The market has sure given us all some chills this week, no matter how big or experienced a trader you are…

I mean just have a look at the SPY chart of the past few days:

There were a number of factors that concerned traders and investors alike, but the biggest one was perhaps the “Evergrande situation” – something you likely heard of if you pulled up any piece of news this week.

And in case you’re wondering how one Chinese property developer can send the entire US stock market running scared for its life – I’ve got you covered.

Let’s discuss what exactly has happened, is happening, and what may happen next.

What is Evergrande?

See, we’re not talking about an average property developer here.

In fact, Evergrande Group is anything but average.

The company is the second largest property developer in the world’s second biggest economy and, quite possibly, the single greatest beneficiary of China’s building boom of recent decades.

At the height of its might, the company would put millions of new apartments on the market every year – it even became the world’s most valuable real estate company in 2018, with a market cap of around $50B.

But all good things must come to an end, and as of this week, the end of Evergrande may be just around the corner.

The problem?

Some $305 billion (!!!) – yes, with a B – in debt that the company is currently unable to make payments on.

Evergrande’s (and Chinese) Debt Issue

Let’s set aside the obvious fact this is an astronomical amount of money owed by a single company, and look at what’s happening in the bigger picture.

China has grown fast, there’s no denying that.

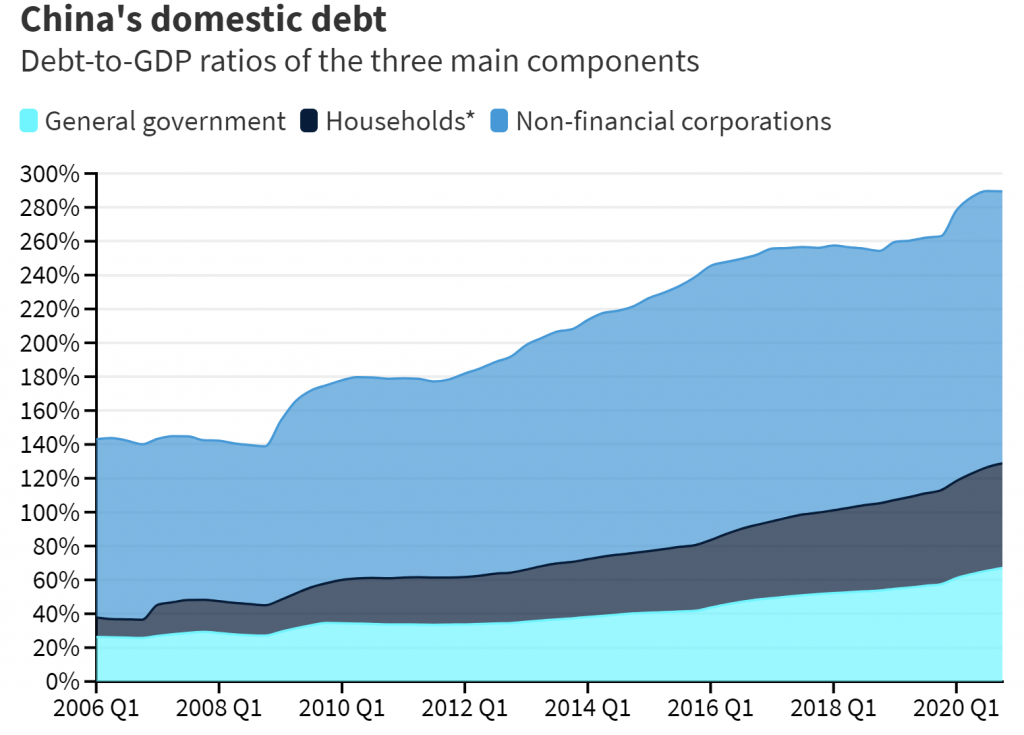

But so has its debt. Here’s a good chart I grabbed from CNBC to give you a good idea of just much the country’s Debt-to-GDP levels have ballooned over the past decade:

The incredible successes of many Chinese businesses often came at the cost of dangerous overlevergaing and outsized borrowing.

And I know what you may say – don’t we, the US, have high debt levels as well?

For sure, but with one caveat – for all means and purposes, China is still a developing nation!

Many economists express worry about rising debt in well-developed nations, but for one that’s still economically developing – Chinese numbers are simply unprecedented.

Concerns over the out of control borrowing in the PRC have been voiced for a long time, but companies and the government itself have managed to navigate both liquidity and reputational risks… Until now!

The world is watching, fearing that Evergrande may very well be the first piece of the domino, about to set off a dire chain of events.

Many in the media even go as far as to call it “China’s Lehman moment” – referring to the infamous collapse of Lehman Brothers that triggered the 2007-2009 financial crisis.

What’s Next For Evergrande?

The Chinese authorities are facing a dilemma right now:

- Bail Evergrande out, save Chinese consumers and reputation, but set a bad precedent to other overleveraged businesses.

- Let the company collapse, do significant damage to investor’s reputation, risk major shockwaves in other parts of the economy, but stand firm on its policy of addressing the debt issue going forward.

It’s coming in a surprise to many, but current indications point that the government is willing to go with the latter option – let the company burn.

Here are some of this mornings headlines:

So here comes the question you’ve all been meaning to ask this whole time…

What Does This Mean for Us, Traders?

Now, I get it… For a guy who mostly trades based on price levels, chart patterns and news catalysts, I’m talking way too big of a deal about a global macro event.

But don’t underestimate its meaning.

First, as a trader, you should always be aware of the bigger picture – if an event can crash SPY 15 point in 2 days, you better know what it is about.

Second, global reverberations of this magnitude are almost sure to affect risk appetites around the world.

For one, Chinese stocks may very well see shrinking valuations – adjusting for added risks.

For example, here’s Alibaba – BABA, breaking below it’s long-term support:

Second, if the Chinese economy is in fact significantly crippled over Evergrande’s collapse – the US economy will get hurt too, and so will our stock market.

Personally, I think this is good enough reason to lighten up on high-flyer names for now – if stuff hits the fan, those may be the first ones to fall.

Now that emotions seem to be more or less priced in, I really want to see how the US market reacts.

So far, this week’s action in SPY looks like yet another perfectly rebought dip:

But I’m not convinced yet – for confirmation that the worst is behind I want to see no trouble climbing over the $445 level and then above $448.

If at any point SPY starts failing, it may very well be the time to get more aggressive with my short positions.

Comments are closed.

1 Comments

… when the manure impacts the ventilator …

I just this week got back into the stock market after a hiatus to re-evaluate my strategies and losses. I looked at $SPY options on Monday and Wednesday, and saw what the stock chart looked like after the opening bell both days. I said to myself too much violent volatility in the stock price. If I had understood more about Evergrande, I would have known that SPY PUTS were a very safe play on Monday. Wednesday I knew about the FED meetings and why the market was so undecided. Today I knew I had to get in, and sure enough, I scored a 33% profit within 20 minutes of the opening bell, and would have had to sit at my computer all day watching paint dry, to make that a 100% profit. I will gladly take what I got.

Thanks for all the work you guys do informing and educating us.