Let’s continue to look under the hood of the WALL ST BOOKIE strategy.

An option’s intrinsic value is its price if it were exercised today. It’s the amount by which the option is in-the-money (ITM). Since I’m always selling at-the-money options and buying out-of-the-money options (simultaneously to make the bull put) there is no intrinsic value.

So what makes up the ‘net credit’ I receive when I put these trades on?

An option’s time value is related to the length of time before it expires and it’s the amount by which the option exceeds its intrinsic value. I’m basically selling time and remember, the closer an option gets to expiry, the more of a move in the underlying stock is needed to impact the options price.

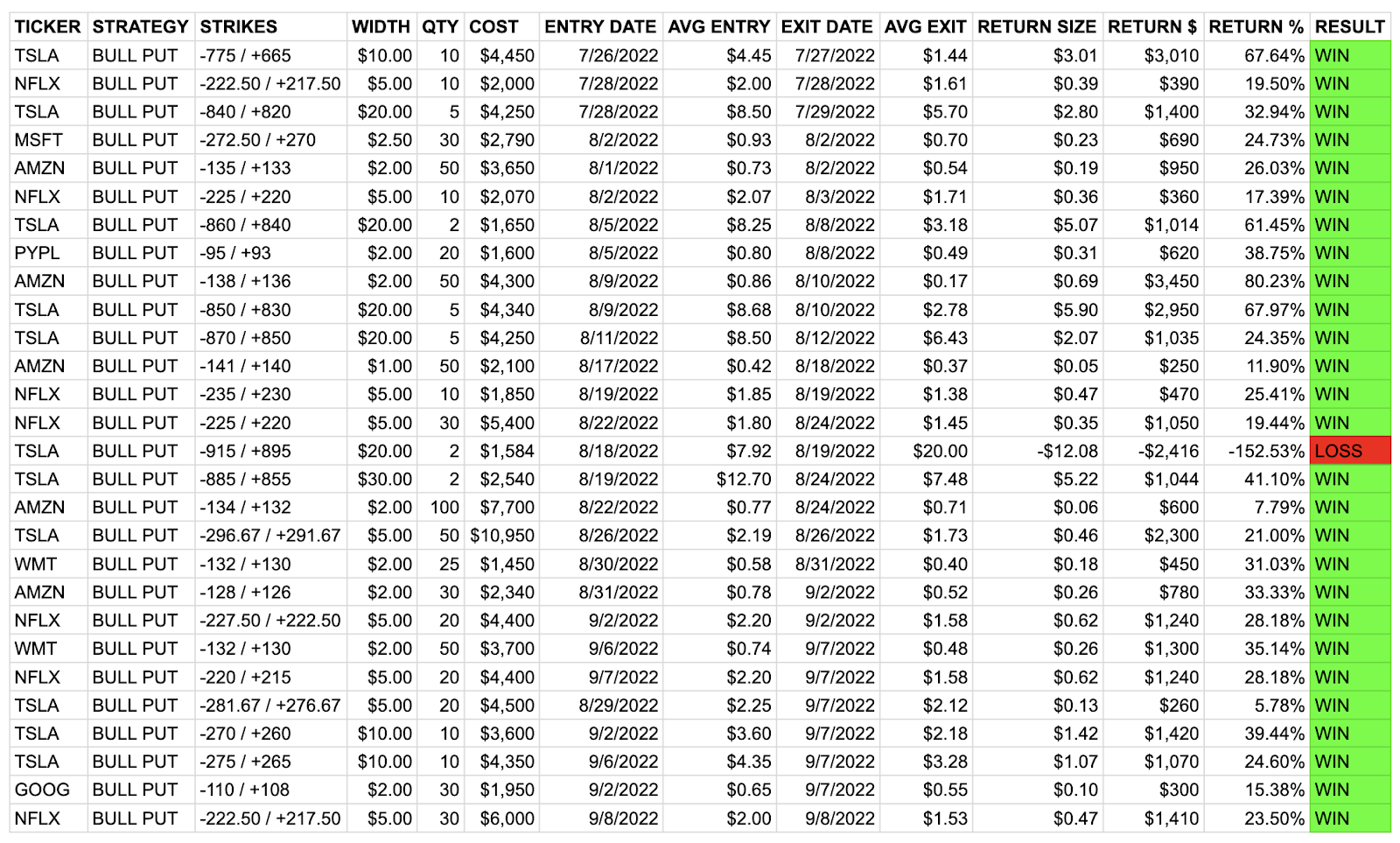

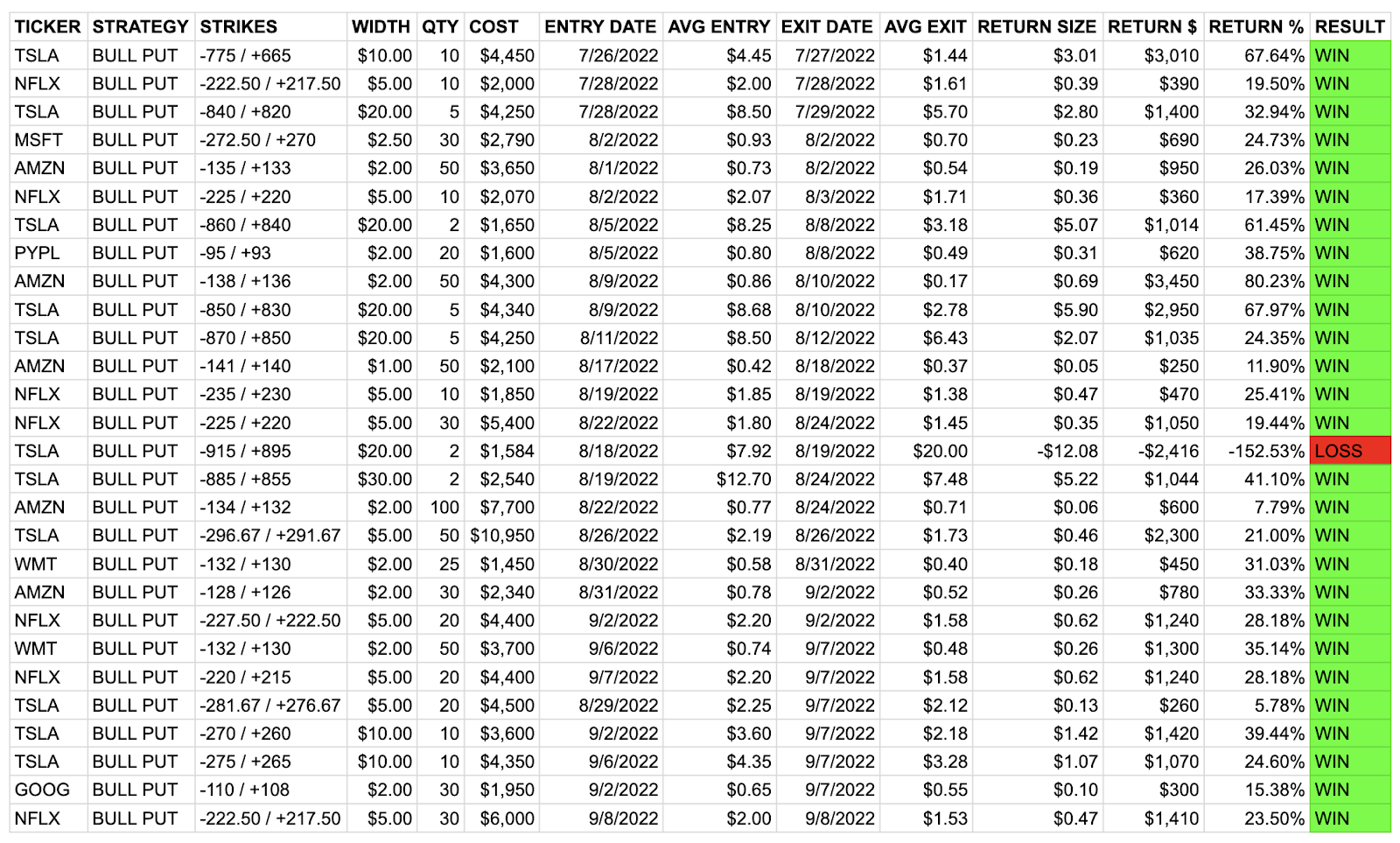

BOOKIE Journal since service launched 7/27/2022. Nothing promised or guaranteed in the future except my transparency and passion for teaching you to learn from both the wins and losses.

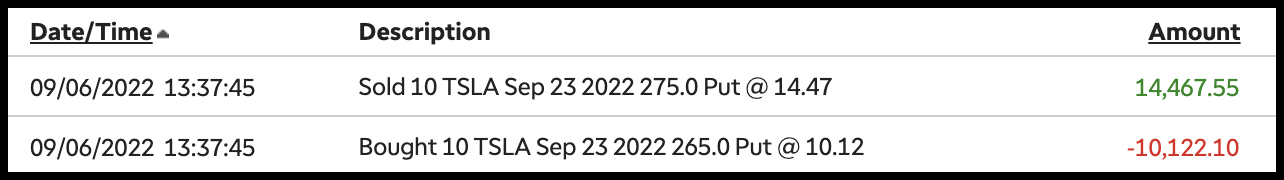

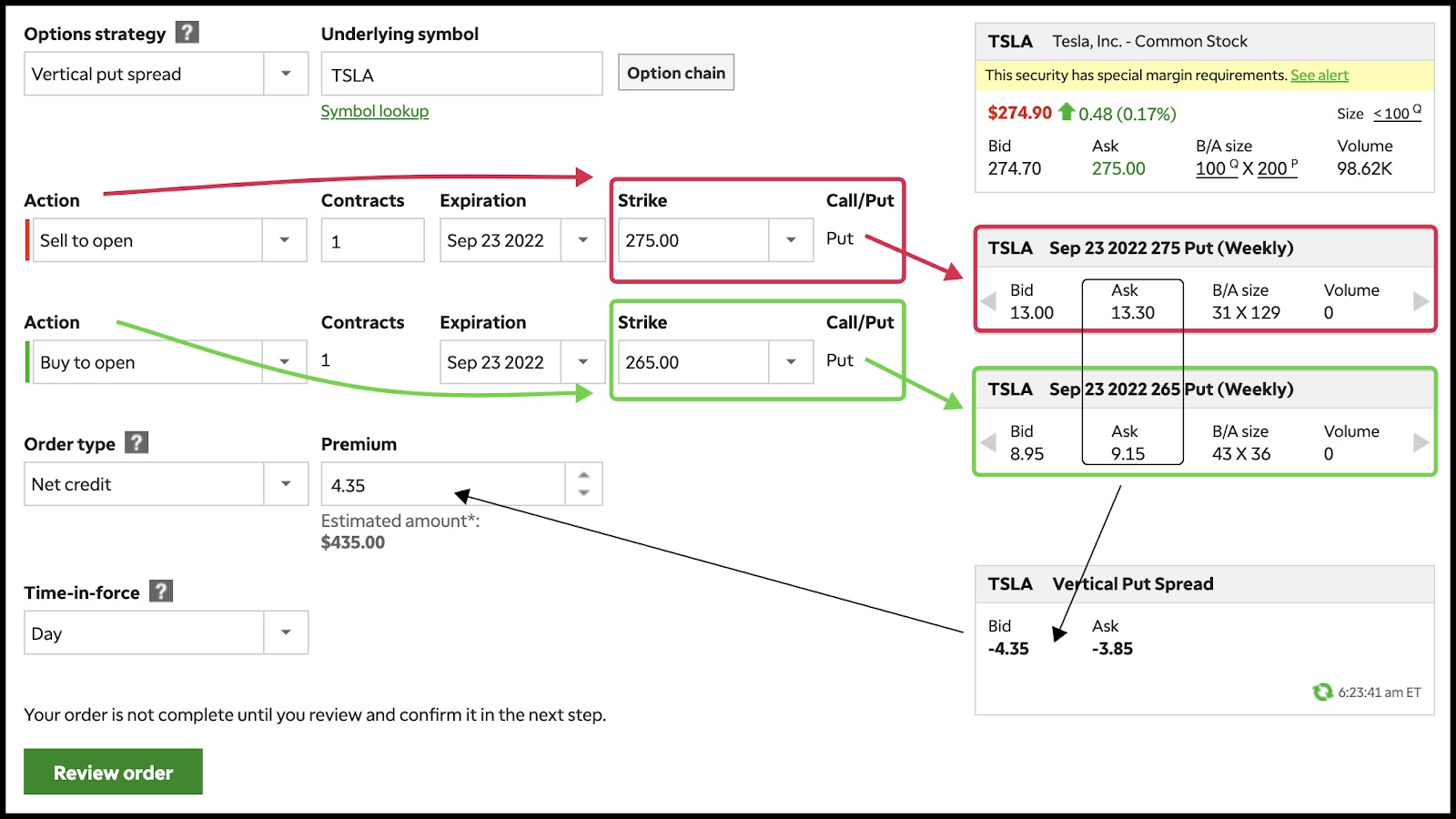

I like to use real world examples for my education, so here’s a trade I alerted Tuesday.

Tuesday September 7, 2022 I entered a $10 wide TSLA bull put -$275 / +$265 for $4.35 credit.

The margin requirement at my broker for this trade is $10,000 because I did 10 contracts on a $10 wide. Remember, each contract is the leverage of 100 shares. So [10 contracts X 100 = 1,000] X $10 wide = $10,000 margin requirement. Essentially I’m using $5,650 to try and make $4,350 and have a 55:45 probability of winning at the onset of the trade.

This strategy can be implemented with a $2,000 margin account. For example, [1 contract X 100 = 100] X $10 wide = $1,000. Essentially using $565 to try and make $435 with 55:45 probability of winning. All I did was a multiple of 10 contracts instead of 1.

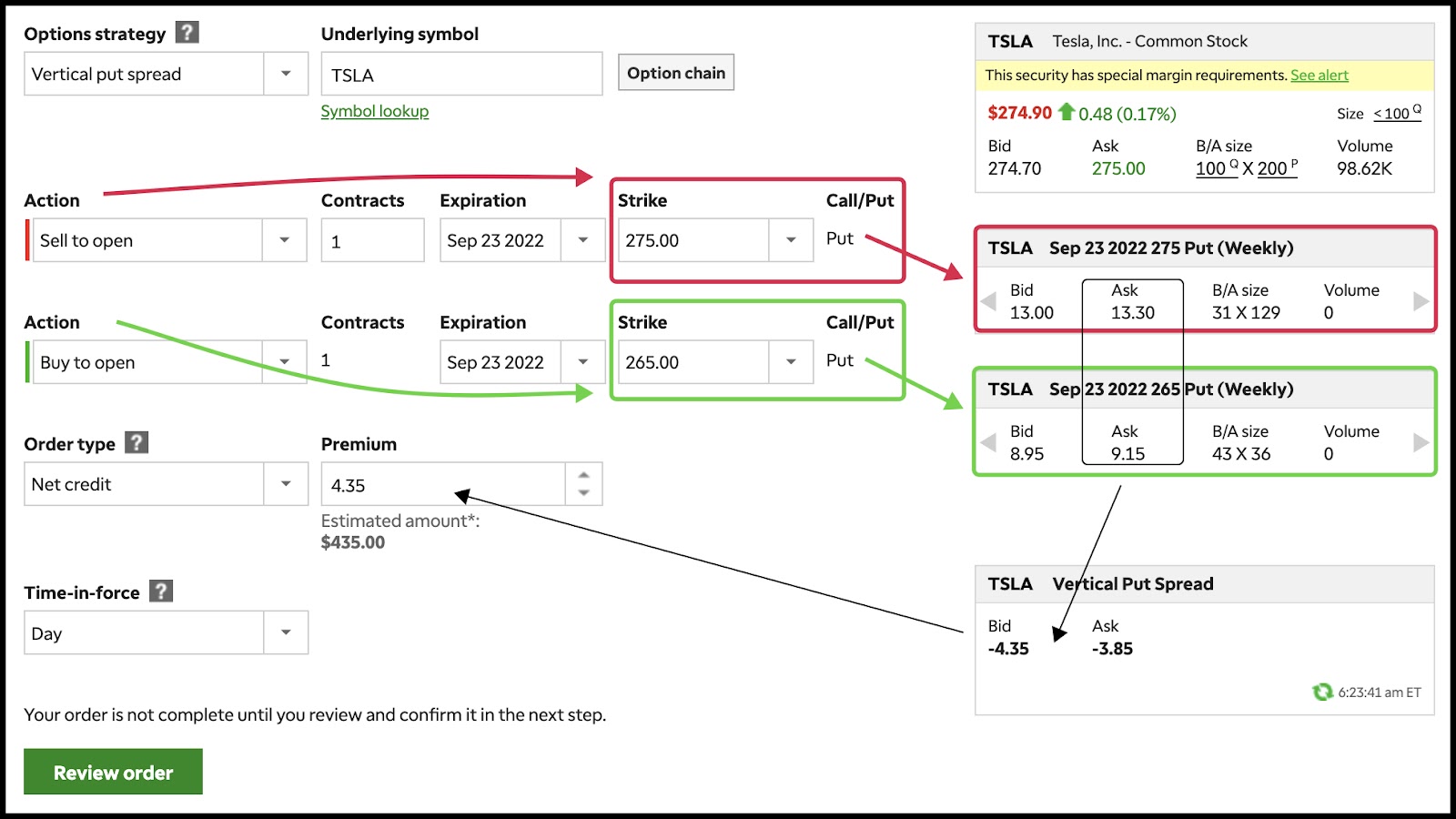

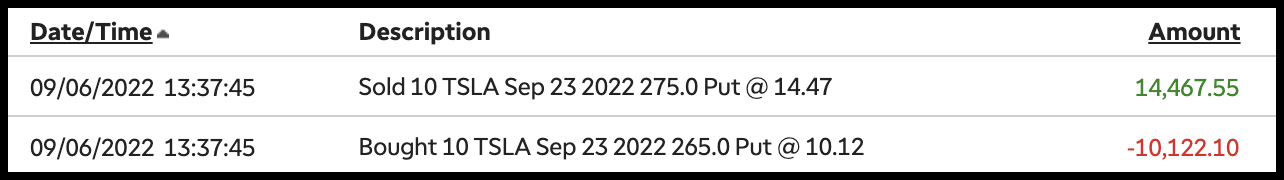

Now using the Ask of each strike:

- The -$275 put I sold was trading at $14.47 (currently $13.30)

- The +$265 put I bought was trading at $10.12 (currently $9.15)

If the strike price is equal to the stock’s price in the market, the option is said to be at-the-money (ATM). If the strike price of the option is not profitable as compared to the price of the stock, the option is said to be out-of-the-money (OTM).

There is no intrinsic value here in either option because the -$275 put was at-the-money (since TSLA was trading at $275) and the +$265 put was out-of-the-money. Intrinsic value doesn’t account for how much (or how little) time is remaining until the option’s expiration—called the expiry.

Remember, intrinsic value is the amount by which the strike price of an option is profitable or in-the-money (ITM) as compared to the stock’s price in the market. Neither the -$275 put I sold or +$265 put I bought (simultaneously to create the spread) is in-the-money, which means all of the premium here (value of the options) is extrinsic or made up of time and volatility.

A few things to write down:

- At-the-money options have the most time and volatility value i.e. extrinsic value

- The rate of which an option decays is the fastest 5-7 days from expiry

With me so far? Good, let’s carry on.

Remember, the primary drivers of an options price are:

- The underlying stocks current price i.e. TSLA $275

- The options intrinsic value i.e. $0 since the strikes are ATM and OTM

- Time to expiration i.e. today is Sep 7, so just over 2-weeks to Sep 23 expiry

- Volatility

Volatility also influences an option’s time value. When the market expects a little movement in the stock, the options time value will be lower. Volatile stocks or those with high beta will create a higher time value. A beta of 1:1 means the stock price will generally move with the market. If the market is up 1%, the stock will move up 1%. TSLA is high beta or 2.2 meaning it will move 2.2% for every 1% move in the market.

Implied volatility (IV) rank is a measure to determine how cheap or expensive stock options are based on their implied volatility (IV). Since overall markets have fallen for nearly 4 straight weeks, fear is rising in the marketplace which makes TSLA’s IV rank higher than normal. I want to sell options when IV is high, because it makes the time value or extrinsic value of those $275 puts someone bought more expensive than if IV was low.

With me?

In summary, I sell ATM bull puts because it has the most time value (extrinsic value) and I like to sell more aggressively with IV rank is high, which it is on TSLA. Someone bought those $275 puts epiring in just a few weeks from me and they paid $14.47 to get them. The $14.47 is made up fully of time and volatility, all extrinsic value. Now remember, the rate of decay on options is fastest in the final 5-7 days before expiry. These options are basically in that window. And the closer an option gets to expiration, the more of a move TSLA needs to make to impact the stock. Think of it this way, all I need is for TSLA to trade at or above $275 anytime before expiration and I’ll book a win. However, the trader who bought those $275 puts at $14.47 from me has a low probability of winning because he / she needs the stock price to fall fast to $260.53 just to break even.

And as you can see here, the current quote of those $275 puts is $13.30, meaning the buyer has already lost $1.17 or -8% on that trade in just a day. As each day passes that TSLA does not fall fast below $260, the buyer’s $14.47 puts will lose more and more time value and the net credit of $4.35 I received, which is already at $4.10, is likely to move toward $0, in which case I’d make $4,350 profit. Now remember, I don’t like to trade these to expiry, so when I’m up 30, 50, or 70% of the premium I like to book the trade and wait to put it on, into the next dip.

In closing, I favor bull puts, because stocks generally go up over time. So as traders chase moves down, I’m there to sell them the puts when they are about 2-weeks from expiration. I sell a vertical put spread to define my risk and that’s called a bull put which is neutral i.e. (TSLA can go sideways at $275 and I win) to bullish i.e. (TSLA can go up and I win) whereas the buyer of those $275 puts needs a fast drop on the stock to $260.53 just to break even.

Here are all the trades I’ve made since the service started on July 27, 2022. I will circle back and report how this -$275 / +$265 bull put on TSLA went.

Updated 9/9/2022 → the trade delivered +24.60% or +$1,070 as seen below in my journal.

31 wins and 2 losses since service launched 6-weeks ago on July 27. All trades from watchlist and were alerted before I entered and exited positions. Nothing promised or guaranteed in the future except my transparency and passion for teaching you to learn from both the wins and losses.

Now do you see why this is a high probability strategy? Options expire fast in the final 5-7 days, at-the-money options have the most time value, and buyers of those have low probability of winning because they need a big move in a short period of time.

Here are some of my rules to keep in mind as you watch the webinar.

- Staying mechanical is key to my success.

- Right now I like to put about $5,000 into a trade and look for 50% of the premium so $2,500 is a good win.

- When selling at-the-money (most extrinsic value) vertical put spreads into dips I look for an entry at 40% of the width. For 1 strike out-of-the-money vertical put spreads I look for an entry at 30% of the width or 70:30 probability.

- Write this down → 100 – the % of premium you collect = odds of success.

- These are swing trades so 5-7 days to expiration. Remember, the rate of decay on the extrinsic value of an option is fastest 5-7 days to expiration.

- I pick the width based on technical analysis as well as where I can get 40% credit e.g. $10 wide would be a $4 entry with a $2 exit goal.

- Opening bull puts into dips is my favorite setup.

- MSFT, TSLA, AMZN, GOOG, PYPL, WMT, AAPL and NFLX are my favorite stocks to trade right now. All are earnings winners and therefore should find buyers into dips.