Part 2: How Option Prices Change

When the stock market is open, the value of an option contract can change continuously. The way the value changes is important to understand, because option prices move differently from stock prices. Stocks have one single factor that moves share prices around, but an option contract has three different factors that will influence its price. Let’s look at each one.

The first factor is the normal market action generated by buyers and sellers.

Similar to stocks, options also rise or fall in value depending on the flow of orders between buyers and sellers. In the stock world, the price of stock shares will rise or fall with the flow of orders from buyers and sellers. If buy orders come in faster than sell orders, the price moves higher. If sell orders outnumber buy orders, the price moves lower. This is also true for option prices, though it’s only one of three factors that affect option prices.

Market action tends to be the biggest factor moving stock prices higher or lower at any given moment. However, except during earnings announcements or other big events, market action is often the least influential of the three factors that move option prices.

The second factor is the decreasing amount of time left before expiration.

Since all option contracts have a time limit, the value of the option decreases bit by bit as the expiration date draws near. That decrease is known as time decay. Those new to option trading often overlook the influence of time decay, but they shouldn’t. Option values decrease at an increasing rate, so the value of the option decreases faster as the expiration date draws closer. Some option buyers ignore the influence of time decay, but that’s because the third factor is more influential most of the time.

The third factor is the movement of the stock.

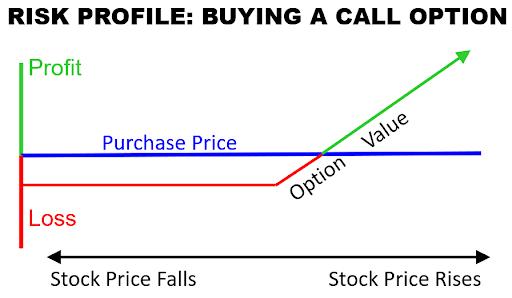

The value of an option is connected to the stock through the option’s strike price. The movement of the stock can push the value of that option higher or lower depending on the type of the option contract, and what the contract’s strike price is.

A call option will increase in value if its underlying stock moves higher. That’s because call option contracts mimic the action of owning the stock starting at the strike price. A put option will move higher if the stock moves lower. That’s because a put option contract mimics the action of short-selling the stock, starting at the strike price.

In the next two parts of this guide, we’ll take a closer look at how call and put option prices can change depending on the type of the option (whether it is a call or a put). It also matters what the contract’s strike price is as well. Part 3 takes a close look at call options, while part 4 takes a look at the way put option prices change.

You can get a better idea of how call and put prices change in the next part of this guide.

——————-