Vertical Spreads

One thing you’ll notice when you start to learn about options and option trading strategies is that there are a lot of them. That said, vertical spreads are some of the more basic options strategies to grasp.

Specifically, a vertical spread is one where a speculator purchases a set amount of options while simultaneously selling an equal number of options on the same stock but at a different strike price. Both options have the same expiration date.

By combining a short option with a long one, vertical spreads allow traders to lower their risk on a trade, though they also limit their profit potential. Vertical spreads can be initiated with either calls or puts, and can be either bullish or bearish

Below, we’ll give a quick overview of four types of vertical spreads: the bull call spread, bull put spread, bear put spread, and bear call spread. More detailed explanations of these strategies can be found in other sections of the Options Academy.

Bullish Vertical Spreads

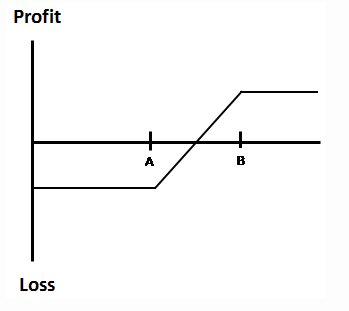

A bull call spread is also referred to as a long call spread or a long vertical call spread. It’s a combination trade made up of a long call and a short call with the exact same expiration, but two different strike prices. Take a look at the image below:

The call you buy will be the lower-strike option. This is strike price “A” on the graph. In addition, you simultaneously sell strike “B,” which is further out of the money.

Why would you do this versus buying a call or selling a put?

Well, the long call spread brings down the cost of the trade because you’re collecting a premium from selling “B.” However, unlike buying a call, your profit potential is limited.

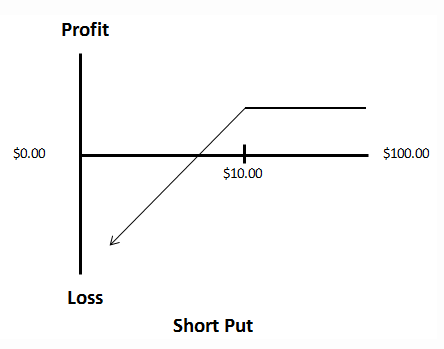

Another way to benefit from a rise in the price of a stock is to sell a put spread. A short put spread is also referred to as a bull put spread, and is known as a credit spread. You’re receiving a net credit because your short option is more valuable than your long option.

Refer to the chart above. The short put setup is pretty much the same as the long call spread, only now you’re selling a put at strike “A” and buying a put at strike “B.”

Bearish Vertical Spreads

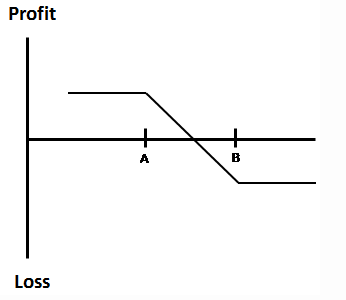

A long put spread is also referred to as a bear put spread or a long vertical put spread. In a long put spread, you are going to sell the option with strike price “A,” and buy the option with strike price “B.” The option with strike price “B” has more premium in it than “A.”

Check out the image below:

Another type of bearish vertical strategy is the short call spread, or bear call spread. Using the chart above, you would sell the lower-strike “A” call and buy the higher-strike “B” call.

By combining the short call with the long one, you’re limiting your risk (as well as your profit potential). The trade is done for a credit, and this credit collected is the maximum profit you can make on the play. The most you can lose is the difference between the strikes less the premium you took in.

Wrapping Up

Vertical spreads are combination options strategies that help speculators define risk, though they also limit profit potential. Examples of these two-legged strategies are the long call spread, short put spread, long put spread, and short call spread. Vertical spreads are the foundation for more complex trades like butterflies or condors, so you’ll want to understand how vertical spreads work before moving on to more advanced options strategies.