All options lose value as time passes, like a produce item at your local grocery store.

In options, this is known as time decay, and is measured by the Greek “theta.”

Theta is one of the four primary greeks that traders use to describe and analyze various risks to an options trade at any specific point in time. Theta is measured as a value in dollars, and tells us how much an option premium loses (or gains) each day through expiration.

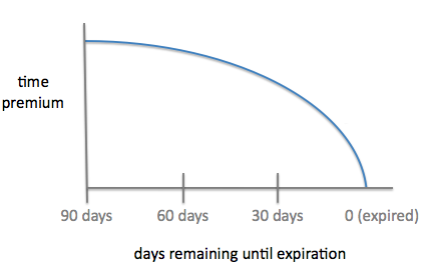

Theta, or time decay, is not linear. Theoretically, the rate of decay will accelerate for the option as expiration approaches.

At first, the rate of decay measured by theta is negligible the further out the expiration period goes, and rapidly accelerates as expiration nears.

Here is a chart illustrating this more clearly.

As you can see from the image above, time value of an option decays at a quicker pace as you approach expiration. At expiration, an in-the-money option has no time value, only intrinsic value.

Long calls and puts have a negative theta, while short calls and puts have a positive theta. In other words, time decay works against the option buyer, but works in favor of the option seller.

Why?

Because the more value an option loses over time, the less expensive it is for the option seller to buy back the contract.

Theta and Implied Volatility

Theta and implied volatility go hand in hand. You see, implied volatility affects the extrinsic value in options, which affects theta values. Generally speaking, the higher the implied volatility, the higher the theta.

There are many influences on an option’s implied volatility that can in turn impact theta. These include upcoming earnings announcements, product releases, drug trials, tariffs, etc.

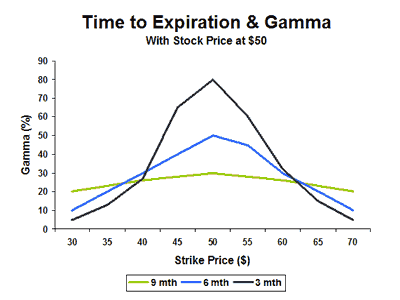

Here is a chart that describes the relationship of implied volatility to theta.

Theta and Moneyness

At-the-money options are most susceptible to time decay, while theta will decrease the deeper in the money or out of the money an option moves.

For traders who are long options, it is a good idea to try and avoid the impacts of time decay by picking an option that has an expiration date that’s further out. A good rule of thumb is to target an option with 60-90 days until expiration to avoid a rapid decline in your option prices each day, though these further-dated options will likely be more expensive because of the additional time value that’s priced in.

For traders who are short options, it is a good idea to try and target shorter-term contracts that have the greatest acceleration of time decay. These can typically be found in options that have between 0 and 60 days until expiration.

Some additional points about theta to consider when trading:

1. Theta can be high for out-of-the-money options if they carry a lot of implied volatility.

2. Theta is typically highest for at-the-money options since there is a greater chance they will finish in the money.

3. Theta will increase sharply as expiration approaches, and can severely undermine a long option holder’s position, especially if implied volatility declines at the same time.

Wrapping Up

Understanding theta is extremely important when trading options, since it lets you know how much the price of an option should change as expiration approaches. As an option buyer, your position has a negative theta — which works against you as expiration nears. On the other hand, when you sell premium, your position has a positive theta, which works in your favor. Being aware of this greek is another way to choose the options trade that works best for your risk profile.