The overall market has not given us any fireworks lately, as it continues to trade in a tight short-term range.

However, I see some fantastic opportunities elsewhere.

Over the few days, I have spoken with my members about a theme I have picked up on in the market, specifically with low-priced, small-cap biotech stocks.

I was able to identify the theme early on and take advantage of a stock benefiting from that theme.

If the action continues, you’d want to be aware of these names.

More importantly, I want to tell you about HOW I identified this theme and HOW I took advantage of it so that you might be able to as well in the future!

Quick shoutout to my members before we get started because the chatroom has also been on fire lately. I love the contribution and collaborations. Keep it up, gang!

The Theme

As I told my members, I noticed that my scanner was lit up two days ago!

Interestingly, though, a lot of the names were small-cap biotech stocks.

I noticed that these stocks were moving together and a part of a common theme.

I have one thought that perhaps with the overall market sluggish, traders and investors might be allocating some of their attention and capital to small-cap biotech stocks.

Now it gets interesting

What stood out to me, gang, is how the biotech stocks on my scanner had a similar chart pattern.

I took strong note of that.

Let me show you precisely what I saw, two days, courtesy of charts from stockcharts.com:

In the above chart of AVGR, notice how the stock experienced a gap down and selloff before the reversal two days ago.

It’s a similar story in the above chart of GHSI. Notice how this stock experienced a large gap down and consolidation before reversing and pushing higher two days ago.

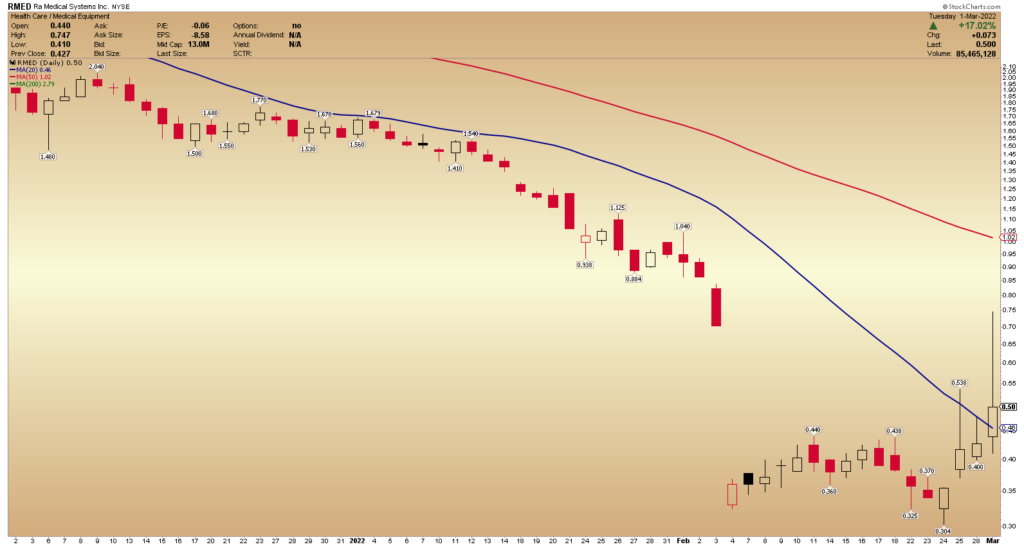

Lastly, RMED was another stock that hit my scanner two days ago. Once again, you can see the same theme play out.

After gapping down at the beginning of February and then consolidating, the stock reversed and pushed higher two days ago.

How I took advantage of this theme

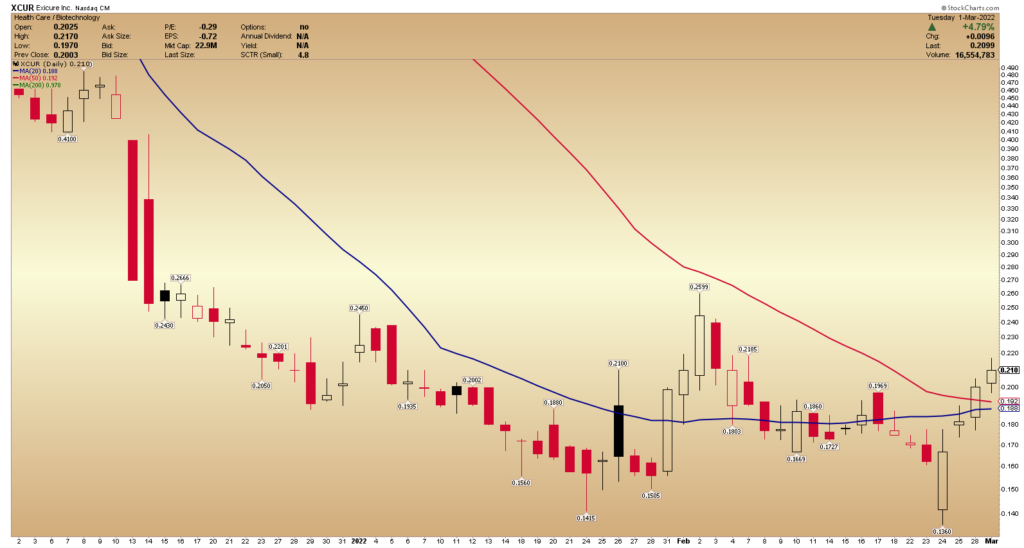

Two days ago, I noticed that XCUR was shaping up a similar pattern and trend as the other stocks I mentioned above.

As a result of the overall theme, the consecutive higher highs and higher lows on the daily chart, I got long the stock two days ago.

I got long the stock àt $0.19.

I was targeting the $0.26 area to take profits in the trade. I thought that if the stock could break over $0.22 – $0.23, it might have enough momentum to reach the $0.26 area.

In the after-hours trading period, the stock got going and traded near $0.30.

I had a target in mind of $0.26, and therefore when the stock traded near my mark in the after-hours, I had no reason not to sell.

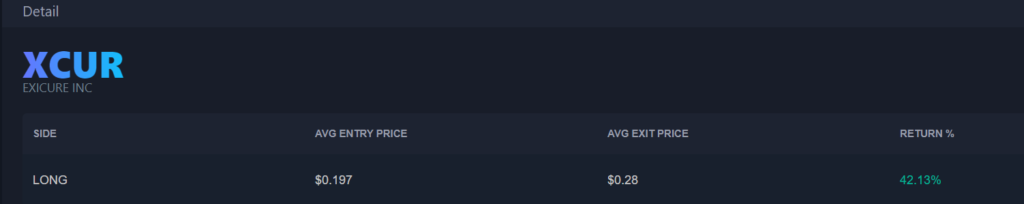

I exited the position in the after-hours at $0.28 for a 42% return.

Is the opportunity finished?

I do not think so, gang.

I don’t believe this theme is cooling off yet because I still see small-cap bio stocks pop up.

I also believe that this theme might be sustained, and after a challenging year, many small-cap biotech stocks might catch a sustained bid.

One stock, in particular, popped up yesterday that I like.

I’m stalking RGLS for a potential trade because I love the chart pattern.

As you might notice, this stock has the W pattern.

Notice the double-bottom and the midpoint, which was taken out yesterday after the stock pushed higher and closed up over 35%, according to stockcharts.com.

I’ll be watching RGLS closely for a potential entry on a higher low or intraday consolidation breakout.

I am targeting mid to high $0.30s.

The Bottom Line

Gang, 2021 was a challenging year for small-cap biotech stocks, in my opinion.

However, the current theme, volume, and moves that I have spotted in small-cap biotech stocks make me very optimistic about this sector’s year ahead.

So, going forward, I will continue to pay close attention to these types of stocks and search for opportunities within this theme.