👋High Alert Members do the talking

The Hottest Trading Ideas

👋High Alert Members do the talking

How I Played Today’s Market Crash Did you see this gap coming?

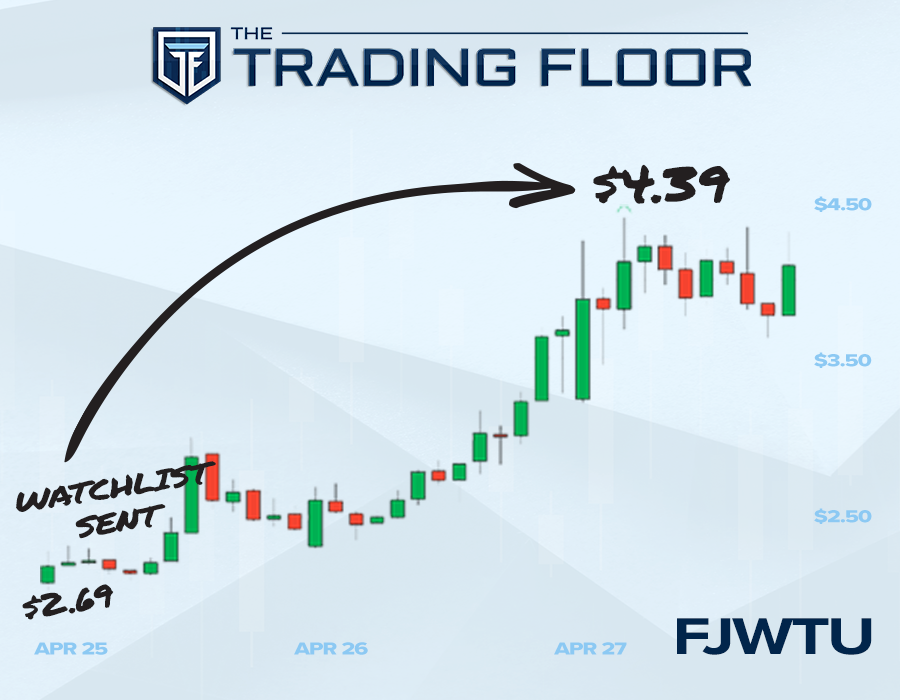

Coming out swinging with this idea Great way to start the week

- Angel Insights

- Ben Sturgill

- Biotech Breakouts

- Biotech Stocks

- Boardroom Investing

- Bullseye

- Chart Hunter

- Daily Setup

- Day Trading

- Dennis Moffat

- Editorial

- Education

- Education & Exchange

- Energy ETFs / ETNs

- Fundamental Analysis

- Getting Started

- Getting Started - beginners-guide

- hot-tocks-idea

- Insider

- IPO Payday

- Jason Bond

- Jason Bond Picks

- Jeff Bishop

- Jeff Williams

- Large-Cap Stocks

- Learn to Trade

- Marijuana Stocks

- Market Navigator

- Michael Parks

- Momentum Stocks

- News

- Options Profit Planner

- Options Trading

- Options Trading

- options-definitions

- PennyPro

- RagingBull Investor

- Sponsored Content

- Stocks

- Styles & Strategy

- Success Stories

- Swing trading

- Technical Analysis

- Tools & Techniques

- Trading Apps

- Trading Styles

- Visual Training

- Weekly Money Multiplier