1. A trader buys 5 AAPL Jan 40 Calls @ $8.00 and sells 10 AAPL Jan 50 Calls @ $2.00 when the market price of AAPL is at 43. The position created is:

Ratio Spread

Calendar Spread

Vertical Spread

Call Spread

Answer: A

The trader created a 2×1 ratio call spread on AAPL

2. A trader sells 1 FB Dec 100 Call @ $10 when the stock price of FB is $95. The breakeven is:

$105

$100

$95

$110

Answer: D

The trader would have a breakeven calculated from short call + premium paid

3. A trader buys 100 shares of ABC stock at $50 and sells 1 ABC Jun 55 Call @ 3.00. The maximum loss is:

$5,000

$300

$5,300

$4,700

Answer : D

The stock can go to $0, causing the trader to lose $5000. The Call will then expire allowing the trader to collect the credit of $300. Therefore, the max loss on this trade is $4,700.

4. A trader has buys 1 XYZ Jun 50 Call and sells 1 XYZ Jun 55 Call on his books. What position does he have?

Long Put Spread

Long Calls

Long Strangle

Long Call Spread

Answer: The position created is a called a Long Call Spread

5. A trader buys 1 XYZ Jun 50 Call and sells 1 XYZ Sept 50 Call on his books. What position does he have?

Long Calendar Spread

Short Calendar Spread

Short Straddle

Long Straddle

Answer : B

6. A trader sells 1 ABC Jun 50 Call and buys 1 ABC Dec 50 Call. What position does he have?

Long Calendar Spread

Short Calendar Spread

Short Straddle

Long Straddle

Answer: A

7. If a trader wanted to go short a stock, but wanted to sell options, what possible trade could he place.

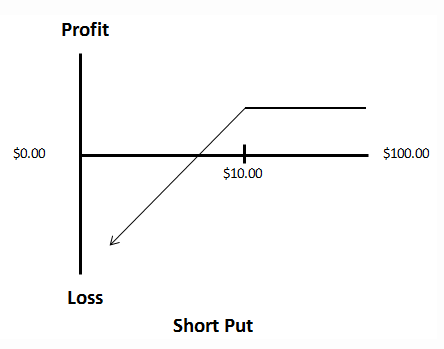

Short put

Short call

Long put

Long call

Answer : B

The sale of a short call is a short premium trade for going short instead of selling the stock directly. Like a stock, they both have unlimited upside risk. If the stock stays neutral, as a short call seller you will collect premium whereas a short stock position will not return any profits. Options contracts lose time premium as the position nears expiration; this is not true for stock positions.

8. When the market price of ABC stock is trading at $38 per share, which of the following choices creates a strangle?

Short 1 ABC Jan 40 put / short 1 ABC Jan 40 Call

Short 1 ABC Jan 40 put / short 1 ABC Jan 35 Cal

Short 1 ABC Jan 35 put / short 1 ABC Jan 40 Call

Short 1 ABC Jan 50 call / short 1 ABC Jan 40 Call

Answer C

A strangle is a specific variation of a combination, where both contracts are out the money.

9. When the market price of ABC stock is trading at $38 per share, which of the following choices creates an At-The-Money straddle?

short 2 ABC Jan 40 put / short 1 ABC Jan 40 Call

short 1 ABC Jan 45 call / short 1 ABC Jan 40 Call

short 1 ABC Jan 35 put / short 1 ABC Jan 45 Call

short 1 ABC Jan 40 put / short 1 ABC Jan 40 Call

Answer : D

A straddle is a specific variation of a combination, where both contracts are at the same strike.

10. The time value of 1 ABC Jun 310 Call trading at $10.00 with ABC trading at $315.58. is?

442.00

342.00

310.00

558.00

Answer : A

The current price closed at $315.58, so the contract is in the money by $5.58. Any premium above this is considered to be time premium. Therefore, since the contract is selling at $10 minus $5.58 = $4.42 time premium x 100 multiplier = $442.00