Long Straddle

Let’s face it, most investors who get involved with options stick to the basics — calls and puts. However, what sets options trading apart from equity trading is versatility. The more you learn about the ins and outs of options trading, the more you’ll be able to make money in the market.

For example, the straddle option is a volatility strategy.

What is a straddle?

There are two types of straddles: the long and the short.

We’ll dive into the short straddle in a separate section, but the long straddle strategy consists of simultaneously buying a call option and a put option with the same strike price and expiration date.

When combined, this position creates a trade that should profit if the stock makes a big move either up or down. For example, a trader may be looking at a company with an upcoming catalyst event – corporate earnings, an important FDA announcement, a court ruling — which could have the potential to spark a major swing in the shares.

Another reason for a long straddle is to avoid choosing the wrong direction of the move. There is a certainty of movement but lack of knowledge of the direction, a trader would utilize a long straddle to take advantage of this sharp price movement in the stock.

It’s important to remember that since the long straddle consists of buying a call option and a put option, it is said to be a 2x long volatility, or a “double premium,” trade. As such, you want to buy it when volatility is low.

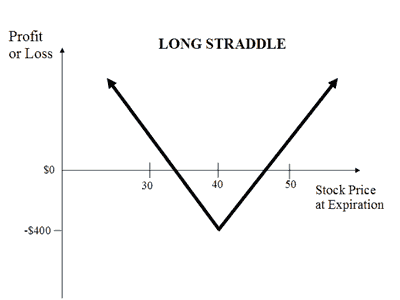

Here’s a diagram showing how the profit and loss work on a long straddle:

How a Long Straddle Works

Here is an example of how a long straddle could be executed. Let’s say Apple (AAPL) stock is trading at $100 ahead of the tech giant’s upcoming earnings report, and the stock has a history of making big post-earnings moves. A trader could:

Buy one at-the-money 100-strike call for $3.00

Buy one at-the-money 100-strike put for $3.50

Net debit on the trade = $6.50 ($3.00 + $3.50)

Next… let’s break down more details about the potential profit and loss on a long straddle.

Breakeven

This strategy has two breakeven points.

This is calculated as:

Upside breakeven = strike price + premium paid

Downside breakeven = strike price – premium paid

Swinging back around to our AAPL example above, the upper breakeven rail on this trade would be $106.50, while the lower breakeven rail would be $93.50.

Max Gain

The maximum gain on the call side is theoretically unlimited, while the potential profit on the put side could be quite substantial — accumulating on a move all the way down to zero. Big increases in implied volatility could also benefit the long straddle trader, as this allows them to sell to close the options at a higher price than what they paid.

Looking at our AAPL trade, profit for the long straddle trader will accrue on a move above the upper breakeven rail of $106.50, or on a move below the lower breakeven rail of $93.50.

Max Loss

The maximum loss on a long straddle is limited to the net debit paid for the position. The worst that could happen is for the stock price to hold steady and have the implied volatility decline after the event. If at expiration, the stock price is at the money, then both options will expire worthless and the entire premium paid is lost.

Wrapping Up

A long straddle is the strategy of choice when a trader forecasts a big move in the stock price, regardless of direction.

When to place a long straddle trade:

Prior to earnings reports

Before new product introductions

Before FDA announcements

When to avoid a long straddle trade:

If implied volatility is expected to decrease

If the stock is expected to experience consolidated, or range-bound, price action

It’s important to remember that a long straddle is best initiated when implied volatility is low, since it requires a “double premium” — or buying both a call and a put.