Often we lose track of stocks that were widely spoken about and in-play the prior week. I highly recommend that you continue to monitor stocks that were in play the week before. You can keep a list or set alerts at key levels so that you are aware if any of those stocks make significant moves.

One stock that I am keeping tabs on that is setting up for a potential breakout long is Xenetic Biosciences (NASD: XBIO)

MARKET CAP: 20.5m

FLOAT: 8.02m

ATR: 0.53

SHORT %: 4.83

AVG. VOLUME: 7.26m

What’s Happening In XBIO

Last week, the stock gapped up, broke the downward trendline on the daily, and traded up 116% to a high of $4.75. The stock then reversed and closed up slightly on the day at $2.52.

The following trading day, Monday, July 26th, the company announced a private placement of $12.5m at a premium to the market. The company also announced they issued warrants with an exercise price of $3.30 per share. The news was viewed as bullish by the market, and the stock closed at $3.03 on the day, compared to $2.52 the previous trading day.

Yesterday after a brief morning selloff, the stock recovered and closed the day higher than the previous day, at $3.17. Monday and Tuesday’s close was inside of Friday’s close.

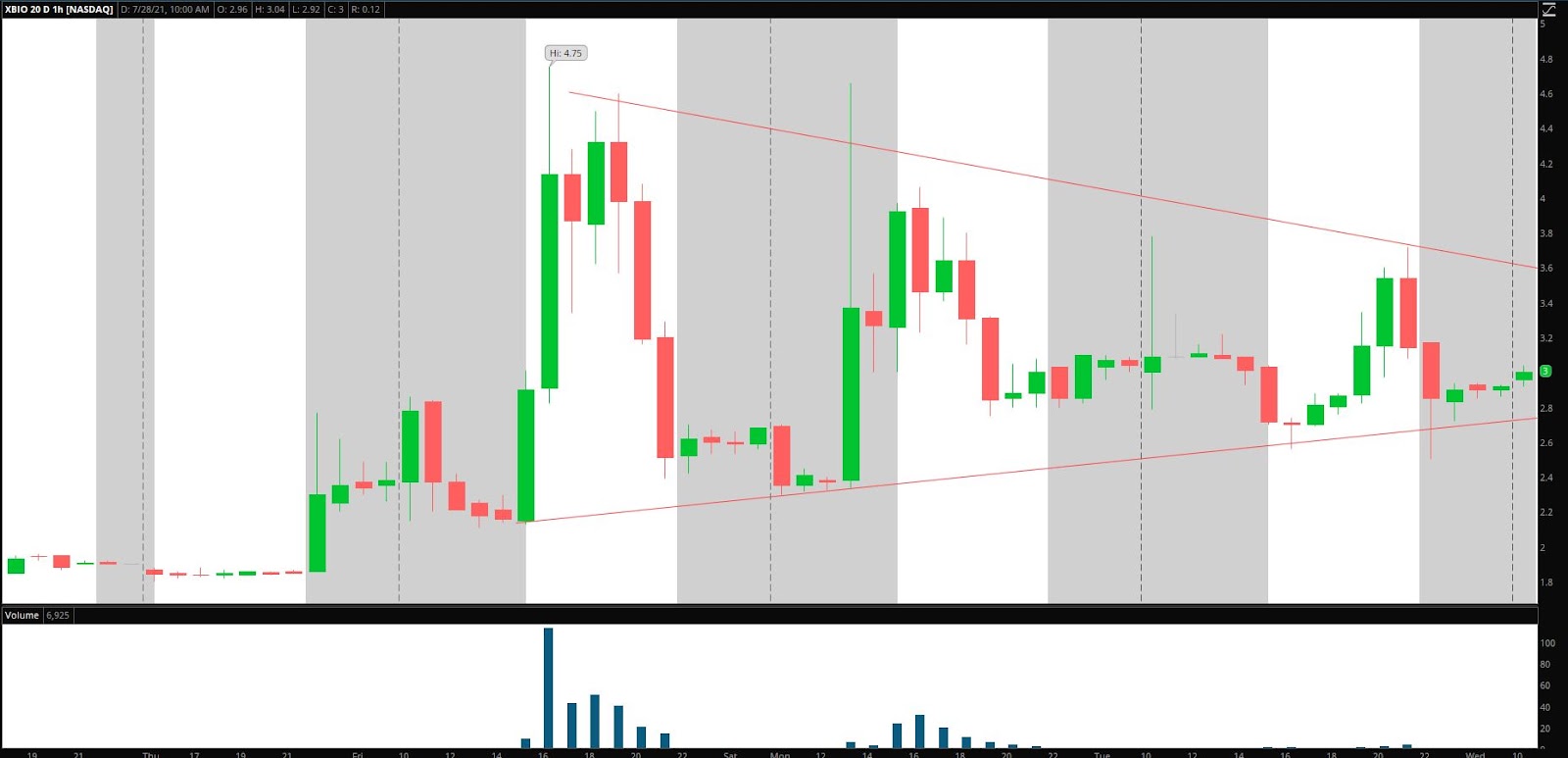

Bull Flag on the Hourly Chart:

The hourly chart paints a bullish picture. Each time the stock has sold off, it has found support and held the bull flag’s support. Critical support is $2.50, and resistance is $3.60.

After the move last week, the stock has spent a couple of days consolidating, and volume has dried up. The stock is digesting the action from Friday.

What you want to see is the stock begin to hold in the upper part of the bull flag, volume to increase, and a breakout over $3.60 to be supported by an increase in volume. If that occurs, it is possible the stock could trade over Friday’s high of $4.75 reasonably quickly.

If the bull flag fails to hold up and shares trade below $2.50, then there is no trade for me. However, if we break below $2.50 and then recover and hold over $3, that would signal a short trap and that the bull thesis is still intact.

Not only is the setup bullish, but the fundamentals are favorable as well. I like the float size of 8.02m. This means that the stock can make significant and volatile moves if volume comes into the name again. I also find it interesting that XBIO’s market cap is currently $20.5m, and they just completed an offering for $12.5m, thereby strengthening their balance sheet.

The Bottom Line

As is the case with trading, it is all about risk: reward, and looking at where this stock came from and where it is now, I like the risk: reward to the long side. Of course, you need to wait for confirmation before thinking about going long. It would be best to remember the critical levels of support and resistance and always have a detailed trading plan written out.

1 Comments

NICE job on this one ! Makes me pay SERIOUS attention to your emails over the constant barrage of supposedly hot stocks recommended by others . Even the timing was superb !