Much Adobe About Nothing

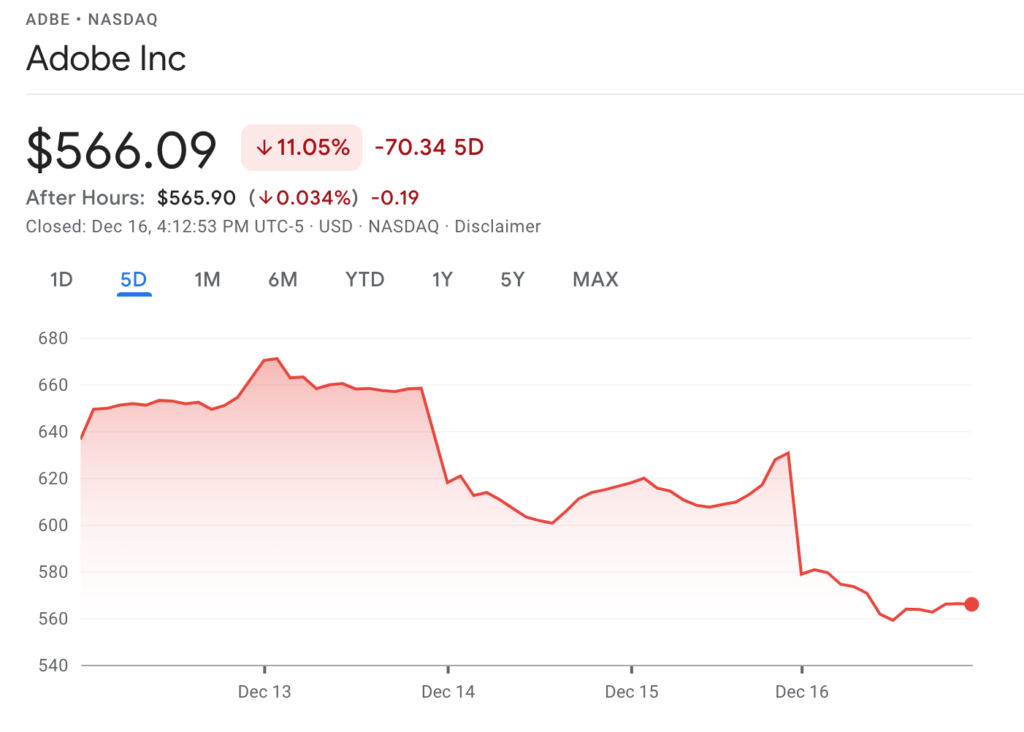

Adobe had its second-worst day in a decade on Thursday after releasing lackluster guidance for the first quarter of 2022. The software company projected revenue of $17.9B and adjusted profit around $13.70 a share, both of which fell short of Wall Street’s expectations of $18.2B in revenue and a profit per share of $14.26. ADBE’s EPS predictions disappointed too, clocking in at $3.35 on $4.23B in sales, where analysts were expecting $3.39 on $4.33B respectively. Don’t worry, guys, you can always fix the numbers in Photoshop.

Adobe had its second-worst day in a decade on Thursday after releasing lackluster guidance for the first quarter of 2022. The software company projected revenue of $17.9B and adjusted profit around $13.70 a share, both of which fell short of Wall Street’s expectations of $18.2B in revenue and a profit per share of $14.26. ADBE’s EPS predictions disappointed too, clocking in at $3.35 on $4.23B in sales, where analysts were expecting $3.39 on $4.33B respectively. Don’t worry, guys, you can always fix the numbers in Photoshop.

- Shares fell 10.19% on Thursday by markets’ close. That’s the third serious dip for the stock this month, making December 2021 ADBE’s worst month since June 2010.

- Too bad everyone was so busy freaking out over guidance that they didn’t pay attention to Adobe’s totally decent fiscal Q4 earnings report. Revenue and profit both beat estimates, with revenue up 20% thanks to a 21% bump in their digital media department.

While Adobe faces strong competition, like Microsoft Paint, they’ve also got strong fundamentals. 2021 was a pretty good year, with Adobe stock rising 26% to narrowly outpace the S&P500’s 25.4% swell. Their terrible Thursday has less to do with anything they’re doing wrong and more to do with how market sentiment is finally, inevitably contracting. (See also the extra week that was added to Q1 2021, which added $267M to Adobe’s revenue figures). Inflation’s got investors shying away-from high-risk high-reward options like software and opting instead for safer industries like infrastructure and raw materials.

Y’all not Reddy for this

Reddit right before they get shut down by the SEC

According to their recent confidential IPO filing, Reddit may soon be a memestock on its own r/WallStreetBets. That’s if the SEC okays it first– which is not a sure thing given General Gensler’s current attitude towards Wall Street. Thanks to the pre-IPO quiet period, Reddit hasn’t released any more information about share price or target valuation yet. But I’m sure if you ask Reddit you’ll get a nice, straight answer.

- We can take some good guesses, though. As of August of this year the website was valued at $10B, but word on the street is it’s praying to the memestock gods to be blessed with a $15B evaluation.

- That’s not as crazy as it sounds though. Stupid? Yes. Crazy, no. As of October 2020 Reddit had over 52M active users in over 100,000 subreddits, and just one of those was able to single-handedly make GameStop believe it was relevant again.

A record number of IPOs were launched in 2021, and they raised a record amount of money. If that trend continues into the New Year it’s easy to see Reddit hitting their $15B target no matter how ridiculous it sounds. The real question is whether or not the SEC will allow something like this to happen. At least they’re not going SPAC.

Gimme those McBucks back

Hell hath no fury like a clown scorned. McDonald’s (MCD) has settled a lawsuit against former CEO Steve Easterbrook to get the cash and stock back it paid to fire him, which amounted to $105M. The McBoard found that Easterbrook had an inappropriate relationship with another employee, hid it from them, and committed fraud in the process. They still paid him a massive severance because apparently Lionel Hutz is the general counsel.

- MCD fired Easterbrook back in November of 2019, then later found further evidence of several additional inappropriate relationships. (Trying to refrain from making a drive thru joke)

- The severance package was originally valued at $42M when granted, but MCD has since run up 37% to current levels of about $265 per share, making Easterbrook the real life Hamburgler.

- Shareholders questioned the company’s internal investigation, which was conducted quickly and did not bother to check internal servers for damning emails.

MCD now has an additional $105M in capital for the balance sheet, which it could use to test new menu items, invest in software, or settle lawsuits with franchisees. Here’s a crazy thought, maybe throw a couple bucks at fixing the ice cream machines?