market is slowly moving away from fossil fuels, and nuclear energy is a top contender to replace them, for good reason.

Earlier this month, the Intergovernmental Panel on Climate Change (IPCC), the United Nations’ body for assessing the science related to climate change, issued a report entitled Climate change widespread, rapid, and intensifying, which the United Nations called a “code red for humanity.”

Recently, developing nations are looking for power sources that can keep up with the rapid expansion of their industries.

Natural gas and coal capacity factors are generally lower due to routine maintenance and/or refueling at these facilities.

Renewable plants are considered intermittent or variable sources and are mostly limited by a lack of fuel (i.e. wind, sun, or water).

As a result, these plants need a backup power source such as large-scale storage or they can be paired with a reliable baseload power like nuclear energy.

Nuclear power has reliably and economically contributed almost 20% of electrical generation in the United States over the past two decades.

It remains the single largest contributor (more than 70%) of non-greenhouse-gas-emitting electric power generation in the United States, and in recent years has earned better confidence on the part of decision makers because of new and advanced light water and small modular reactor technologies, versatile test reactors, and space power systems.

In addition, nuclear power plants are typically used more often because they require less maintenance and are designed to operate for longer stretches before refueling (typically every 1.5 or 2 years).

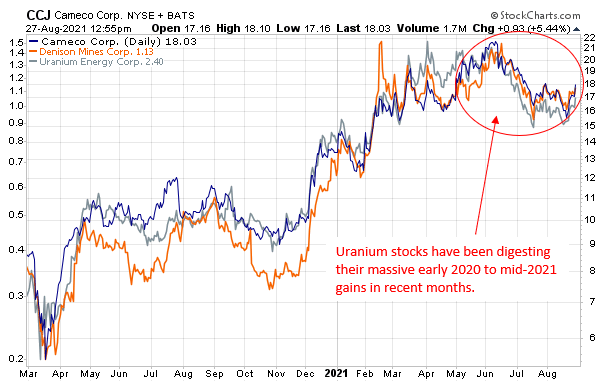

This has spurred demand for uranium to increase, which has allowed uranium stocks to benefit, with most registering incredible gains from their 2020 lows to their 2021 highs.

Since peaking earlier this year, however, Figure 1 below shows that the 3 stocks on my watchlist have been digesting these gains in a corrective cycle.

Figure 1

What are the technicals telling us about this industry’s near-term future?

I picked this industry as the topic of today’s discussion because of the technical setup that, while currently neutral, has the potential to generate a short squeeze in these stocks.

Some of the greatest trades start with failed technical patterns

On this next set of charts, you’ll notice that there are currently two important bearish setups taking shape: First, potential “Head-&-Shoulders” patterns. Second, potential “death crosses,” which occurs when the 50-day moving average crosses below the 200-day moving average.

Figure 2

Figure 3

Figure 4

Since none of the bullish or bearish setups shown on these charts have been confirmed as of yet, as traders we have to understand that these setups only offer the “potential” for a big move.

How should traders approach Uranium stocks at this time?

As of Friday’s close, price action seems to be signaling that some portion of the short base in these stocks is starting to get squeezed.

This can be seen on the charts of Cameco Corp. (CCJ), Denison Mines Corp. (DNN), and Uranium Energy Corp (UEC), where prices have begun to creep above the lower sloping 50-day moving averages. Note: Finviz currently lists the percentage of floats short on these stocks at 2.68%, 2.94%, and 9.07%, respectively.

At this point, prospective longs need to just wait for the point where shorts might officially start to break, and that would probably occur in the event these stocks close above the most recent pivot highs (see red lines on charts).

1 Comments

Thanks, Jeff! I would love more info on floats! Thank you! KD