Option trading is structured to allow traders and investors the ability to leverage their money. This makes options a more effective instrument for investors to hedge or protect large stock positions they may be holding. That same leverage also makes it possible for options to be used as tools for speculation. The growing sophistication of the option market allows traders to access many different trading strategies. This wide array of strategies can be confusing to beginning option traders, so it is helpful to divide the strategies into categories.

The three categories discussed in the previous part of the Beginners Guide will help explain what each of the trading strategies is most commonly used for and what a trader needs to learn to be able to use these strategies well. There is a lot to learn about each trading strategy, but for now, the following information will simply introduce you to the ideas behind these strategies. We’ll divide these explanations into three categories:

- Delta trading, for emphasizing leverage opportunity

- Theta trading, for emphasizing income opportunity,

- Gamma trading, for emphasizing speculation opportunity.

Delta Trading Strategies

Delta trading strategies are those which help traders leverage their trading capital so that they can protect existing stock positions, or so that they can speculate on price movements.

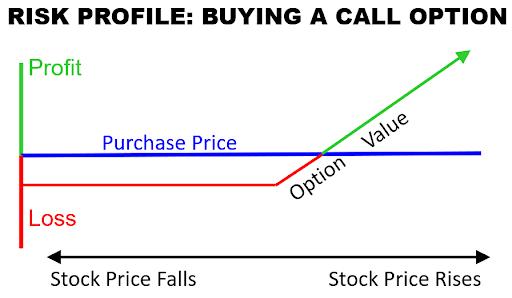

The two most commonly used option trading strategies are the most straightforward ones: buying a call option, or buying a put option. Buying a call option leverages an upward move in the price of a stock, while buying a put option leverages a downward move.

However, these straightforward trading strategies have the challenge of time decay. Option prices lose value over time, so effective delta trading strategies need to overcome that challenge. Here are the four most commonly used delta trading strategies that overcome time decay.

- Buying in-the-money call or put options

- Buying vertical spreads

- Buying calendar spreads

- Buying diagonal spreads

Theta Trading Strategies

Theta trading strategies help traders generate income opportunities because they rely on the most consistent aspect of option pricing: time decay. Theta-style strategies try to help a trader benefit from the time decay by taking the approach of selling options rather than buying them.

If you buy an option, some of what you pay for includes the amount of time left before the option expires. So it stands to reason that if you sell an option, you are collecting the value of that time. Theta strategies emphasize the collection of that time value. Here are the most commonly used theta trading strategies that seek to collect time decay.

- Selling covered calls

- Selling out-of-the-money call or put options

- Selling vertical spreads

- Selling Iron Condors

Gamma Trading Strategies

Gamma trading strategies are those that traders would consider if they are seeking to capture highly speculative moves that represent larger opportunities than other strategies. Gamma trading strategies tend to be more effective when they emphasize time frames that are closer to the expiration date. That’s because options with more time left to expiration have lower gamma scores.

Traders who seek to capture speculative moves also like to limit their risk to relatively lower starting prices in their option trades. Here are the most commonly used gamma trading strategies that seek to emphasize speculation opportunities

- Buying out-of-the money call or put options

- Buying call or put options with less than three weeks to expiration

- Buying out-of-the-money diagonal spreads

- Day-trading options one or two days before expiration

There are many more strategies that can be classified into these three styles of trading. It is important to know the emphasis for each option trading strategy. No matter how complex an option trading strategy can become, it usually has the emphasis of one of the three trading styles.

It is also important to know that not all option trading strategies are available to the beginning option trader. Brokers allow different levels of trading authority based on a trader’s profile of available funds, investing horizon and experience in the markets. To learn more about how a trader acquires option trading authority from a broker, be sure to check out the next part of the Beginners Guide.