Part 1: Introduction

If you want to learn about stock option trading, you’re in the right place. My name is Amanda and in the next few minutes, I’ll introduce you to stock option trading and tell you how you can learn more through Raging Bull’s Options Academy.

Perhaps you’ve asked yourself, “What does it mean to trade stock options?”

Let me explain. When trading options you buy or sell the chance to make a profit from trading stocks—but without having to own the stocks outright. So instead of buying or selling shares, trading options is literally buying or selling A CHANCE.

Does that make you wonder how someone can BUY A CHANCE?

Here’s how it works. Option trading is based on option contracts. Contracts are usually based on the size of 100 shares of stock, and each contract establishes three things: the option type, its strike price, and its expiration date.

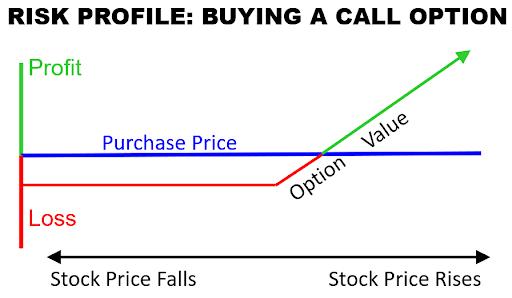

The first characteristic, the option type, is either a call or put. This tells you what kind of stock trade you have the chance to make. Traders buy CALL options to have the chance of owning shares, and they buy PUT options for the chance of selling shares short.

The second characteristic of a contract is the strike price. This tells you what the PRICE of the shares would be if you decided to exercise your right to take that chance.

The third characteristic is how much time you have to take that chance. Each option contract has a specific time and date when it will expire.

Let me give you an example. If I tell you that I want to buy a November 21st, 150, CALL option contract on Apple, then you know that I want to have the chance to buy 100 shares of AAPL stock at the price of 150 dollars per share, and I want to be able to do so any time until November 21st.

With these three characteristics defined, you can see how options can create a specific window of opportunity. Stock movement during this window is the chance. The VALUE of the chance will change in response to stock moves.That change in VALUE, is the BENEFIT that option traders seek.

If you are interested to learn how option values change, then you’ll want to watch the remaining videos in the Beginners Guide to Options Trading.

These options academy videos are designed to be a source of quick information you need to know before you get started trading options.

————————