Introduction

Over-the-counter (OTC) stocks are stocks that are not listed on a formal exchange, such as the New York Stock Exchange (NYSE) or NASDAQ. Instead, they are traded through a network of individuals and firms that work together to buy and sell the stocks. OTC stocks are often small, relatively unknown companies, and they may be more risky to invest in than stocks that are listed on a formal exchange. However, they can also offer investors the potential for higher returns.

Advantages of OTC Stock Trading

One of the main advantages of OTC stock trading is that it provides investors with the opportunity to invest in a wider range of companies. Because OTC stocks are not subject to the same listing requirements as stocks that are traded on formal exchanges, smaller, less well-known companies may be able to have their stocks traded on an OTC exchange. This can provide investors with the chance to invest in companies that may not meet the requirements for a formal listing, and can potentially offer higher returns.

Another advantage of OTC stock trading is that it can provide greater liquidity for certain stocks. Because OTC stocks are traded through a network of individuals and firms, rather than on a centralized exchange, they may be easier to buy and sell, especially for stocks that do not have a lot of trading volume on formal exchanges. This can make it more convenient for investors to buy and sell OTC stocks, and can also help to ensure that they are able to obtain fair prices for the stocks they trade.

Pink Sheets and OTCBB

Pink sheets are listings for OTC stocks that are not listed on a major U.S. stock exchange. Most pink sheet stocks are considered penny stocks, which trade for less than $5 per share and are considered highly speculative. Companies may choose to sell their shares through the OTC network to avoid the costs and regulatory requirements for listing on a large exchange.

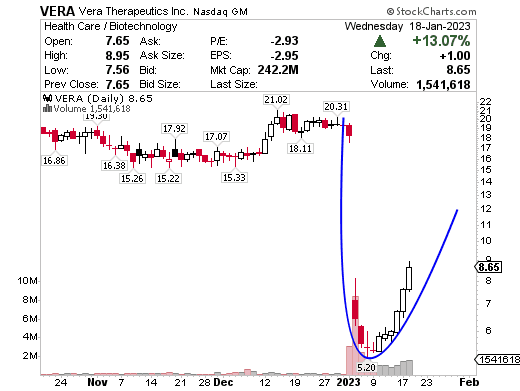

The OTC Bulletin Board (OTCBB) is an electronic system that displays OTC securities with real-time quotes and volume information. Shares listed on the OTCBB are required to file financial statements with the Securities and Exchange Commission (SEC) and carry an “OB” suffix. The OTCBB is operated by NASDAQ and is divided into the OTCQX and OTCQB platforms.

Disadvantages of OTC Stock Trading

However, OTC stock trading also has some disadvantages. One of the main drawbacks is that OTC stocks are not subject to the same regulatory oversight as stocks that are traded on formal exchanges. This means that there may be less information available about the companies and their financial health, and investors may have a harder time evaluating the risks and potential returns of OTC stocks. Additionally, because OTC stocks are not traded on a centralized exchange, they may be more susceptible to price manipulation and other forms of fraud. This can make it difficult for investors to accurately assess the value of an OTC stock and can increase the overall risks of investing in these stocks.

Pink sheet stocks are considered especially risky, as they are often penny stocks that trade infrequently and may be difficult to accurately price. Additionally, some pink sheet stocks have been found to be fraudulent shell companies or companies on the verge of insolvency. Investors in OTC stocks should carefully research the companies and their financial health before making any investment decisions.

Conclusion

In general, OTC stock trading can be a good option for investors who are willing to take on higher levels of risk in order to potentially earn higher returns. However, it is important for investors to carefully research the companies and their financial health before making any investment decisions, and to consult with a financial advisor or other investment professional if they have any doubts or concerns. Investing in a diversified portfolio that includes a mix of different types of stocks, including both OTC and formal exchange-listed stocks, could be one way to limit the risk of trading OTC stocks.