The short straddle strategy is just the opposite of the long straddle and consists of simultaneously selling a call option and a put option with the same strike price and expiration date.

And while you want to buy a long straddle when volatility is running low, you want to sell a short straddle when volatility is high.

Why?

Because the higher the implied volatility, the higher the option prices. This pays you more for selling the contracts.

And since the ultimate goal is for the stock to make a minimal move in either direction, but not move beyond the breakeven prices, through expiration, this is a strategy to avoid when a company is expected to release earnings, news, or other catalyst events that could significantly impact the stock’s price.

However, the short straddle should be reserved for only the most advanced options trader with a margin account, since it combines a naked call with a naked put — leaving the trader open to potentially unlimited risk.

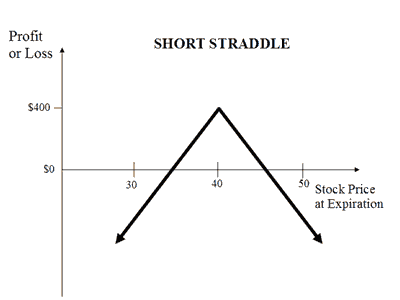

Here is a diagram showing how the profit and loss work on a short straddle:

How a Short Straddle Works

Here is an example of how a short straddle could be executed. Let’s say Apple (AAPL) has been churning near $100 for some time. A trader who expects this period of stagnation to continue could:

Sell one at-the-money 100-strike call for $5.00

Sell one at-the-money 100-strike put for $5.50

Net credit collected on the trade = $10.50 ($5.00 + $5.50)

Next… let’s break down more details about the potential profit and loss on a short straddle.

Breakeven

This strategy has two breakeven points.

This is calculated as:

Upside breakeven = strike price + premium received

Downside breakeven = strike price – premium received

Looking at our AAPL example, the upper breakeven would be $110.50, while the lower breakeven would be $89.50.

Max Gain

The maximum profit potential on a short straddle is limited to the net credit collected from the sale of the put and call. The trader can pocket this reward, as long as the stock settles squarely at the stock price at expiration.

The trader can still retain some profit if the stock remains in between the two breakeven rails through expiration.

The short straddle player could also benefit from a drop in implied volatility since that will make it cheaper to buy to close the options.

Looking at AAPL, the trader will pocket the full potential reward if the stock lands right at $100 at the options’ expiration, though they can still make some money if the shares remain between the breakeven levels of $89.50 and $110.50.

Max Loss

A short straddle carries considerable risk, and losses can be quite substantial because in order to execute this strategy, you will need to sell (naked) both one call and one put.

Should the stock breach the lower breakeven rail or topple the upper one, the trader could be at risk of assignment on the put and call side, respectively.

To combat the risk of a short straddle many traders will implement a hedging strategy using the underlying stock to protect against adverse moves.

As mentioned above, this is a high-risk, low-reward strategy compared to the long straddle, and is not suitable for beginning options traders.

Impact Of Time

All option contracts are impacted by time. Some more than others, depending on their time until expiration and other factors that are associated with the specific contract or strategy.

In terms of short straddles…

The time value of an option’s total price decreases as expiration approaches. This is known as time erosion, or time decay.

Short straddle trades consist of two short options, and this means the sensitivity of time erosion is higher compared to a single options contract. This strategy tends to make money more rapidly as time passes, and the stock price does not change, meaning it’s beneficial for the short straddle trader to target options with nearer-term expirations.

This is a stark comparison versus equity trading, where a trader will not make any income for a stock that trades within a range-bound market.

Wrapping Up

A short straddle is a high-risk, low-reward strategy that requires selling one call and one put with the same strike and expiration.

When to place a short straddle trade:

If implied volatility is expected to decrease

If the stock is expected to remain range-bound

When to avoid placing a short straddle trade:

Prior to earnings reports

Before new product introductions

Before FDA announcements

It’s important to remember that a short straddle is best initiated when implied volatility is running high, since it requires selling both a call and a put.