`The Pros and Cons of trading options

Options give traders powerful tools to seek out trading opportunities in any market condition. You should know: trading options comes with risk. It’s true that option buyers can come across big opportunities, but the option pricing formulas actually favor option sellers.

Buyers have two challenges. All options come with a built-in expiration date and a daily loss of time value. Let’s take a closer look at the pros and cons of overcoming these challenges.

It is true these two challenges can be overcome if a buyer happens to get lucky enough to make a trade at just the right time.

This kind of timing is not easy to predict. That’s why it’s important for traders to weigh the advantages and disadvantages of trying to time trades. The alternative to being a buyer and seeking opportunities for well-timed trades, is to become an option seller. Some traders prefer to take that approach because it allows them to focus on risk management, rather than timing.

So let’s compare the difference between being an option buyer as opposed to the advantages of being an option seller. First we’ll consider the pros of being an option buyer.

#1. You Hunt down big opportunities.

You may not always be right about an option trade, but if you are, the opportunity for unusual returns does exist.

#2. You can clearly define how much you will risk.

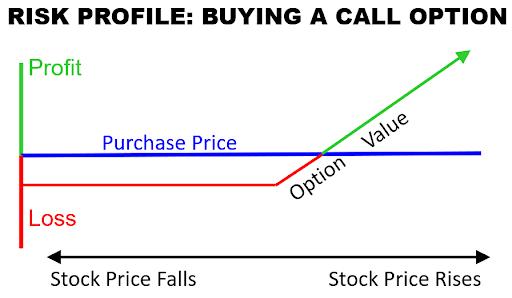

You may not always have a winning trade as an option buyer, but when you have a losing trade, you have a clear understanding of how much money you put at risk when you made the trade. That’s because option buyers pay a premium, and their risk is largely limited to that premium paid.

The pros of being an option seller are different.

#1 You get to collect time value instead of paying it.

Options are priced to favor the sellers. That’s because sellers set the price. They do this in a way that covers most of their risk. The price of an option reflects what the seller expects to see happen with the stock. If they expect the stock price to move strongly against them, they set the price of the option higher. As a result sellers are more likely to be successful every day the stock closes without big moves.

#2 You don’t need to have excellent timing.

Since option sellers benefit from time decay, and since time decay happens every day, an option seller doesn’t have to worry as much about initiating the trade on an exact day. As long as the stock doesn’t move against them rapidly, sellers have a higher frequency of opportunities for good trade setups.

It’s also true that each decision comes with tradeoffs. For example, those who buy options have the potential for a big opportunity, while those who sell options give up that potential in exchange for smaller, more frequent opportunities.

Another tradeoff has to do with how much an option trader must risk. The premium a buyer pays represents their entire risk of the trade. However, sellers take on much more risk in exchange for the premium they collect. That’s because when a trade goes against a seller, the losses aren’t limited to the cost of the option premium, but the potential profits are.

A good rule of thumb is that option buyers will experience less frequent opportunities but have similar larger trade setups compared to the risks. By comparison, option sellers will experience more frequent opportunities but take similarly larger risks compared to the cost of the trade.

These pros and cons tend to balance out in such a way that neither side has much mathematical advantage over the other. However once a trader has picked a side, they also have to select option strategies that work best for that kind of trading.

Options Academy has structured its educational information to help answer that question. Be sure to check out the content that describes common strategies for option sellers as well as for option buyers.