What a time to be day trading!

Sure, there have been periods in the past of quietness and less opportunistic times, but I don’t think we are experiencing that now.

If I can say so myself, gang, my recent article titled “Small-Cap Penny Stocks Are BACK” seemed to have hit the nail on the head!

In that piece, I mentioned that I was excited about the current market climate, specifically penny stocks, because my scanner presented me with many small-cap stocks trading abnormal volume and solid percentage moves higher.

Well, good news, because that has continued and doesn’t appear to be slowing down.

I think that it is only going to get more opportunistic.

You might be wondering why I am so optimistic?

The best way to answer that question is not to tell you but rather to show you…..

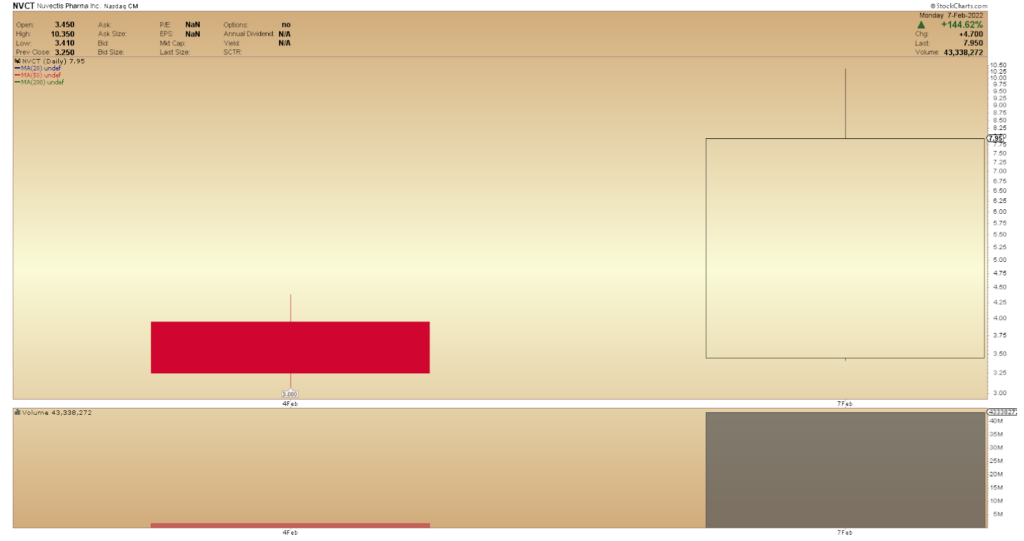

The impressive chart above is of NVCT.

I spoke about the stock early on in the day live in my chatroom and shared my thoughts and plan with my members on my watch list.

Before I discuss why this is good for other small-cap penny stocks, and share my thoughts on the stock, let’s go over the basics.

What Is NVCT?

NVCT is, according to Yahoo, a biopharmaceutical company that focuses on developing targeted small molecule therapeutics for the treatment of cancer.

On Friday, the 4th of February 2022, NVCT announced the pricing of its initial public offering (IPO) of 3.2M shares of common stock at a public offering price of $5 per share.

On its debut trading, NVCT traded light volume and closed red.

However, yesterday, the companies second day trading on the NASDAQ, was a completely different story.

Compared with the previous day’s trading session, volume increased significantly, and the stock closed green on the day.

Could this be good for the small-cap market?

In my opinion, hell yeah!

Why?

Well, the answer is pretty straightforward.

A move like this might very well excite traders and lead to further speculation and an increase in volume in other small-cap penny stocks.

So, I welcome the action from yesterday because not only does it create short-term opportunities, it might also lead to sustained opportunities for the medium-term.

Recapping the opportunity from yesterday

I spoke about this stock yesterday to my members in the chatroom when it was in the $4s, and then I talked about it on my watch list when the stock was in the $5s.

Later in the day, the stock traded above $10.

I told my members that I was looking for a possible entry late morning, around $4.75 – $5.

If I got that entry, I would be targeting $6 – $6.80, and my stop would be around $4.

Two clear-cut opportunities stood out to me, and both patterns are similar and present a substantial risk: reward opportunity.

The bullish flag pattern.

Notice the two setups highlighted above and how the range contraction along with volume contraction resulted in range and volume expansion.

I love this setup, and the above chart is a fine example of it.