Equity vs. Index Options

An option contract is an option to buy or sell an underlying asset over a defined period of time, which could be a stock, index, futures, or commodity. While an equity option gives you exposure to a single stock, index options are financial derivatives that are based on stock indices like the S&P 500 Index (SPX) or the Dow Jones Industrial Average (DJI). By trading index options instead of equity options, a speculator is able to gain access to a broader basket of stocks, as well as create diversification for and/or hedge an existing portfolio.

How Equity and Index Options are Similar

Similar to buying a stock option, which gives a trader the right (but not the obligation) to buy or sell a stock at a specified price at a specific date, an index option gives the speculator the right (but not the obligation) to buy or sell the index at a specified price by a specific date.

And like calls and puts on stocks, index options offer leverage, and a call’s value tends to rise when the value of the underlying index gains, while a put’s value tends to rise when the value of the underlying index falls.

Moneyness is the same with index options, too. An in-the-money option is one where the index price is greater than the strike price (for calls) or lower than the strike price (for puts). An at-the-money option is one where the index price and the strike price are the same. Finally, an out-of-the-money option is one where the index price is lower than the strike price (for calls) or greater than the strike price (for puts).

The pricing component of index options echoes that of equity options, as well, in that an index option’s price is composed of:

- The price of the underlying index

- The strike price of the option

- Volatility

- Time until expiration

- Interest rates

- Dividend payments of the companies found in the index

Additionally, the two main components that make up an index option’s price are intrinsic value and extrinsic value.

Remember, intrinsic value is what an option is worth at expiration, and is calculated by taking the difference between the current price and the strike price. Extrinsic value is primarily determined by time value and implied volatility, and is calculated by taking the difference between the market value of an option and its intrinsic value.

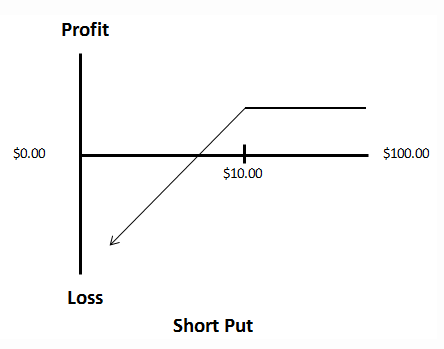

The risk-reward profile of stock options and index options are similar, too, with losses on long calls and puts and profit on short calls and puts limited to the initial premium paid or collected, respectively.

Meanwhile, the potential profit on long calls and puts can accumulate quickly, as can losses on short calls and puts.

And in addition to buying and selling calls and puts outright, both equity and index options allow speculators to employ a wide variety of strategies to suit their trading styles, including bull call spreads, bear put spreads, protective puts, and covered calls.

How Equity and Index Options are Different

One equity option typically allows a trader control of 100 shares of the underlying stock. An index option is cash settled, and does not account for a set number of shares. While it’s not done in shares of the underlying, the “size” of an index option is still determined by a multiplier, which is generally $100.

What is a cash settlement?

It’s when, at expiration, the seller of the option (or other financial instrument) does not deliver the physical asset (100 shares of stock, for instance), but instead settles with a cash payment (the exercise settlement amount) — avoiding certain fees, like transaction costs.

And unlike stock options, whose price changes throughout the day, the price of an index option changes value at the end of each trading day. As such, the profit and loss calculations are based on the broader market’s closing price of the day, as compared to intraday valuations for equity options.

In fact, settlement is one of the biggest differences between equity options and index options. Another is expiration.

For instance, while equity options tend to be classified American, index options are generally European. American-style options can be assigned at any time, while European-style options can only be exercised or assigned during a specific period prior to expiration.

Plus, standard (monthly) equity options expire on the third Friday of the month at the market close (P.M. expiration), while most index options are closed out before the market opens on the third Friday of the month (A.M. settlement), and stop trading at Thursday’s close. However, some SPX weekly options have P.M. settlements.

If an option is closed out during market hours, the speculator is at risk of a bigger profit or loss if the index closes below or above the intraday exercise price, respectively.

For example, let’s say you have an index put option with an exercise price of 30, and you ask your broker to exercise the option at 10 a.m. when the exercise price is 28. If the underlying index is still at this price at the close, you will get $200 (times the $100 multiplier) in the cash settlement. If, however, the exercise price jumps to 32 by the close, you’re now on the hook to pay $200 to the assigned writer (and are down $200 on the trade, as a result).

Wrapping Up

While equity options allow traders access to one specific stock, index options give speculators exposure to a basket of stocks that are based on stock indices like the S&P 500 Index and Dow Jones Industrial Average. There are a number of similarities between the two types of options, including the risk-reward profile and the ability to use the derivatives to hedge an existing portfolio.

However, differences between equity and index options. The two main differences are settlement and exercise, both of which need to be considered when considering which options strategy works best for your trading goals.