Options Strategies for a Bull Market

What is a bull market?

When you’re new to the trading game, a bull market and bear market might come across as unfamiliar stock market lingo.

While there isn’t a universal definition of a bull market, there are a few commonly accepted definitions that are helpful in understanding the term. There are also many standard characteristics that are present during a bull market period.

For instance,

- During a bull market, the price of stocks follow an upward trend.

- A commonly accepted definition of a bull market is when the stock prices increase by 20% following a 20% decline, and then witness another 20% decline after the rise.

While investors will typically buy and hold during bull markets, options allow traders a wide array of strategies to position for more upside in equities.

Here are some of the best options strategies for a bull market. While we give brief explanations of these strategies below, more detailed breakdowns can be found in separate sections of RagingBull’s Options Academy.

- Long call: Buying a call option on an underlying stock based on the assumption that it will rise above the strike price by the expiration date.

- Bull call spread: Buying a call option at a specific strike and selling a call option at a higher strike. Both options will have the same expiration date and underlying asset. This is used to position for a moderate rise in the underlying, with the sold call lowering the cost of buying a long call outright.

- Bull put spread: Selling a put option at a specific strike and buying a put option at a lower strike. Both options will have the same expiration date and underlying asset. This is used to position for a moderate rise in the underlying, but traders can still make money even if the stock fails to move.

- Covered call: Selling a call option on a stock you already own in your portfolio to generate additional income and/or protect your portfolio against any downside risk in the underlying security.

- Protective put: Buying a put option on a stock you already own in your portfolio to act as an “insurance policy” to protect against any downside risk in the underlying security.

- Collar: Buying one out-of-the-money put option and simultaneously selling an out-of-the-money call option on the same underlying asset with the same expiration date. The trader will have a long position in the underlying stock, and the collar is used to protect the portfolio against downside risk.

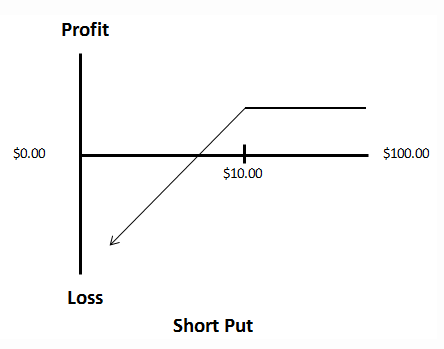

- Cash-secured short put: Selling one put option on a stock you plan to purchase. You must have enough cash in your account to cover buying 100 shares of the underlying, in case the option moves into the money. Often viewed as a “paid-to-wait” strategy.

- Call ratio backspread: Selling a call option at a specific price and buying two call options at a higher strike. The options will have the same expiration date and underlying asset. This strategy is used to position for a breakout in a highly volatile stock.