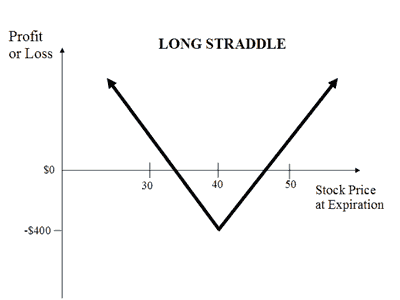

Intro to Long Straddles

Long Straddle Let’s face it, most investors who get involved with options stick to the basics -- calls and puts. However, what sets options trading apart from equity trading is versatility. The more you learn about the ins and outs of options trading, the more...