Are you a one-trick pony?

You know, a trader that is comfortable trading only one setup?

Well, if recent volatility should have taught you anything it’s that you need to be skilled in more than one style of trading in order to keep drawdowns small and your PnL rising.

That, my friends, is the beauty of Ragingbull’s diversified “lineup” of services.

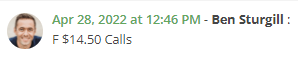

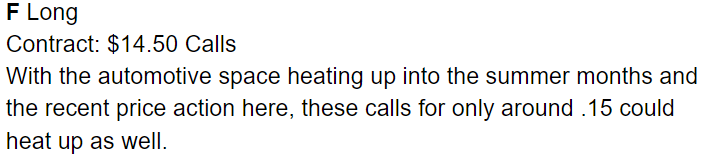

In just a moment, we’re going to get into the details behind my latest 0-DTE trading idea that saw Ford’s (F) sub-$1 options rise from the price at which I alerted members ($0.18) on 04/28 to an intra-day high of $0.57 (+216%) on 04/29 (less than 24 hours).

Right now, however, I need to make you aware of an alternative market strategy that another one of Ragingbull’s gurus, Davis Martin, has to offer.

Like me, Davis is a family man…

And over the years he has learned the pitfalls of being a greedy trader.

That’s why he has devised a method of trading that he calls “base hits,” which, for those of you who are baseball fans are aware, are smaller, consistent hits that occur more frequently than home runs and keep players moving around the bases.

This is the kind of alternative strategy that successful traders have in their arsenal to stay in the game in tough markets like this.

NOW, if you were to take this strategy of setting modest targets and employing ultra-tight stops through choppy markets with the KILLER 0-DTE ideas my man Ethan Harms and I have been providing to members, well, you’d have one heck of a “lineup” at your disposal.

If you’ve ever been on a diet, you know the ONE THING that helps you to keep your sanity is the “CHEAT MEAL.”

For me, it’s cheesecake! Sweet, creamy, New York-style cheesecake.

Well, that’s what these 0-DTE trades are…they’re your “cheat meal,” “junk food” trades of the week.

Why is that?

Because, these are trades built for excitement, NOT for building a career on.

These sub-$1.00 trades are meant to allow traders to leverage the power of options with a low capital requirement, and they have the potential to see significant movement in either direction, just like the F calls I’m about to show you.

Some of the ideas that Ethen and I showed members in our last 0-DTE lesson on April 28th moved so much that I have to spread the excitement in more than just this article.

That’s why tomorrow I am going to show you another one of our ideas from last Thursday’s session where the options rose by an even greater amount.

So what was the F trade?

Here are the exact alerts that went out to members regarding the 29 Apr 22 $14.50 Ford calls:

You think this is a fast Ford?

Well, get a load of this!

So, what were we seeing that made us like F so much?

Well, as is often the case, ENORMOUS call volume as shown in this actual image from last Thursday’s LIVE 0-DTE trading session…

AND, and good old fashion Jason Bond-like “fish hook.”

Daddy like!

If you do too, make sure you’re back for what I got coming in tomorrow’s article!

Let’s have a great rest of the day and until next time…

Related Articles: